Apecoin price recovers after +11% meltdown, although recovery looks doubtful

- Apecoin price action gets knocked KO after two meltdown trading days in a row.

- APE price action sees $4.60 underpinned for now, but great technical support is missing.

- Expect to see a slight recovery, but the overall downtrend is ruling.

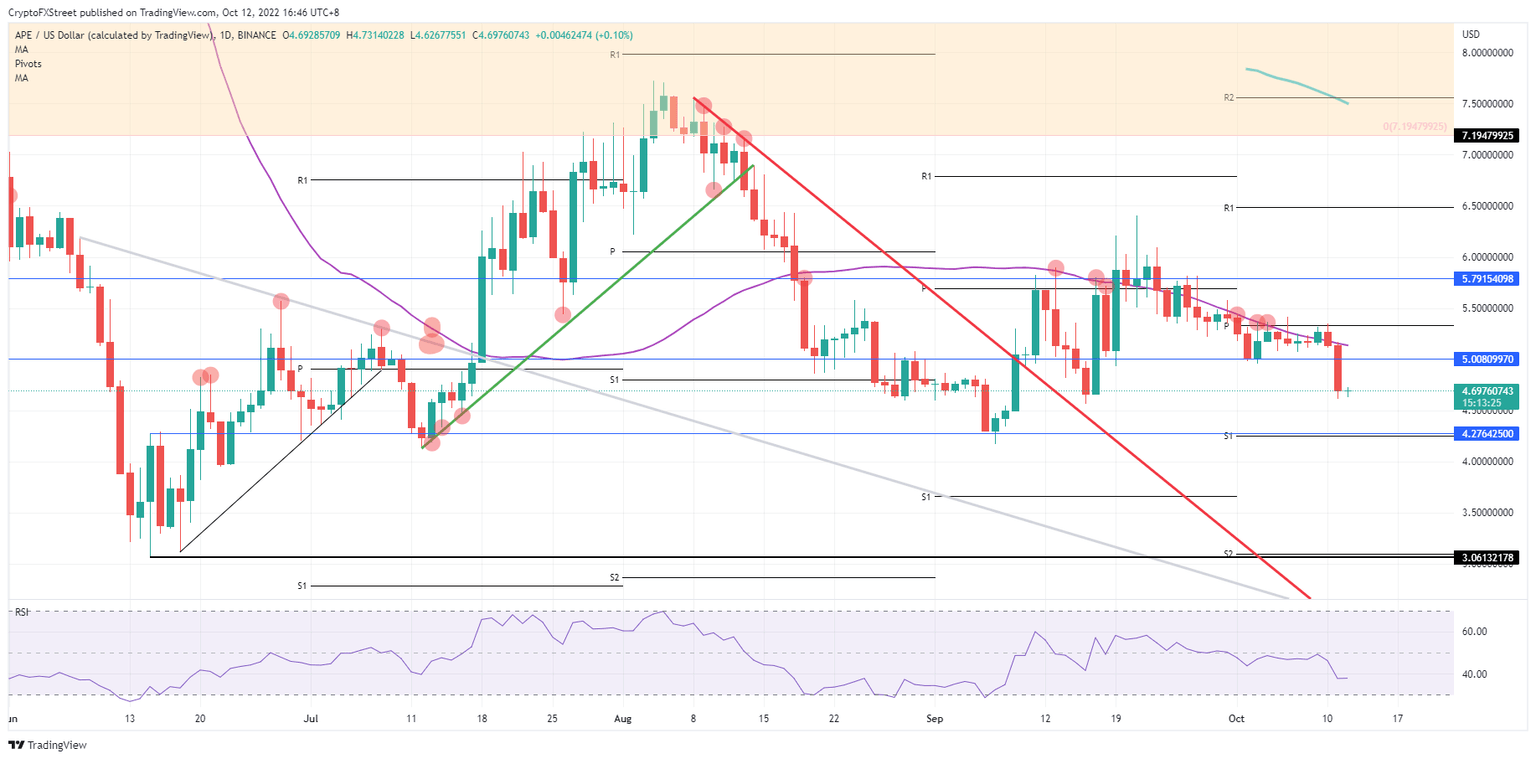

Apecoin (APE) price action tanks massively this week as bulls get sucker-punched and slaughtered as APE price dips toward $4.60. The move to the downside came after a firm rejection on the monthly pivot and triggered a false break above the 55-day Simple Moving Average (SMA), making a bull trap. With the squeeze, plenty of bulls will have been washed out of their trade, and a small recovery is due to happen today, but a full recovery by the end of this week is doubtful.

APE price decline has more room to go with RSI not bottomed out just yet

Apecoin price action imploded on Monday and Tuesday as markets rolled over, and on a purely technical front, bulls had no match for the game plan bears had laid out. With the pure technical rejection against the monthly pivot and the bull trap that unfolded, it was just a question of when the squeeze to the downside would happen. Currently, a small recovery is underway, but that does not bear any logic, and the bounce level is not historically relevant.

APE price could recover back to $5, although seeing the market nervousness, it would be quite remarkable. Rather expect the recovery to go nowhere, below $5 and see a step back to the downside by Thursday or Friday. The blue line in the sand is that the $4.27 level coincides with the monthly S1 support level and holds historical relevance and with the Relative Strenght Index (RSI) that has some leeway to go.

APE/USD Daily chart

Of course, markets could go for a 180-degree move where first, the week starts very dire and next jumps by Friday. A full recovery of the 11% in cured losses would be staggering but could be in the cards, although nervousness will be granted around the 55-day SMA and the monthly pivot. The best would be to get a daily or even a weekly close above the monthly pivot which would see follow-through to the upside going into next week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.