A second consecutive bearish close for the Dollar Index as Major crosses continue to trade within corrective patterns.

KEY EVENTS THIS WEEK:

AUD: Monetary policy minutes; CPI q/q; RBA Stevens speaks; Business confidence

CAD: Wholesale sales; Core Retail Sales; BOC rate ststament and decision; Press conference

CHF: Trade Balance

CNY: GDP q/y; Industrial Production; Flash Manufacturing PMI

EUR: Flash Manufacturing PMI; Flash Services PMI;

GBP: MPC Votes; Retail Sales; Prelim GDP

JPY: Trade Balance

NZD: CPI q/q; Trade Balance

USD: Core CPI; Unemployment claims; New Home Sales

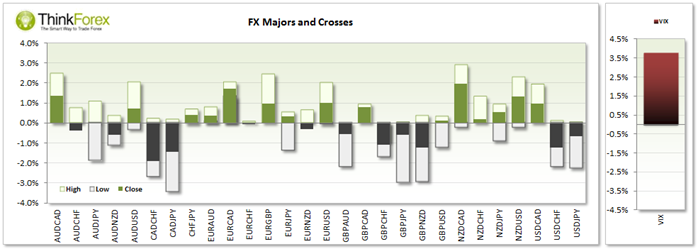

Australian Dollar:

A slight increase of short positions has been added but price continues to whipsaw within a 2c range making positional trading tricky. We have now seen 2x Hammers near the 4-year lows which could either be an inverted Hammer (bullish) or Shooting Star (Bearish) if we break below 0.863. Until then we have to assume the correction and whipsaws will continue. RBA minutes are unlikely to provide much information but traders will look out for any hint of macro-prudential tools for the housing market. Stevens also speaks on Thursday which may provide further direction.

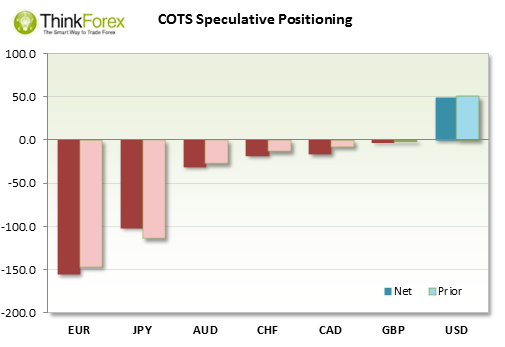

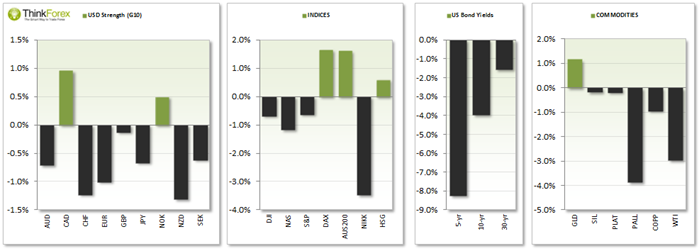

USD Dollar

The Dollar Index continues to be within a corrective phase but not really hinting an end to the bullish trend as of yet. There has been a slight fear of lower inflation pressures and Net longs have reduced slightly but we would need to break below 84 before becoming too concerned with the bullish move. Core CPI on Wednesday is the headline figure with any soft numbers likely to extend the dollar losses and help support AUD, EUR and GBP above their recent lows. USDCAD continues to grind higher and produce higher highs and lows, so favours buy-the-dip strategies.

Euro

As long as EURUSD remains below 1.30 then the downside towards 1.20 looms. INtraday price action has a bullish bias but overall price action appears corrrective which favours a resumption of the bearish move. EURCAD may have seen a cycle low at 1.40 with last week's bullish close at a 7-week high.

British Pound

The daily charts are showing the potential for a bullish wedge to form which if completed weould target the base near 1.65. Traders are marginally Net short on British Pound futures but not enough to read too much into it. Last week produced a Bullish Pinbar above the Nov '13 swing low so a case is building for GBP gains.

Japanese Yen

Early Asia trading has seen a gap-up to suggest a breakaway gap (bullish) and an end to the correction from the 110 highs. JPY Trade Balance could help support USDJPY if the numbers come in soft but we are more likely to see the catalyst come from US Core CPI.

Gold

The retest of $1240 has been achieved and we now see price oscillate around this key level. A convincing break above here invalidates the Double Top setup and could quickly see Gold target $1265. However we would need to see the USD extend losses which may be triggered by any soft GDP data. My bias is for data in US to be string and help support the USD and bring further downside on Gold.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.