$EURUSD

What ProAct Forex Target Traders See: We are currently sitting @ 1.0871. We are ranging and looking for a continuation to the 0.786 Fibo @ 1.0643 with an overall target to the range bottom @ 1.0500. The average daily true range (ATR) for the pair currently is 76 pips.

————————————————————————--

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 120.21 in a sideways move. We are looking for a bounce to the 0.500 Fibo @ 121.83. On a breakout look to the 1.270 Fibo @ 119.15. The average daily true range (ATR) for the pair currently is 69 pips.

——————————————————————————–

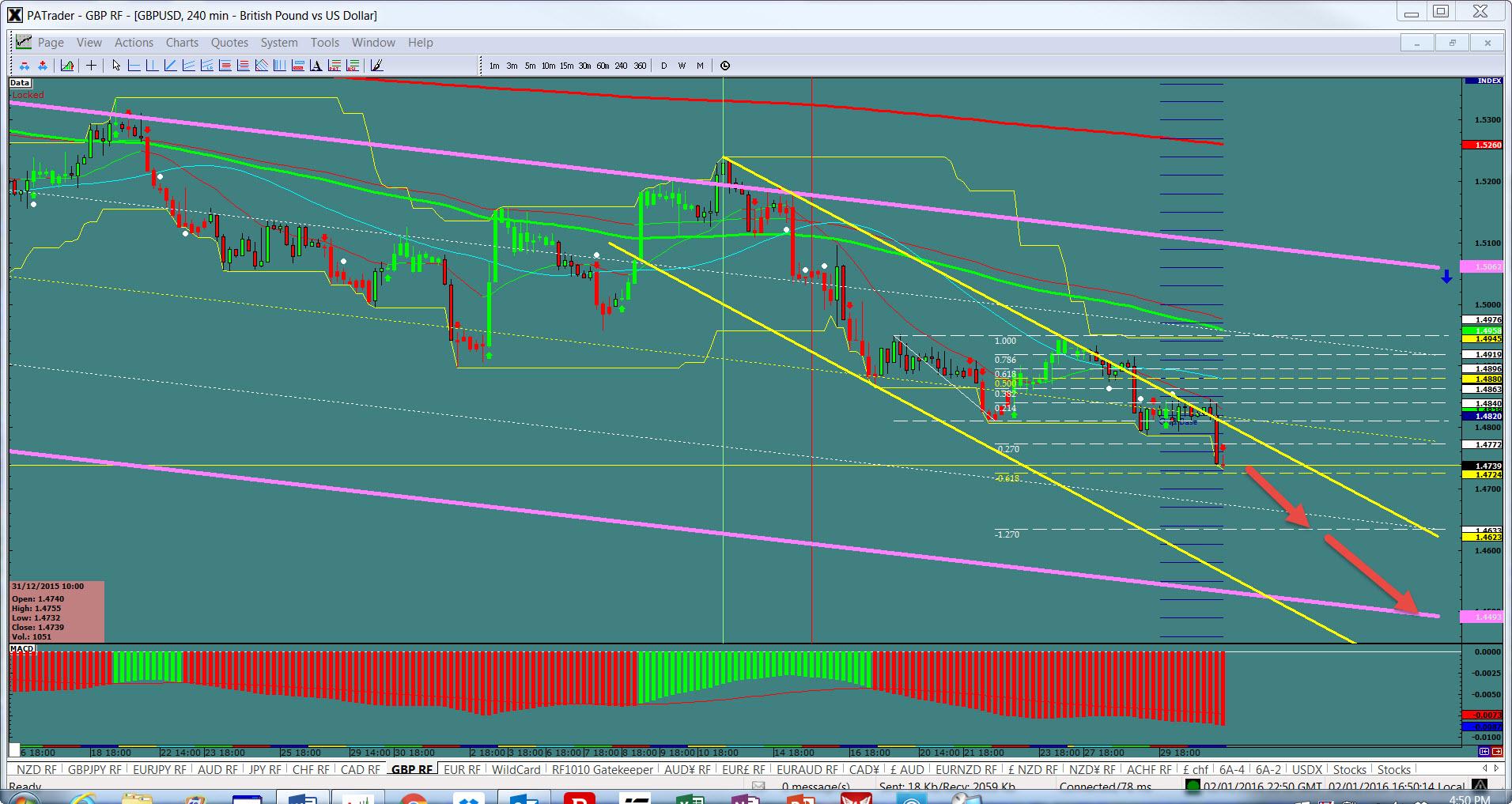

$GBPUSD

What ProAct Forex Target Traders See: Sterling is currently @ 1.4739. We are looking for a continuation to the 2.270 Fibo @ 1.4623 with a continuation to the Trend bottom around 1.4493. The average daily true range (ATR) for the pair currently is 87 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7294 in a large range. We are looking for a continuation to the initial support @ 0.7164 and then the 0.7013. The average daily true range (ATR) for the pair currently is 60 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.