Algorand Price Forecast: ALGO right on track to hit $1.05 as it encounters no resistance

- Algorand price had a massive 18% move in the past 24 hours to $0.992.

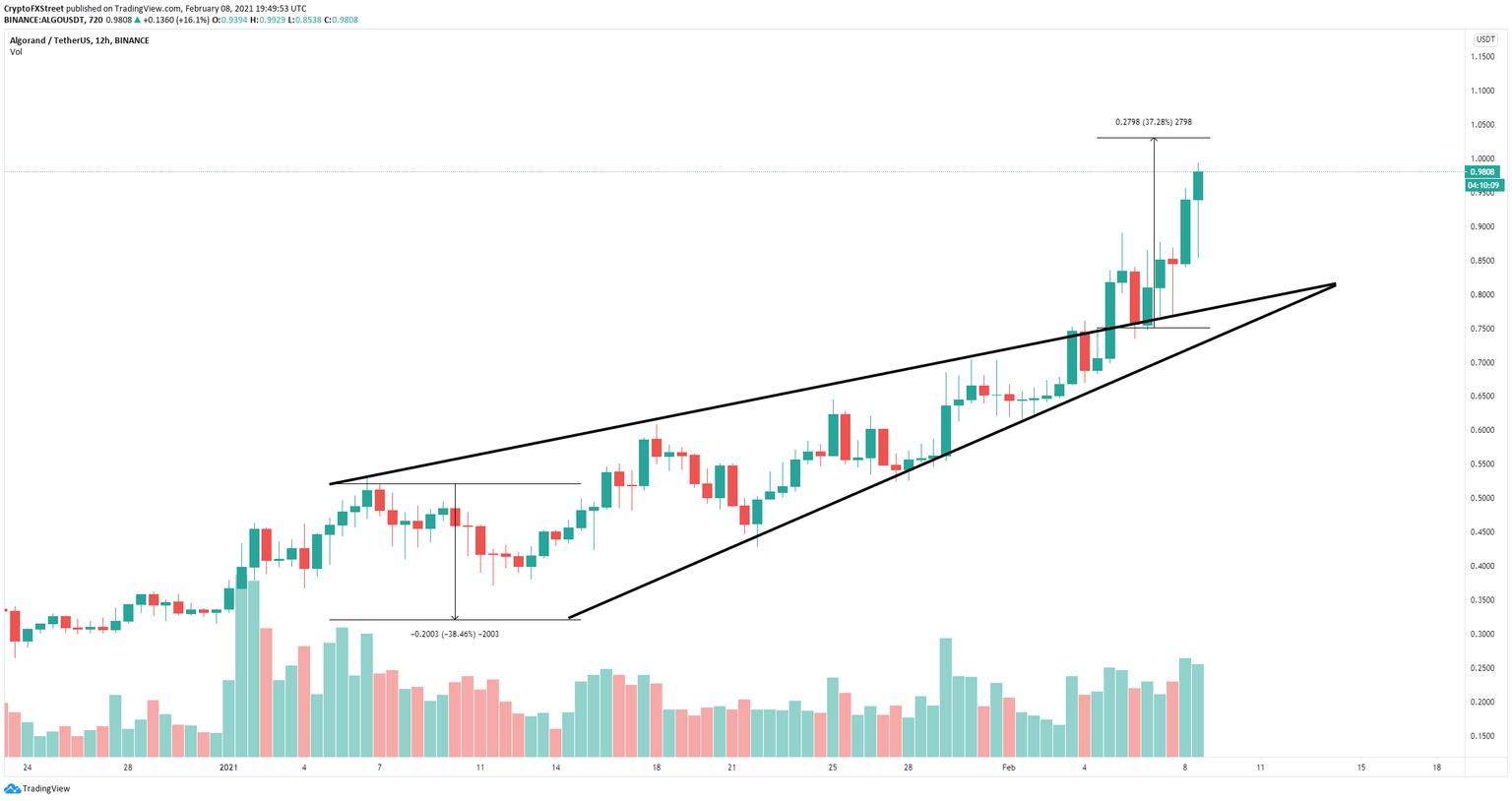

- The digital asset broke out of an ascending wedge pattern on the 12-hour chart.

- The bullish price target of $1.05 will most likely be hit within the next few hours.

Algorand has experienced a massive rally since the beginning of 2021 and it’s getting closer to its previous all-time high levels hitting a market capitalization of over $1 billion.

