3 Reasons why Ethereum price recovery remains elusive despite surging demand

- Demand for Ether soars as investors capitalize on the Ethereum price drop to $1,285.

- The correlation between ETH and Wall Street's Nasdaq jumps to a four-month high.

- Ethereum price recovery largely depends on its buyer congestion at $1,300.

Ethereum price is consolidating around $1,350 after bouncing off support at $1,300. The newest proof-of-stake (PoS) token's downtrend hit a two-month low of $1,285 as investors reacted to the Merge last week on Thursday.

Interest in ETH is on an upward roll as investors position themselves for an expected bullish trend reversal. On-chain data from Glassnode reveals a sharp increase in the number of addresses holding 1,000 and more tokens to 6,472 from 6,174 in May.

Usually, spikes in this on-chain metric positively influence ETH price. However, several fundamental and on-chain factors will likely deter Ethereum price from achieving its bullish potential, at least in the foreseeable future.

Ethereum addresses chart

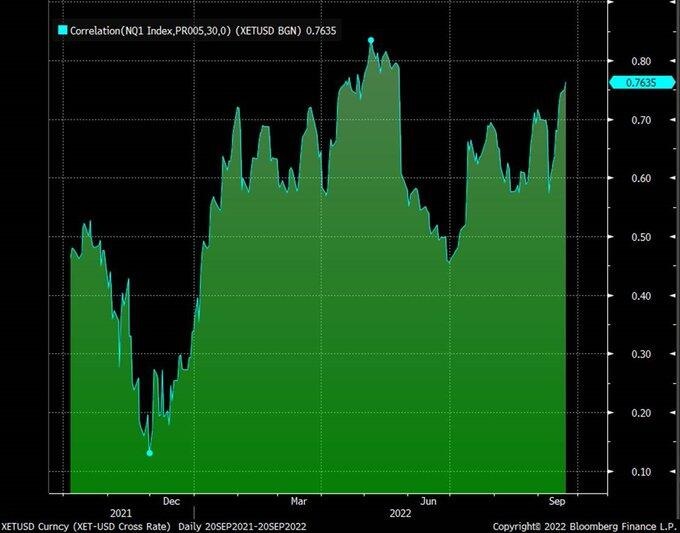

Ethereum price correlation with Nasdaq index hits four-month high

The second-largest cryptocurrency recently transformed from one reality (proof-of-work consensus) to another (proof-of-stake), a move that elicited interest among investors. Although the scales tipped in favor of Ether bulls due to increasing demand, positive price developments remain scarce.

Analysts believe the burgeoning sensitivity to stocks is holding Ethereum price from taking off. According to data from Cumberland, ETH is currently heavily correlated with the Nasdaq index. The correlation between the two different asset classes stands at 0.765 (a four-month high), up from 0.580. It is worth mentioning that a value of 0.700 and more is considered a weighty positive relationship between the assets.

"The ETH/Nasdaq [30-day] correlation is nearly back to the highs of the year – a feature which has overshadowed the idiosyncratic dynamics of the Merge (for now)," Cumberland said on Tuesday.

"In price action space, this degree of macroeconomic correlation has made it difficult for crypto-native participants to extract alpha from their edge: the deep understanding of on-chain dynamics," Cumberland continued.

Cumberland's insights suggest that Ethereum price might continue to struggle with recovery owing to Nasdaq's weakness. More pain is expected in the stock market following the soon-to-be-released FOMC report (Federal Open Market Committee report).

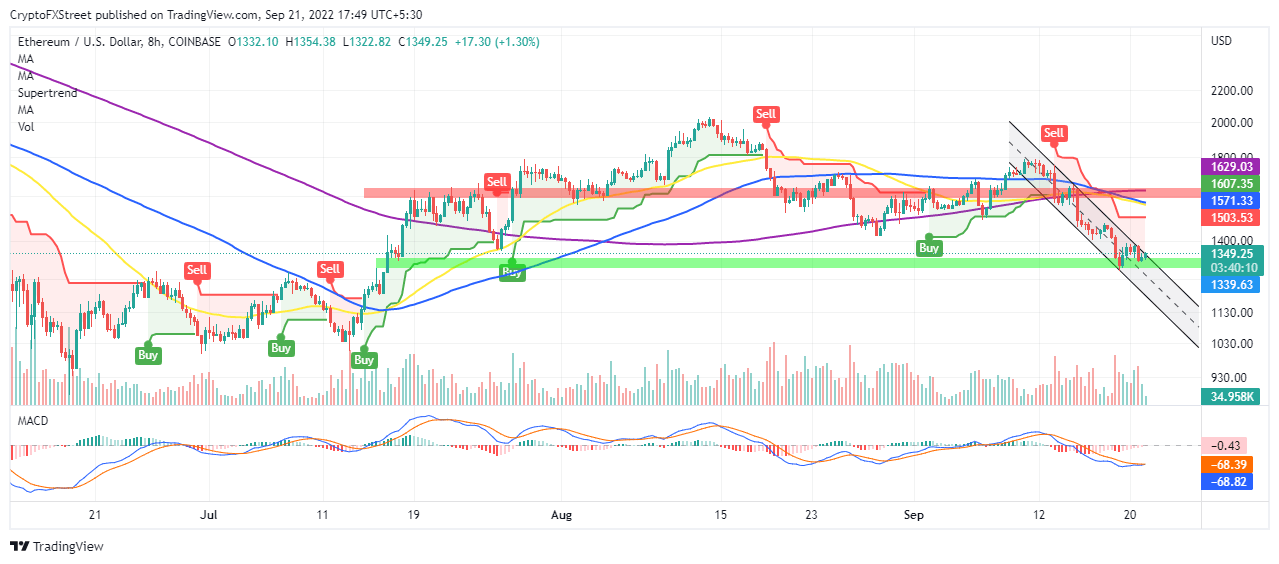

Ethereum price flaunts sell signal

Following its rejection from highs around $1,800, Ethereum price nosedived within a descending parallel channel. Support at $1,300 came in handy, preventing the losses past a bearish candle wick price level of $1,285.

Ethereum price may have to establish a break above the channel to affirm a bullish trend reversal. However, a sell signal presented by the SuperTrend indicator continues to water down the buyers' efforts.

ETH/USD eight-hour chart

Consequently, the Moving Average Convergence Divergence (MACD) is lagging a buy signal. Traders looking forward to going long on ETH must wait for the 12-day Exponential Moving Average (EMA) to lift above the 26-day EMA before placing their orders.

Ethereum price faces robust supply zones

The pioneer smart contracts token needs to break above $1,600 to shake off selling pressure and pave the way to $2,000. However, IntoTheBlock's IOMAP model shows that overhead pressure is stronger between $1,514 and $1,557. Approximately 749,800 addresses previously purchased 8.35 million ETH in the range.

Ethereum IOMAP model

As bulls push Ethereum price higher, investors in the above zone are likely to consider selling at their respective breakeven points, resulting in stronger headwinds and a possible trend reversal.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637993667218603674.png&w=1536&q=95)

-637993668024917758.png&w=1536&q=95)