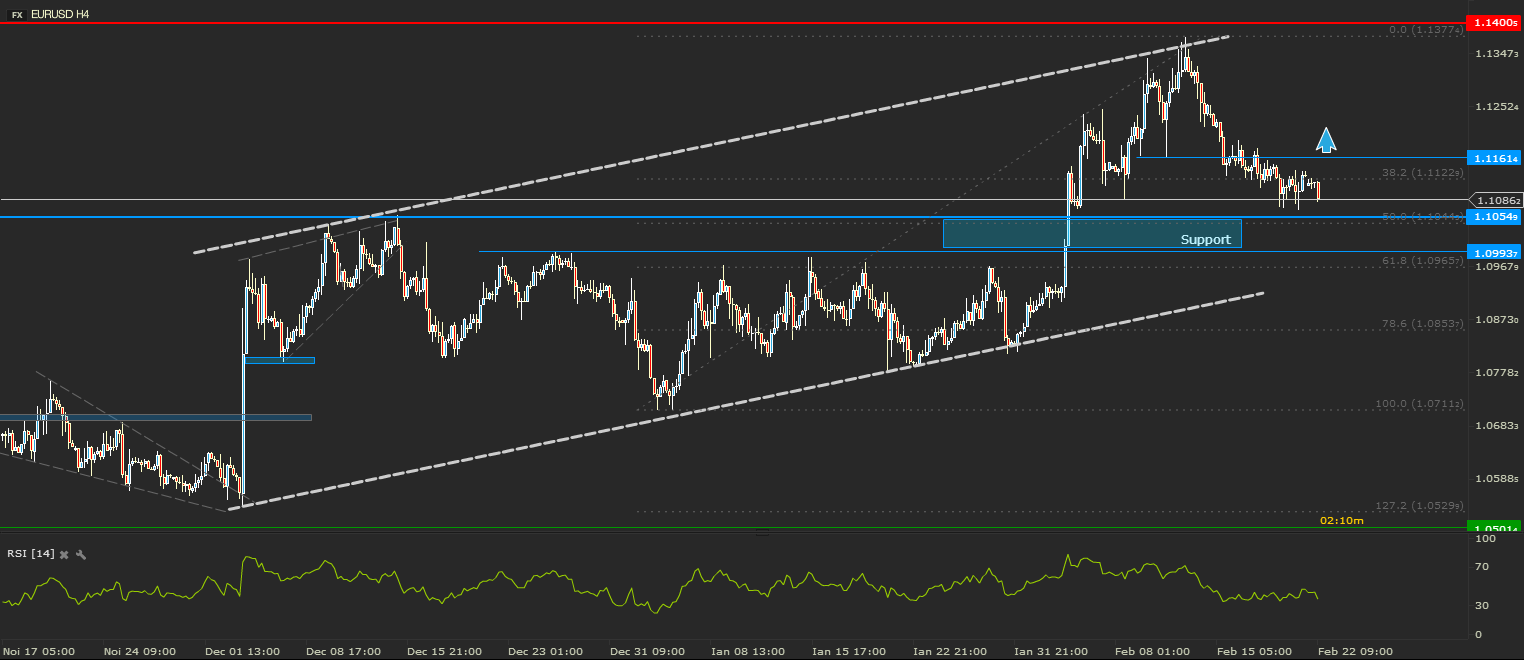

Last Monday I have seen that the price of EURUSD bounced back down before hitting the 1.1400 resistance, so I was expected for the price to continue the down move towards the key support area situated between 1.1000 and 1.1050. As forecasted, the price fell, but did not reach yet this area.

Considering the fact that the main trend for this year is still up, the down fall might just stop around the 50% retracement (found in the same support area) and bounce back up, aiming for a new higher high. The direction of this trend will be endangered if the price will fall below 1.1000. Otherwise I would consider the down move to be a corrective movement for the uptrend.

