Algorand Price Prediction: ALGO uptrend reaches exhaustion as technicals scream sell

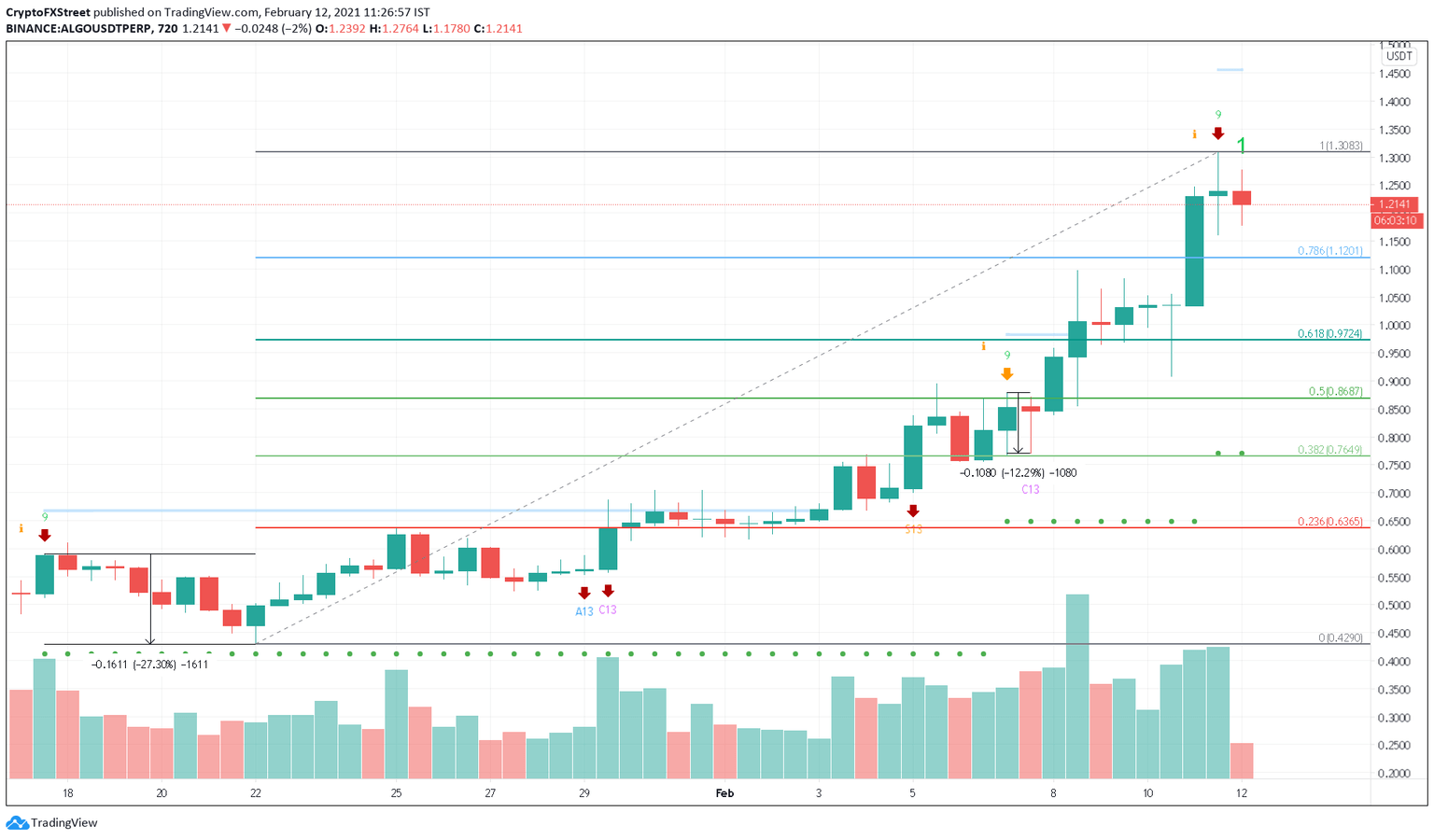

- Algorand price faces a potential sell-off as the TD Sequential indicator flashed a sell-signal on the 12-hour chart.

- The last two times this setup flashed this sell signal on the same time frame, ALGO price saw a 12%-to-28% correction.

- A bearish thesis invalidation might come into play if ALGO manages to break above the recent high at $1.30.

Algorand price saw a 100% rally in the last three weeks and recently hit a local top of $1.30. Now, ALGO could potentially reverse as the Tom DeMark (TD) Sequential indicator presented a sell signal on the 12-hour chart.

Algorand price eyes a reversal in trend

Algorand price suggests exhaustion of the bullish momentum after the previous 12-hour candlestick developed as a potential reversal doji. Additionally, the TD Sequential indicator flashed a sell-signal in the form of a green nine candlestick. The bearish setup forecasts a one-to-four 12-hour candlestick correction before the uptrend resumes.

Interestingly, the last two times the TD setup turned bearish within this timeframe ALGO price took a significant nosedive. If something similar was to happen, investors should expect a pullback to the immediate support levels provided by the 78.6% and 61.8% Fibonacci retracement level.

These areas of interest sit at $1.12 and $0.97, respectively.

ALGO/USDT 12-hour chart

While this does seem bearish for Algorand, investors should note that cryptocurrencies are highly volatile. Therefore, a spike in buying pressure due to unforeseen events could lead to a 12-hour candlestick close above the recent high at $1.30.

If this were to happen, Algorand price might rise to $1.60 or even $2.00.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.