Oil continues it’s bearish consolidation, while precious metals await this weekend’s French election.

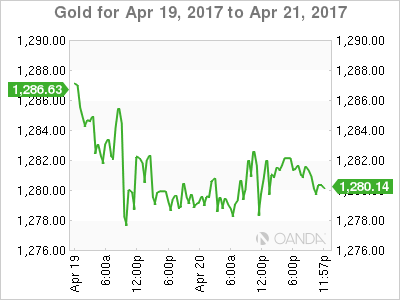

Gold has spent the overnight session consolidating to open quietly mid-range at 1281 this morning in Asia. The fact that gold is almost unchanged from its open of the previous day suggests that traders are now positioned and in a wait and see mode ahead of this weekend’s French presidential voting.

From a chart perspective, however, gold appears to have run out of momentum, having made a series of lower highs over the past few days. Assuming the weekend passes without surprises election wise, there is potential for a correction on Monday as safe-haven hedges are lightened. However, a surprise win by both the extreme left and right candidates could make gold’s price action when it opens early Monday emotional, to say the least.

Key levels for the Asian session and into the weekend are supports at 1270 and 1260 with resistance at 1296, 1300 and 1308.

Silver

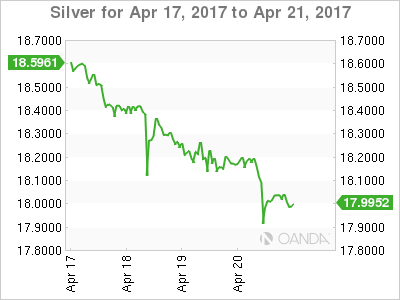

Silver meanwhile, it looking even less constructive on the charts. Since peaking on Monday at 18.6550, Silver has made a series of lower daily highs and lows and is now perched precariously on its 200-day moving average at 18.0200. Clearly, this weekend’s vote in France will set the price agenda into the next week, but like gold, its price action is not constructive from a technical perspective.

For today’s session, Silver has support at 17.8650 initially and then 17.7400. Resistance lies at 18.2400 with a close above implying a move back to the 18.5000 area.

OIL

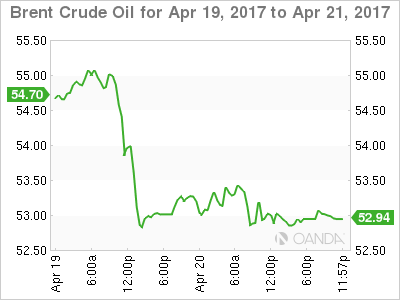

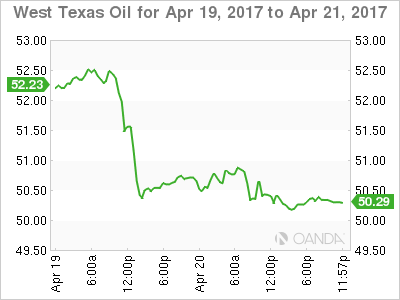

Crude has consolidated near the bottom of its recent ranges as Asian trading gets under way. After the midweek clean out of long positioning, traders appear averse to initiating fresh longs as the Street frets about record oil inventories globally and rising U.S. production.

From a technical perspective, neither Brent nor WTI’s price action is constructive. Instead, both seem to be making bearish consolidation patterns before another move to the downside.

Brent spot has clearly defined support at 52.50 with resistance at 53.50 intraday.

WTI spot has support at 50.00 with resistance at 51.00 intraday.

The price action over the last 48 hours, suggests a break of the support levels in both, could trigger more stop-loss selling as optimism meets reality.

Summary

Were it not for the French election this weekend; commodities would not be looking constructive technically. However with “Le Crunch” this Sunday, surprises cannot be ruled out, and they have the potential to override the technical picture. Some more short-term consolidation cannot be ruled out over today’s session, but traders should be watching their news feeds late Sunday, and the metals open at 6 am Singapore for further clues.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.