Three reasons why QuickSwap (QUICK) price spiked by 50%

QUICK price gained 50% shortly after a partnership with CelsiusX proves that the platform is serious about bridging the gap between DeFi and CeFi.

Decentralized finance (DeFi) and the control it gives users over their assets is one of the most applicable sectors of the cryptocurrency ecosystem, but the general public is still hesitant to interact with most DeFi products due to the steep learning curve and the possibility of losing funds.

One decentralized exchange (DEX) that is taking strides toward bridging the gap between DeFi and centralized finance (CeFi) is QuickSwap (QUICK), the top ranked DEX on the Polygon network.

Data from Cointelegraph Markets Pro and TradingView shows that the price of QUICK saw a rapid 50% spike in value from $166.40 on Jan. 31 to a daily high of $250 on Feb. 1 after its 24-hour trading volume surged by 168%.

QUICK/USDT 4-hour chart. Source: TradingView

Three reasons for the rapid bounce back in QUICK price include the announcement of a partnership with Celsius, the addition of new high yield liquidity pools and the launch of stable-stable pools that offer a higher yield and decrease the risk of impermanent losses.

QuickSwap partners with CelsiusX

The most significant recent development for QuickSwap was the announcement that the DEX partnered with CelsiusX, the DeFi arm of the Celsius banking and financial services platform that is focused on integrating CeFi and DeFi.

#DeFi is about to get a lot more interesting

— QuickSwap (@QuickswapDEX) January 12, 2022

@CelsiusXDeFi x QuickSwap x @0xPolygon

❤️Now THAT is progress@CelsiusNetwork $MATIC $QUICK pic.twitter.com/jgn4GZQFLX

Partnering with QuickSwap also allows for the creation of wrapped versions of popular tokens like Cardano’s ADA and Dogecoin (DOGE), which do not currently have a major presence on Polygon, along with well-funded liquidity pools for these assets so that users, bots, arbitrageurs and institutions have easy access to that token.

This also provides DOGE and ADA holders with added ways to use their assets in DeFi to earn a yield instead of simply holding their DOGE or staking their ADA.

New liquidity pools could attract a new breed of investor

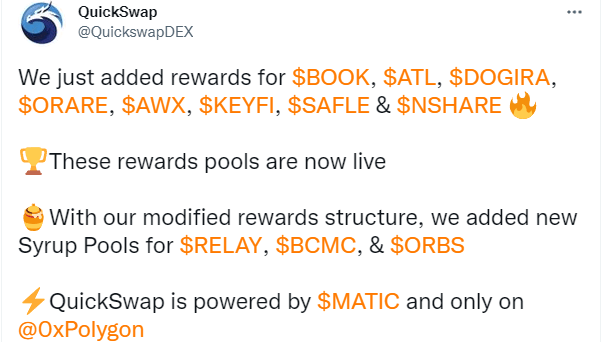

A second factor helping to bolster the price and momentum of QUICK has been the launch of multiple new liquidity and ‘syrup’ pools. This could be a bullish sign, especially when considering that a handful of projects launched and integrated bridges to the Polygon network in January.

Aside from the addition of support for DeFi protocols like Atlantis Loans or the layer-one blockchain solution Orbs (ORBS), QuickSwap has seen a flurry of added support for nonfungible tokens (NFT) projects, which have once again been gaining momentum despite the wider weakness in the cryptocurrency market.

Some of the newly supported NFT projects on QuickSwap include the UniArts network, Dogira, OneRare and Blockchain Monsters Hunt.

New staking options for stablecoin holders

A third factor helping to attract users and liquidity to the QuickSwap DEX is attractive yields for liquidity providers of stablecoin-stablecoin pairs.

Yielding on stables sound good?

— QuickSwap (@QuickswapDEX) January 24, 2022

⚖️QuickSwap offers several stable-stable pools where LPs can earn over 14% #APY & balance risk of Impermanent Loss

If yielding on $USDC, $USDT, $MAI & $DAI while earning $dQUICK rewards sounds like your jam: https://t.co/Ac4PagsDsY pic.twitter.com/uRMQ8C790G

These pools provide users with an opportunity to earn a decent yield while also decreasing the risk of impermanent loss associated with other types of liquidity pools.

This could also present more attractive stablecoin yields for depositors on the Celsius network and increase the overall liquidity locked on the QuickSwap protocol.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.