Ethereum price attempts to recover recent losses

- Ethereum price eyes a recovery rally but needs a catalyst to trigger the run-up.

- Investors can expect ETH to face challenges at the $1,430, $1,550 hurdle.

- A daily candlestick close below $1,280 will invalidate the bullish thesis.

Ethereum price aims to kick-start a bounce, but Bitcoin’s lack of volatility has kept it pinned down. Investors should stay focused on BTC, therefore, so as to spot and jump on the next opportunity to ride the bullish ETH wave.

While the market outlook has been bearish after the Merge update on September 15, Binance announced on September 20 that it had completed the Ethereum proof-of-work (POW) token distribution to its users.

Unlike other exchanges like BitMEX or ByBit, however, Binance is yet to list futures for trading the newly forked token ETHW, which is trading at $6.

Ethereum price awaits a bullish catalyst

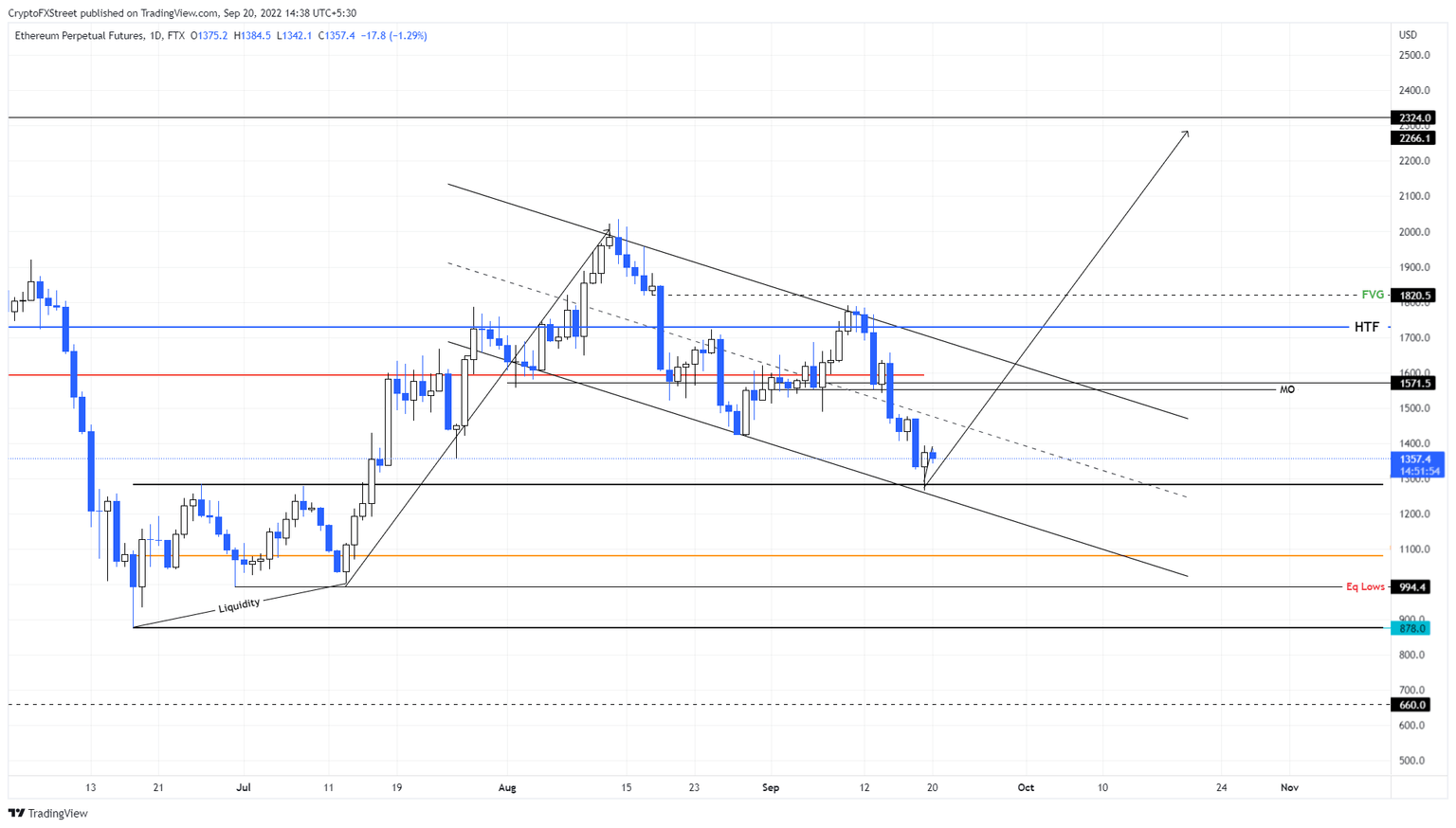

Ethereum price seems to be in the process of traversing a descending parallel channel after producing a string of lower lows and lower highs since August 29. The latest swing low formed on September 19 and ended at $1,280.

So far, Ethereum price has recovered roughly 8% since the swing low, but an explosive rally is likely to push ETH higher. The immediate hurdle at $1,550 is the first target for bulls, but overcoming this barrier could extend the run-up to retest the higher time frame resistance level at $1,730.

Although unlikely, ETH could even retest the $2,000 psychological level, which would bring the total gain from 23% to 36% and is likely where the upside will be capped.

ETH/USD 12-hour chart

While things are looking up for Ethereum price, there is a chance a recovery rally will fail to materialize, especially if Bitcoin price ruins the setup. If ETH produces a daily candlestick close below $1,280, it will invalidate the bullish outlook.

This development could potentially crash Ethereum price to the next support level at $1,080.

Note:

The video attached below takes a look at how to approach Ethereum price from an investment as well as a trading standpoint. It also picks out a few ETH-centric altcoins that could rally in the next bullish phase.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.