AI coins to watch after Siri 2.0 announcement at Apple WWDC 2024: WLD, RNDR, FET

- Apple’s annual developer conference WWDC 2024 is set to kick off on Monday.

- Investment bank Morgan Stanley said Apple will likely launch a new and improved Siri at the conference.

- Prices of AI-related coins like Worldcoin, Render, Fetch.ai fell ahead of the start of the developer conference.

Apple’s Worldwide Developer Conference (WWDC) 2024, which starts on Monday, has the potential to influence prices of AI-related tokens as the company is expected to release several updates at the event, including a revamped version of Siri, according to reports from Reddit, Apple Insider and Bloomberg.

Project Greymatter is the focus of the discussions on what to expect from the Cupertino-headquartered tech giant. Bloomberg has previously reported on the project, which is based on a set of Artificial Intelligence (AI) tools that the company is expected to integrate into core apps like Safari, Photos and Notes.

Apple Insider reported earlier in 2024 that the investment bank Morgan Stanley believes that the tech giant will benefit the most as AI becomes mainstream. The bank’s analysts highlighted Apple’s Edge AI work, namely an improved AI-powered Siri 2.0 and a broader AI-enabled operating system.

What to expect from Apple WWDC 2024

Reports from Reddit’s OpenAI note that Apple Insider has received the exact details of virtual assistant Siri’s new functionality. The Apple news website states that the tech giant has tested a variety of different prompts for the new AI. Siri’s new prompts reportedly contain “natural” language, as spoken by humans.

In January, Apple Insider reported that analysts at Morgan Stanley expect the tech giant to benefit the most from developments in Artificial Intelligence.

WWDC 2024 is scheduled to kick off on Monday at 17:00 GMT. The announcements at the conference could catalyze gains in tokens in the AI category, like Worldcoin (WLD), Fetch.ai (FET) and Render (RNDR). The three assets lost between 3% and 6% of their value on Monday.

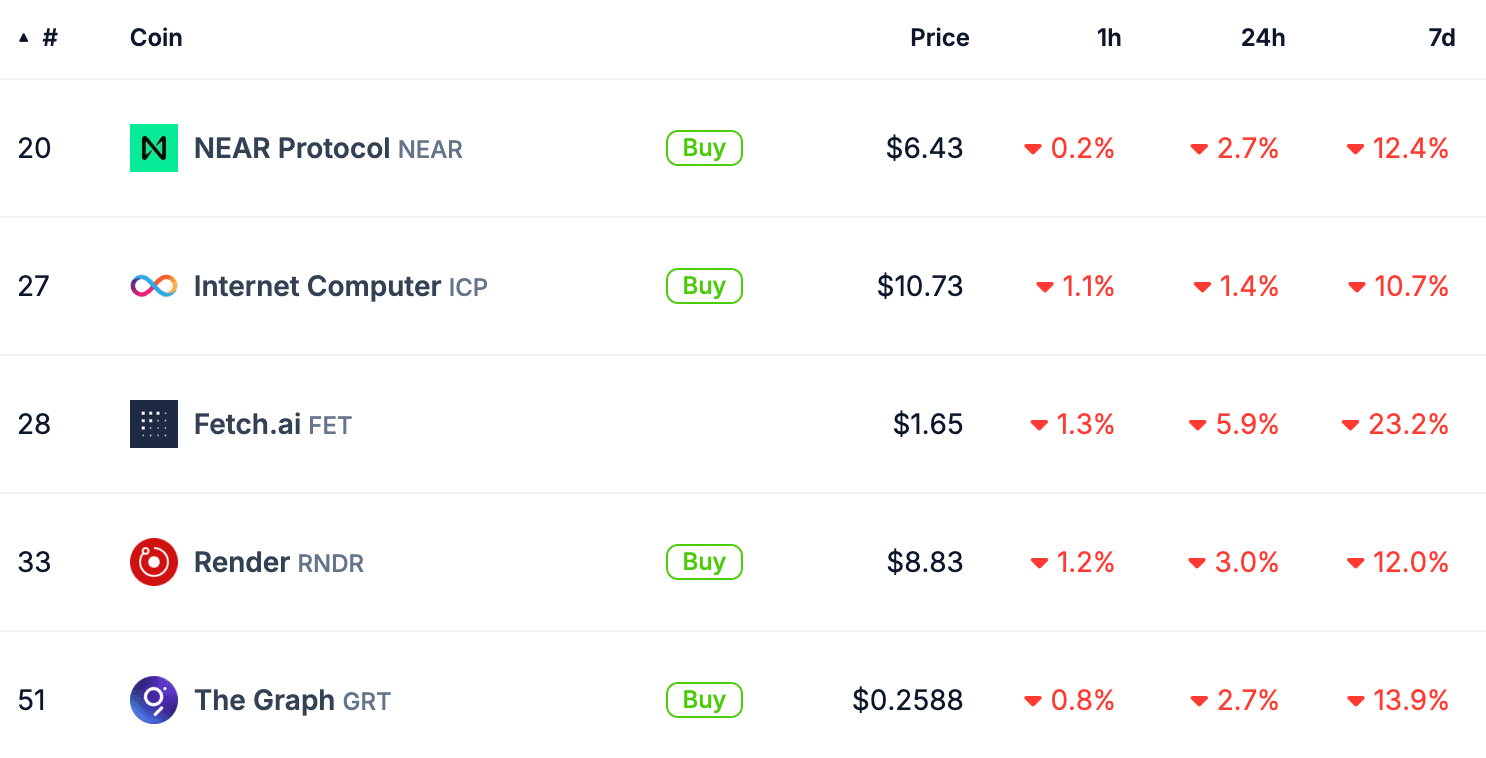

Data from crypto aggregator CoinGecko shows that the top five AI tokens ranked by market capitalization have seen their prices decline in the past 24 hours and seven days.

Top 5 AI category crypto tokens on CoinGecko

AI-related announcements at WWDC 2024 could catalyze gains in WLD, FET and RNDR. The phenomenon has occurred previously. NVIDIA’s earnings reports and AI-related updates or announcements from OpenAI and other tech giants have fueled rallies in AI tokens with large market capitalization.

At the time of writing, WLD and FET prices are down nearly 6%, while RNDR has lost nearly 3% of its value in the last 24 hours, respectively.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.