Aptos Price Prediction: Eight of every ten traders are trying to catch the knife

- Aptos price auctions above $7 as the weekend produced a 15% sell-off.

- Eight out of every ten retail traders are currency bullish on the APT price.

- Invalidation of the bearish thesis is a breach above $7.50.

Aptos price witnessed a strong sell-off during November's first trading weekend. If market conditions persist, a continuation of the downtrend could occur throughout the week. Key levels have been identified to gain perspective on APT’s next potential move.

Aptos price is underwater

Aptos price has experienced a strong downward trend over the weekend as the bears have produced a 15% loss in market value. On Monday November 11, 2022, APT price is consolidating near the lower edge of the liquidity zone, which is enticing bulls to open a long position. Still, on-chain metrics suggest trying to catch the falling knife could lead to a bloody loss.

Aptos price currently auctions at $7.03. The move south was catalyzed on Sunday November 6, as the 8-day exponential moving average failed to hold support near $7.50. The Relative Strength Index (RSI) displays the current sell-off as extremely oversold, which hints that the bears’ intentions are genuine.

APTUSDT 4-Hour Chart

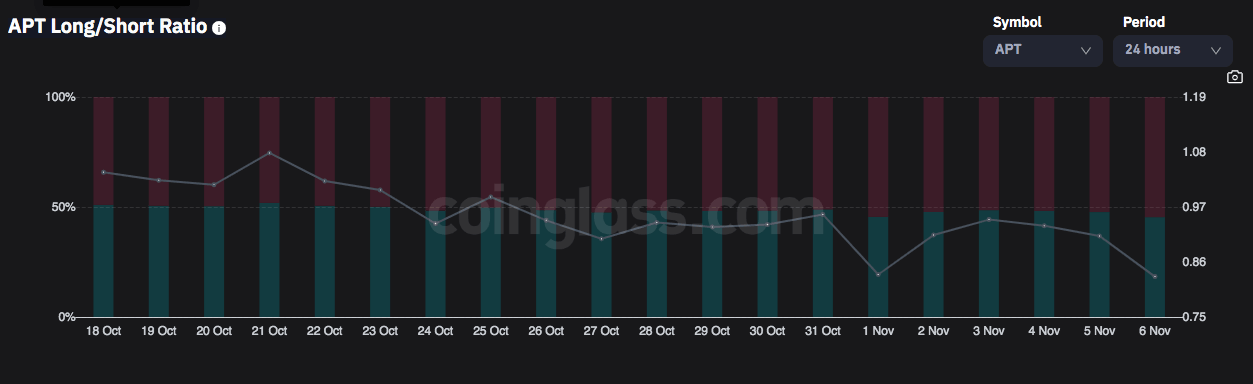

Coinglass' Long vs. Short Ratio Indicator confounds the bearish technicals for the scalable blockchain token. According to the indicator, eight of every ten retail traders are currently positioned long during the current downtrend. Based on the evidence, a capitulation event could be needed to shake retail traders off before the anticipated bull run occurs. Bearish targets lie at $6.61 and $5.90.

Coinglass’ Long vs Short Ratio Indicator

Invalidation of the bearish thesis is a breach above the swing high at $7.50. If the bulls breach this level, an additional uptrend move towards the $8.15 liquidity zone could occur, resulting in a 15% increase from the current Aptos price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.