Algorand can quickly hit $1.05 and perhaps even more

On the 12-hour chart, Algorand price had a bullish breakout from an ascending wedge pattern with a price target of $1.05. The digital asset had a brief pullback to re-test the previous resistance level and held it with a significant rebound towards the target.

ALGO/USD 12-hour chart

Algorand will most likely hit $1.05 within the next 24 hours as it faces no significant barriers ahead. Since Algorand is practically in price discovery mode, we can use the Fibonacci tool to determine next potential levels on the way up.

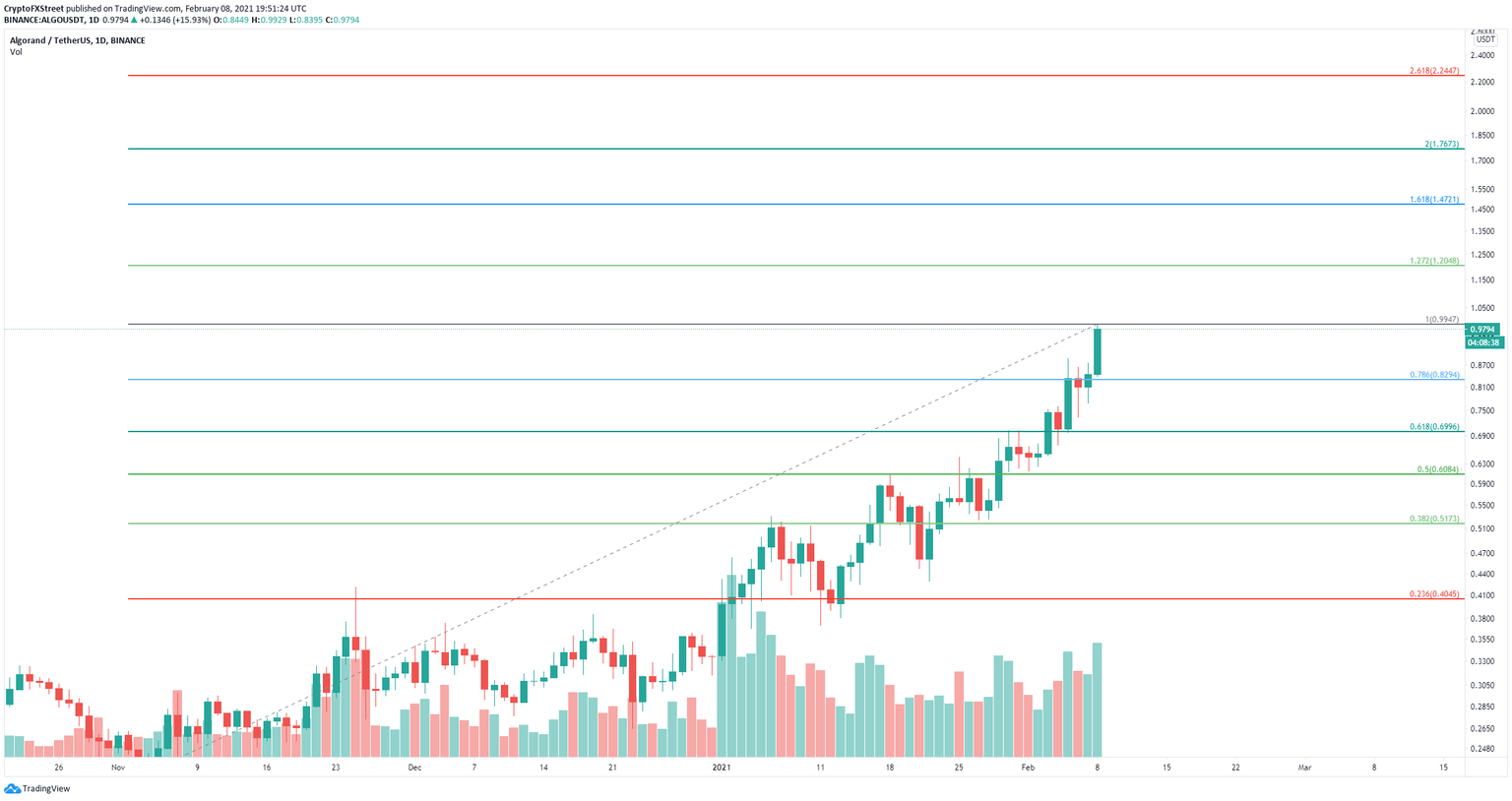

ALGO/USD daily chart

The next bullish price target is $1.20 which is the 127.2% Fibonacci level followed by $1.47 which is the 161.8% level.

