Fundamental Forecast for Dollar: Neutral

Euro rallies on S&P 500 tumbles, but is the Euro truly a new safe-haven currency? (Hint: no.)

Stocks surge ahead of key Jackson Hole Summit—what might we expect?

Look at real-time FX positioning data via our Speculative Sentiment Index

It was a difficult week for traders as the initial US Dollar breakdown left many (including us) looking for further losses. The Euro/US Dollar first saw its largest three-day advance in six years, but instead of continuing higher it subsequently posted its largest three-day decline since 2011. Such choppy price action made it near impossible to keep any real conviction in market direction or a lasting trading bias. A big week of economic event risk and the new month may nonetheless add clarity for the US Dollar and broader financial markets.

Traders should first watch for any surprises out of a highly-anticipated central banker symposium in Jackson Hole, Wyoming. US Federal Reserve Vice Chair Stanley Fischer will deliver a speech on inflation on Saturday, while Bank of England Governor Mark Carney and European Central Bank Vice President Vitor Constancio will also issue statements at the annual summit.

The critical question remains whether the US Federal Reserve will raise interest rates at its September meeting, and Fischer’s commentary will draw special scrutiny as US Dollar traders attempt to anticipate the Fed’s next moves. It was only two weeks ago that interest rate futures predicted a 60 percent chance of a September hike. Yet those same futures now show an implied 40 percent probability—a big reason why many traders may have rushed for the exits on their Dollar trades.

The next big question is how major global central banks will react to the recent bout of financial market volatility. To that end we’ll watch planned commentary from the BoE’s Carney and the ECB’s Constancio for clues on potential policy responses. We should also note that unplanned comments from other major central bank officials at the summit could likewise force big moves in key assets.

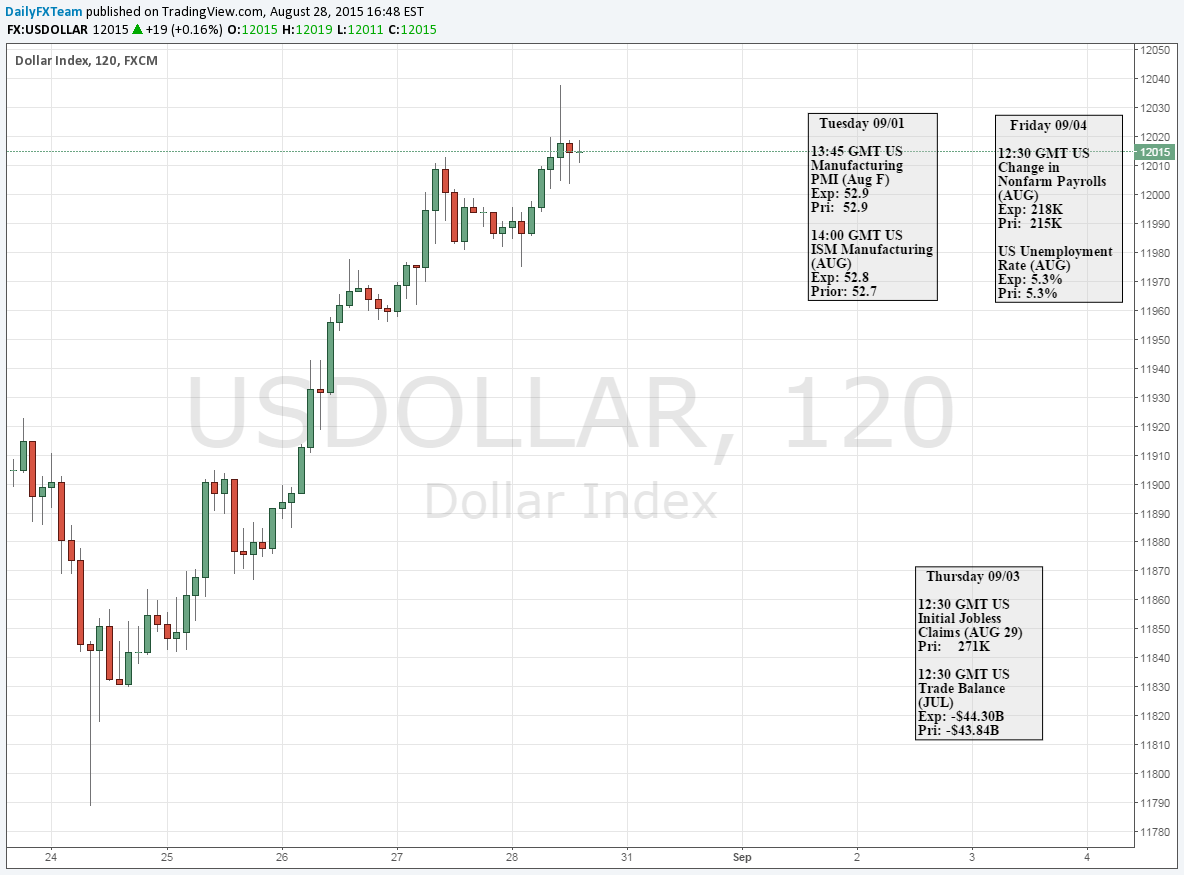

Beyond Jackson Hole, markets will turn to highly market-moving US Nonfarm Payrolls data on Friday for the next clues on US Federal Reserve interest rate moves. The US central bank is fairly unique as its mandate states it must pursue policies of maximum employment while controlling inflation. Recent market volatility and potential knock-on risks to global growth may already make Fed officials less likely to raise rates. But a disappointing US labor market report could sound the death knell for the possibility of a September rate hike.

The possibility of major surprises from global central bankers or US NFPs has pushed 1-week FX volatility prices near multi-month peaks, and the next several days promise to force meaningful shifts across financial markets. The fact that the Euro rallied and the Dollar tumbled as the S&P 500 sold off led many to claim the Euro was a new “safe-haven” currency. We think the opposite is true, but any renewed market turmoil could in fact lead more traders to dump USD-long positions and force Euro rallies. It will be critical to watch how markets open the week and begin trading into the first days of the new month.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.