ApeCoin Price: APE price ready for a massive 25% rally or smoke show?

- ApeCoin proposals are up for Decentralized Autonomous Organization vote that concludes on October 12.

- Large wallet investor sold $114 million in ApeCoin and resumed buying over the past week.

- Analysts predict an ApeCoin price rally to $6.60 as the NFT token begins recovery.

ApeCoin (APE), the native currency of the Bored Ape Yacht Club (BAYC) metaverse, has recouped its recent losses. Analysts have predicted a 25% rally in the NFT token as large wallet investors resume buying.

Also read: Solana price: Crypto analysts predict God candle while researchers allege deceptive design

ApeCoin DAO proposals and why they matter

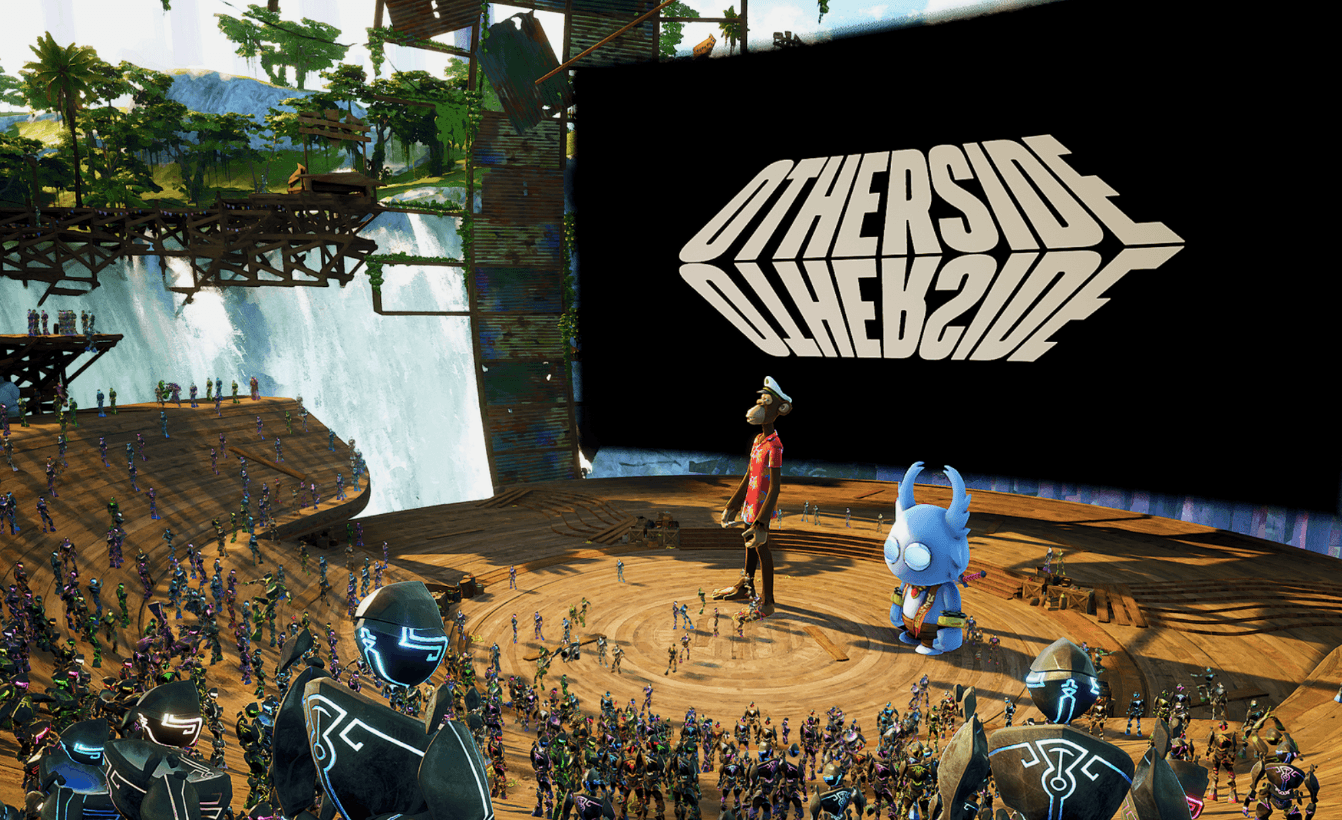

Two proposals, AIP-94 and AIP-106 are up for vote in the ApeCoin DAO. AIP-94 proposes an Otherside animated anthology. Otherside is a gamified, interoperable metaverse currently under development. It blends several multiplayer role-playing games online.

AIP-94 proposes an anthology where each episode occurs on digital plots of land in the Otherside metaverse. Bored Ape Yacht Club characters from the ApeCoin ecosystem would feature in the series, a mass consumption media product.

The goal is to push the value of the Bored Ape Yacht Club NFTs higher and connected assets like APE are likely to benefit from the launch. This would push awareness about the ApeCoin ecosystem higher and result in mass consumption of APE.

The Otherside Metaverse

AIP-106 proposes a contest for Proof-of-Attendance Protocol (POAP) NFT creators. Each POAP is meant as a bookmark of the users or the role-playing characters' life and a record of the memory shared between collectors and issuers. The proposal expects new POAP NFTs to be issued for each live proposal. Both AIPs propose a boost in the utility and adoption of ApeCoin.

Whale wallet sheds $114 million in APE, resumes buying

A large wallet investor identified by analysts at Ourboros Capital recently shed $114 million worth of APE tokens. The whale resumed buying at the end of the APE selling spree and added the NFT token to their portfolio over the past week. Typically, accumulation by whales is considered bullish behavior.

Whale profiler for ApeCoin

Will ApeCoin price climb 25%?

TheEuroSniper, a crypto analyst and trader evaluated the ApeCoin price chart and presented a setup with a target of $6.60. This level is 25% away from ApeCoin’s current price, $5.24. The outlook on ApeCoin is bullish and the NFT token has recouped its losses, yielding nearly 5% gains over the past week.

APE-USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.