Written by: Alexandra Estiot, Senior economist BNP Paribas

2013 started rather positively, with consumers holding their consumption despite the rise in the payroll tax rate. Employment growth was rather dynamic, and for a few months, it sounded like the so long awaited recovery was there. Even the now usual spring slowdown was of rather limited magnitude. With solid GDP growth and sustained decline in the unemployment rate, the calls for the Fed to taper, i.e. slowdown the pace at which it buys securities on a monthly basis as part as QE3 (the third wave of quantitative easing decided in September 2012), got more numerous. Together with mounting concerns from a few Governors about the financial stability, this led Chairman Bernanke to announce such a tapering: slowdown in the next following months (i.e., before the end of 2013), for a stop by mid-2014 when the unemployment rate would be around 7%.

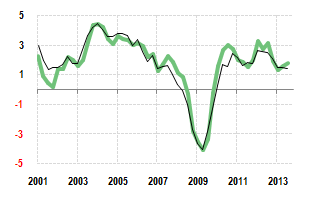

Chart 1: Neither dynamic nor accelerating

Source: US Bureau of Economic Analysis

-- GDP (y/y, %)/ green

-- Final domestic demand (y/y, %)

We now know this was premature. As the economy shrugged away the fiscal deal that was decided at the very beginning of the year, the impact of the sequestration was well under-estimated. On top of that, the announcement of Chairman Bernanke led to a pronounced increase in long-term interest rates, with quasi-immediate negative consequences on home sales. Abroad, the tapering talk caused financial turmoil for a few large economic countries.

The summer was the time of the slowdown, even if the rate of growth remained rather steady. The truth is that Q3 growth performance was supported by large increases in inventories, which were undoubtedly involuntary: businesses over-estimated the potential for increase in consumer spending and ended up with unsold inventories. This phenomenon brought 1.5 points to GDP growth in Q3, but will likely weigh on the Q4 performance.

As for employment, the slowdown was also marked, and the subsequent rebound does not seem that sustained when digging deep into details. Manufacturing and construction payrolls are rather well oriented, but the private service sector is not accelerating the pace at which it hires. As this industry represents around 70% of total non-farm payrolls, it is impossible to imagine a sustained recovery of the labour market without it, at least, participating.

As for the fiscal outlook, things could not go worse than they did: the federal government shut down for 16 days and the debt ceiling was not raised before the last minute. Once more Congressmen kicked the can down the road, postponing deadlines for a few months. 2014 could be starting on a better footing, even if it is actually just less bad. The Congress passed a budget deal that will allow a smooth financing of the federal government until the end of the coming fiscal year. Automatic spending cuts will hit, but slightly less than previously expected.

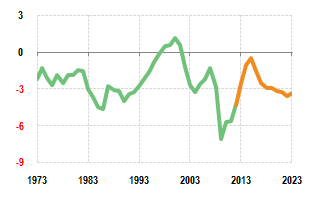

Chart 2 : Fiscal policy is restrictive

Source: Congressional Budget Office

-- Federal government structural budget deficit (% of GDP)/ green

-- Projections from the CBO/ orange

Still, the reasons for expecting growth to accelerate are few. Households’ disposable income remains constrained by limited gains in labour income, and the persons that have been unemployed more than 26 weeks will no more receive benefits. In short, as long as the labour market does not rebound markedly, there is no room for private consumption to accelerate. Then, the only source of possible strength has to be found abroad. The US manufacturing sector benefited from an incredible improvement of its external competitiveness, especially the durable goods industry, thanks to a depreciated dollar and growing productivity that allowed to cut unit labour costs. This lifts the US as one of the large countries that could benefit from the rebound in northern Asia.

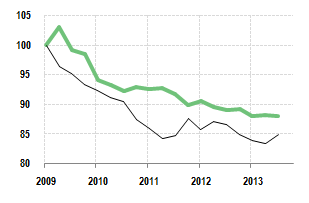

Chart 3 : An remarkable improvement in external competitiveness

Source: US Bureau of Labor Statistics & Federal Reserve

-- ULC, manufacturing durables/ green

-- USD real effective exchange rate

The small relative size of the manufacturing sector, even if it seems about to strongly rebound, should limited the gains for the overall economy, which will, on the other hand, keeps on suffering from the reduction in the federal government deficit. In short, the US economy is likely to keep growing at the sub-par rate of the last few years. In such circumstances, there is no room for strong job creations, and if the unemployment rate keeps on slowly decreasing, it will be thanks to a depressed labour participation rate.

With such a scenario in mind, there would be no reason for the Fed to taper anytime soon. Ben Bernanke however announced at the December meeting that the Fed would start winding down the monthly pace of security purchases from January. They will purchase each month USD 10 bn less of securities (USD35bn of MBS and USD40bn of Treasuries). This tapering will keep going at the same pace, the Fed implementing USD10bn less of accommodation at each of its incoming meeting. Were the situation to disappoint, the scale back would be eased or stopped, and accelerated if activity, employment and prices were to surprise on the upside. That means that under the current expectations of the Fed, QE3 will be stopped at the end of next year.

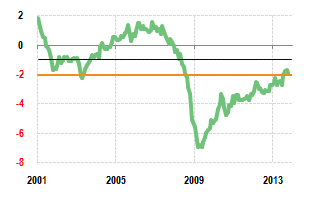

Chart 4 : No time to taper

Source: BNP Paribas Economic Reserach

-- Ben Index (BNPP Economic Research Proprietary indicator)/ green

-- Average - 1 standard-deviation

-- Average - 2 standard deviations/ orange

That move surprised us, and the optimism of Ben Bernanke even more, as he said to be very glad to be able to slowdown QE3 because the program had proved successful and not because of financial stability consideration. Fair enough. We however do not share this positive analysis of the US economy, but history will tell whom was right. As for the dollar, it appears that the Fed managed to clearly establish the path of its monetary policy (tapering on the one hand, forward guidance on the other hand), short-term rates are likely to remain stable. This means that everything else being equal, the dollar does not have a reason to appreciate. But everything never stays equal, and the fate of the green back in 2014 will be decided by what happens in Frankfurt. Should the ECB finally decide to implement some kind of unorthodox policy, the dollar could move up rapidly against the euro. The same can be said about the Bank of Japan and the value of the yen. So now, the ball is no more in the US camp… should the Fed proved efficient in keeping rate hike expectations under control!

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.