ApeCoin staking launches after massive anticipation, users stake Bored Apes and Mutant Apes on Binance

- ApeCoin staking attracts $30 million worth of APE from investors within 24 hours of its launch.

- Binance revealed a staking program where users can stake Bored Ape Yacht Club and Mutant Ape Yacht Club NFTs and receive APE tokens.

- ApeCoin (APE) is currently in an uptrend with a target of $4.50, the monthly high for the NFT token.

Ape Foundation opened staking for ApeCoin (APE), $30 million worth of tokens were deposited in the contract within the first 24 hours. Binance announced a staking program for users to stake their Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) NFTs and earn APE. The outlook on ApeCoin price is bullish, the target for the NFT token is the monthly high of $4.50.

Binance launches BAYC and MAYC staking for users to earn APE tokens

Binance, the world’s largest exchange by trade volume, revealed an NFT staking program. Customers can stake their Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) NFTs to earn APE tokens.

Holders of BAYC and MAYC NFTs are eligible for the staking scheme. Binance’s staking program went live on December 12, 2022. Binance has allocated up to 10,000 APE tokens worth $38,700 to reward customers that sell Bored Ape ecosystem NFTs on the exchange’s platform.

The floor price, the price of the least expensive NFT in the collection, is currently $82,000, for BAYC.

When Ape Foundation launched ApeCoin staking, investors flooded the staking contract with $30 million worth of APE tokens. Holders can stake their APE tokens or their BAYC/ MAYC NFTs on ApeStake.io and start earning rewards from December 12.

According to the company’s website 96.2 million APE tokens worth $391 million have been allocated to reward users who participate in staking.

ApeCoin staking is restricted in the US

ApeCoin staking is restricted in several countries, including the US where the majority of BAYC NFT holders reside. The Ape Foundation cited regulatory concerns as the reason for the restriction. The decentralized autonomous organization is run by a handful of prominent community members and the company issued a statement citing no alternatives to the regulatory restrictions.

Those who sell BAYC/ MAYC NFT will lose staking income

A word of caution for owners of Bored Ape and Mutant Ape Yacht Club NFTs. On successful sale of their NFTs, users can no longer enjoy staking rewards as these will get transferred to the new owner of the digital collectible.

NFT influencer and proponent on crypto Twitter alerted BAYC/ MAYC holders:

if you're staking your ape and it sells, you lose the staked $ape.

— tropoFarmer -35.eth (@tropoFarmer) December 6, 2022

if you're staking your ape and it sells, you lose the staked $ape.

your ape is the key to the safe containing your staked/earned $ape. if you sell the key, you can't open the safe (the new buyer can).

be smart.

Staking has done little to fuel bullish sentiment among Bored Ape Yacht Club NFT holders. Floor prices witnessed 50% drawdown since the summer.

ApeCoin price eyes the $4.50 target

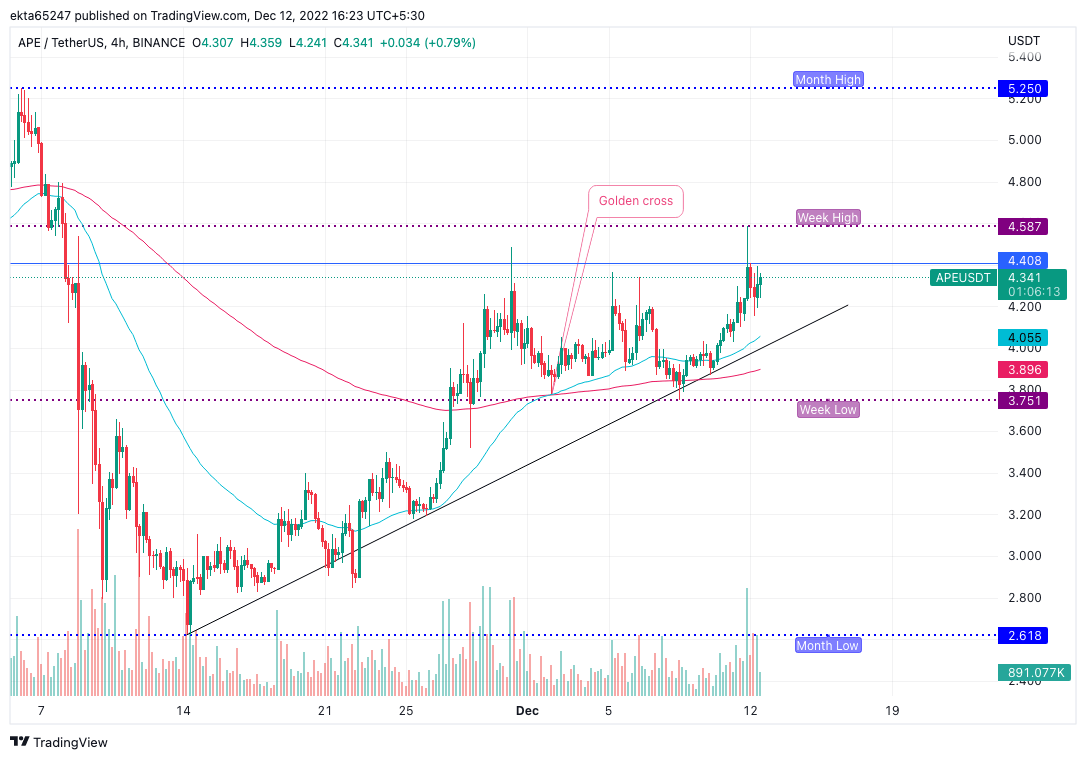

ApeCoin price started an uptrend on November 14, 2022. The 50-day Exponential Moving Average (EMA) crossed over 200-day, essentially creating a Golden cross. This is a bullish indicator for the NFT token.

ApeCoin price is set to target the resistance at $4.40 and is eyeing a weekly high of $4.50. The 50-day EMA at $4.05 and the 200-day EMA at $3.89 are acting as support for ApeCoin.

APE/USDT price chart

A decline below support at $4.05 could invalidate the bullish thesis for ApeCoin price and result in a drop to the weekly low of $3.70.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.