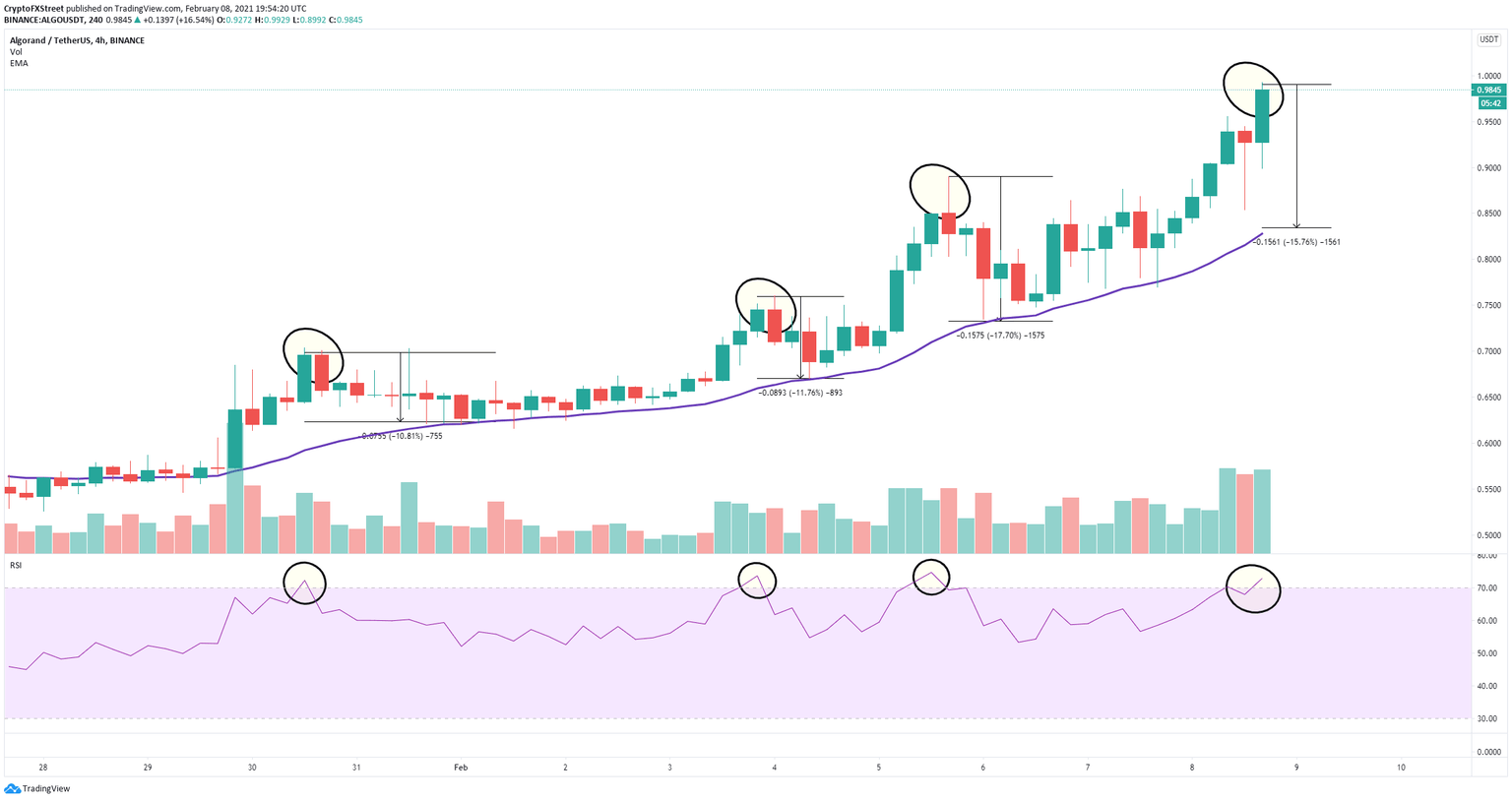

ALGO/USD 4-hour chart

However, on the 4-hour chart, the RSI is overextended and it has been an accurate indicator of upcoming pullbacks. In the past three overextensions, Algorand price dropped towards the 26-EMA, touching this support level and rebounding. Another fall would push ALGO down to around $0.84 which is where the 26-EMA is currently established

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.