Credit Suisse just came out with their excellent Global Wealth Report for 2019. I will likely do a more in-depth report in The Leading Edge earlier in the New Year.

The focus is on wealth, but the income statistics are even more illuminating in this time of peak inequality. I especially like their comparisons per adult as opposed to per capita or per household.

Adults are the people who spend their own money – whether it be earned or saved. Minors are spent on, and it is a lifestyle choice to have kids or not – as well as to have a certain number of them. Of course, if you have more kids you will have less income per person. But people who choose that typically prefer that for their lifestyle. So, this is the best measure to me of how much income and spending power people have in different countries.

Then there are the comparisons of income in PPP, or purchasing power parity. I like that comparison, as well, and it works best for measuring how standard of living grows with urbanization. But although countries with lower costs of living makes life more affordable, there is a quality of life factor that is also a choice. New York or London or Sydney or Geneva or Singapore may cost more to live, but they are considered worth it due to their immense choices and lifestyle quality.

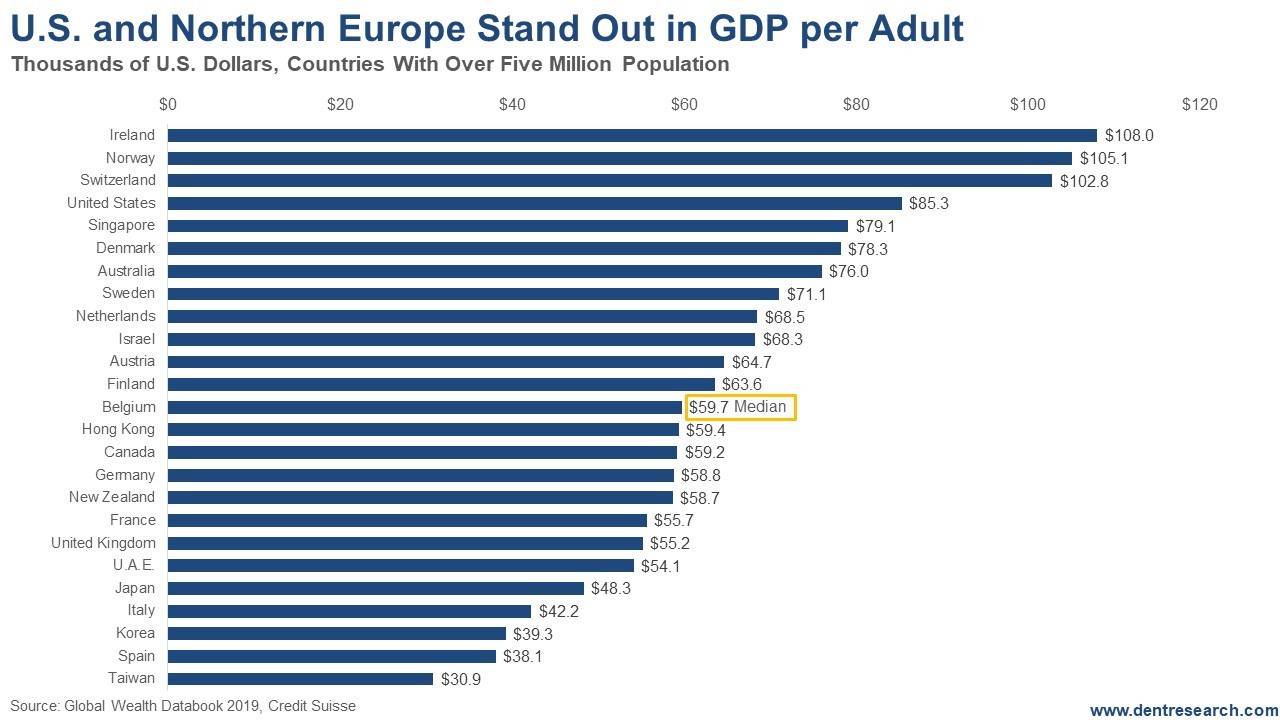

So, in this article, I will show the GDP per adult for the developed countries over 5 million in population – and there is a great variance, from $30.9k to $108k.

First, note the three highest countries, as they all have some exceptions for their high achievements here. Ireland is the highest, but it is a small country with strong tax incentives to attract multinational companies with high paying jobs. Norway is a small country with high relative oil revenues, like a mini Saudi Arabia. Switzerland is the most expensive country in the world, typically with high-value exports. Their companies have to pay more for the privilege of being there.

The U.S. really stands out here, as it is a very large country with a high ratio of lower income immigrants. At $85.3k, it is 7% higher than Singapore that has a 100% urban population and attracts the best of Asia. I did not expect the U.S. to outperform it on this measure. The U.S. is also 44% higher than Hong Kong, which is also 100% urban and attracts the best of Asia.

I look at Belgium here as being right in the middle – like the median – at $59.4k. The U.S. is 44% greater than that. The other countries in Europe that stand out are Denmark, Sweden and the Netherlands – very northern.

Outside of Ireland, the U.S. is also the strongest of our cousins, the English Offshoots. Australia at $76.0k is only 11% lower than the U.S., and they don’t work as long hours. Canada at $59.2k is a surprising 31% lower than the U.S. New Zealand comes in at $58.7, also 31% lower. All the offshoots have now surpassed the U.K, and at $55.2 it is 35% lower than the U.S.

Spain is the lowest in Europe at $38.1k now, about the same as its Spanish cousin Puerto Rico at $37.6k. Kudos to my new home country, which was still an emerging country a few decades ago. Taiwan is the lowest at $30.9k, that was also a surprise to me and likely reflects its still restrictive ties to China.

The U.S. still looks surprisingly good. Too bad we look to peak and fade by 2036-37 at the top of the next global boom.

The content of our articles is based on what we’ve learned as financial journalists. We do not offer personalized investment advice: you should not base investment decisions solely on what you read here. It’s your money and your responsibility. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments such as futures, options, and currency trading carry large potential rewards but also large potential risk. Don’t trade in these markets with money you can’t afford to lose. Delray Publishing LLC expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.