How Avalanche’s AVAX price represents the Crypto market as a whole

- Avalanche price has fallen “penny from Eiffel” style since April.

- AVAX price shows an uptick in bearish volume.

- Invalidation of the bearish trend is a breach above $20.65.

Avalanche’s AVAX price could decay another 40% before the bulls show up.

Avalanche price is subdued

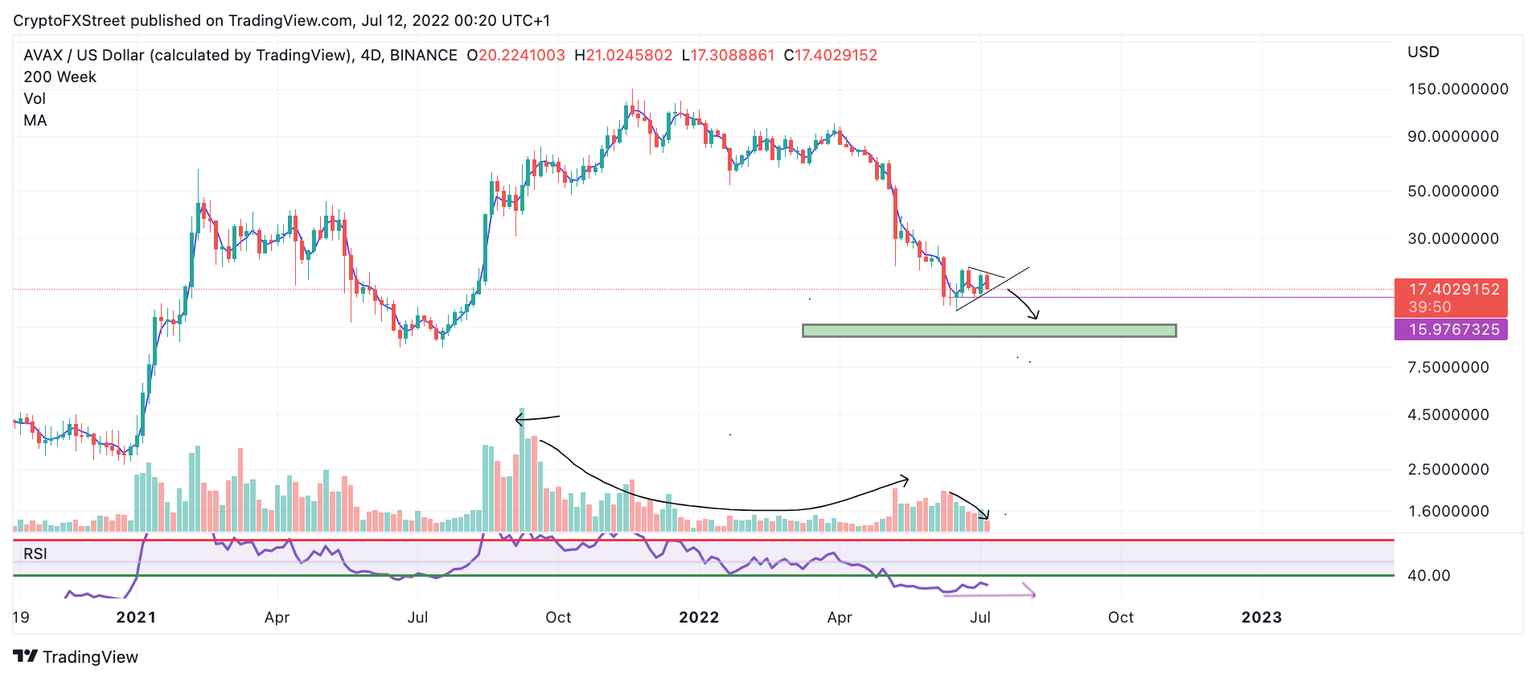

Avalanche price shows a lack of bullish interest in larger time frames. It appears the bulls want to negotiate for lower prices, likely in the $12 price zone. If market conditions persist, a 40% decline will be inevitable as the bears are currently suppressing the AVAX price into the ascending trend line. A breach through the supportive barrier will likely catalyze an influx of bearish volatility.

Avalanche price currently trades at $17.52. A breach of the July 4 lows at $16 could be the signal intraday traders are looking for in order to join the downtrend targeting $12. The Volume Profile Indicator confounds the idea of a downtrend continuation as the bears still have complete control of the order books.

AVAX/USDT 4-Day Chart

Avalanche's steep plummet is synonymous with the overall cryptocurrency market conditions. Tokenized Rugpulls, CEO embezzlement, and hedge-fund capitulation are among the few talking points contributing to the Crypto markets' downfall. On July 8, 2022. CNBC's Mackenzie Sigalos broke the story of notorious institutional investor ThreeArrowsGroup’s crypto demise. The investment managing company has joined the crypto chopping blocks and is filing for bankruptcy due to the multi-million dollar liquidation of poorly managed public funds.

The market sentiment clouding the crypto market almost guarantees further decline for the AVAX price. However, invalidation must be put in place to be aware of possible changes in the trend. If the bulls can breach above $20.65, they may be able to rally as high as $25 resulting n a 20% increase from the current Avalanche price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.