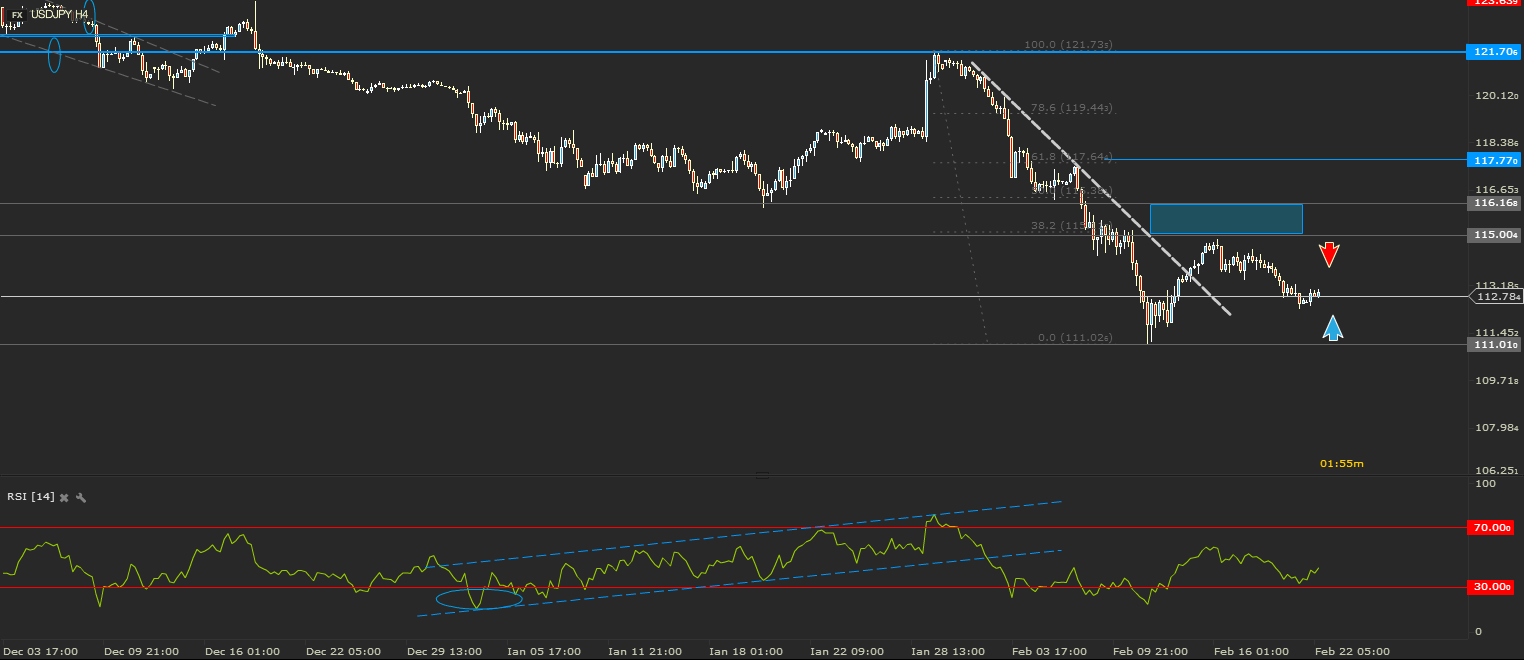

USDJPY - Heading towards 111.00

As expected 115.00 acted as a resistance. The price of USDJPY got very close to this level and dropped before hitting the round number level. The current fall brought the price back below 113.00.

Considering the fact the the main trend is down, the expectations are for the down move to continue below the current key level support from 111.00. But without proper incentives the price might just continue to trade sideways between 115.00 and 111.00.

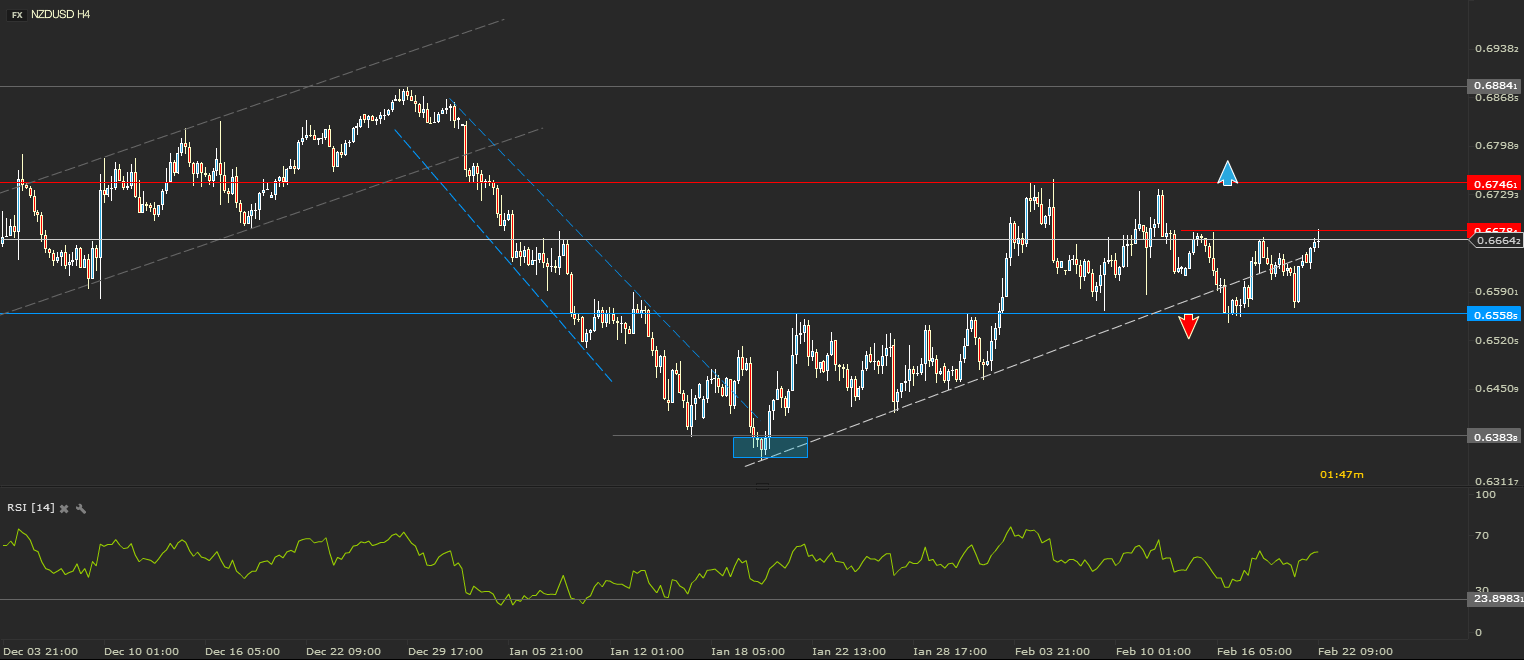

NZDUSD - Continuing the Sideways Move

This is one of the instruments that did not change its price action much during the last 7 days. Last week we were talking about a sideways move between 0.6558 and 0.6746. this week the same levels apply since the price did not move outside this range.

The only new element which I could add to this sideways move would be a local resistance situated at 0.6678.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 after German GDP data

EUR/USD is keeping the red near 1.0700 as investors await inflation and growth data for the Eurozone. The data from Germany showed that the GDP contracted at an annual rate of 0.2% in Q1 as expected, not allowing the Euro to attract investors.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.