Algorand price eyes 40% gain as ALGO bulls take control

- Algorand price has kick-started its 60% rally and is hovering around $0.769.

- Investors can expect ALGO to continue its ascent to $1.1 with more upside on the horizon.

- A daily candlestick close below $0.675 will create a lower low and invalidate the bullish thesis.

Algorand price found stable support on March 14 and kick-started a recovery rally with massive upside potential. Currently, ALGO is nowhere near the midway point and suggests a continuation of this optimism as it heads toward its target.

Algorand price remains strong

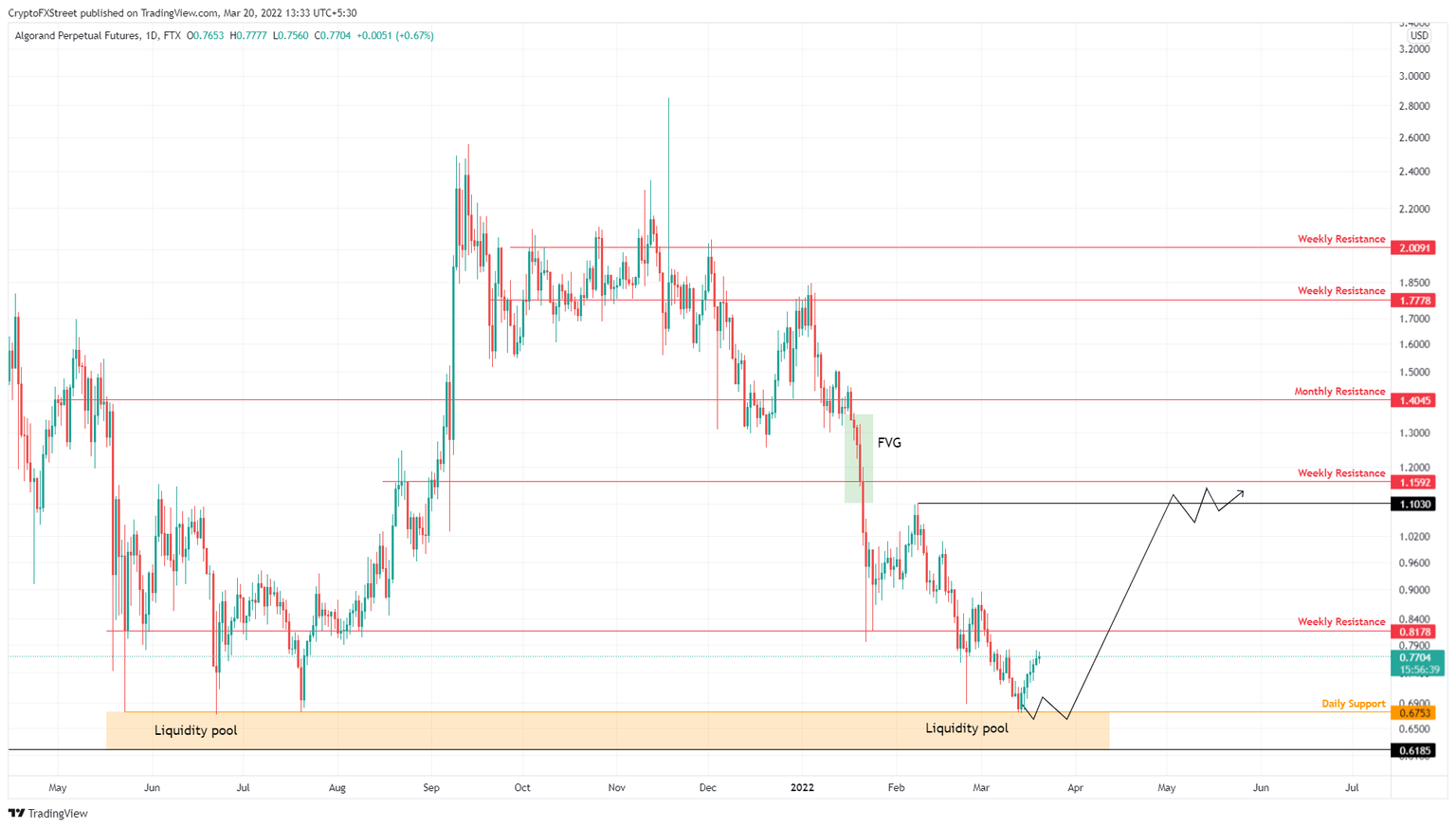

Algorand price bottomed after retesting the $0.675 support level formed between May 2021 and July 2021. Although a sweep below this barrier would have made the upside a high conviction trade, it did not.

Regardless, ALGO has rallied 15% since March 14 and shows no signs of slowing down its bullish momentum. Investors can expect Algorand price to experience a minor slowdown around the weekly resistance barrier at $0.818.

However, clearing this hurdle would open the resistance-free path up to $1.10. This move would constitute a 43% ascent from the current position and is likely where ALGO will form an equal high. However, there is a chance Algorand price could extend to the weekly hurdle at $1.2.

ALGO/USDT 1-day chart

While things are looking up for Algorand price, a flash crash in Bitcoin price could shatter the optimistic outlook established for ALGO.

A daily candlestick close below $0.675 will create a lower low and invalidate the bullish thesis for Algorand price. In such a case, ALGO will most likely collect liquidity and revisit the immediate support level at $0.618. Here buyers can attempt another bull rally.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.