Fundamental Forecast for Gold: Bearish

Gold, Silver Face Make-Or-Break Moment On NFPs As USD Gains Momentum

Gold Breakdown Risk Intensifies

Sign up for DailyFX on Demand For Real-Time Gold Updates/Analysis Throughout the Week

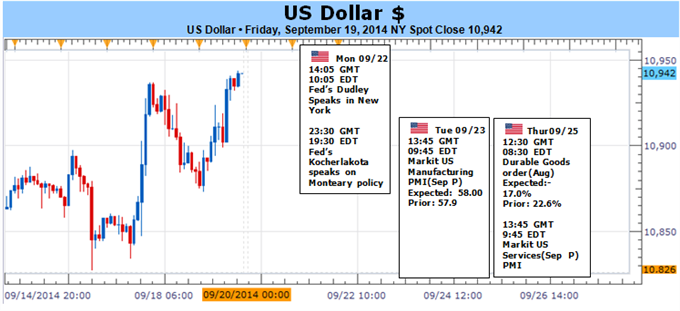

As lackluster as the volatility and sentiment reaction was to last week’s FOMC decision, the event sustained the Dollar’s incredible run. Now on a 10-week bullish binge, this is the most enduring greenback run on record. Some will immediately consider this a ‘mature’ and ‘overbought’ market by virtue of its pace alone. Fundamentals, however, are not ready to revoke support for the bulls. As has been the case over the past weeks, key for the Dollar moving forward is the level of appetite for liquidity and the outlook for US interest rate expectations. And considering the scenarios, it may prove difficult to capsize the currency.

In the primary fundamental veins that feed the dollar, interest rate expectations have offered the greatest blood flow to the bulls’ cause. While the Federal Reserve’s communication effort at this past week’s monetary policy meeting left much to be desired, there was enough tangible evidence of the march towards a first rate hike to rouse the bulls. While the second-to-last Taper (QE3 is expected to end at the next meeting on October 28 according to Chairwoman Janet Yellen) was a concrete step, it was the forecasts that really caught traders eyes. The outlook for employment, inflation and growth were little changed; but the interest rate projections increased substantially.

In its consensus, the FOMC shows 14 of 17 members believe it is appropriate to start raising rates in 2015, versus 12 at the previous review. Furthermore, through the end of 2015, the Fed now expectes its Fed Funds rate to be at 1.38 percent. At the close of 2016, the benchmark is seen at 2.88 percent. That compares to forecasts of 1.13 and 2.50 respectively offered up in June – a full 25bp hike higher. That hawkishness is a boon to the Dollar as it sets it on a faster course to climbing the carry trade scale before most of its counterparts. In fact, this ‘dividend’ forecast keeps the Fed on pace to potentially realize its first hike before all the majors with the exception of the BoE, and its subsequent pace is arguably more intense than all counterparts.

If there is a full consensus on the hawkish outlook, and investors have already positioned for such a future; then there could be a moderation of its subsequent climb without fresh updates to reinforce the theme or a new fundamental driver to take over. However, this well has not been fully tapped. While the currency and Treasury yields have climbed through the past months, there is still a dramatic disparity between the what the Fed is projecting and what the markets are accounting for. We can see that most directly in Fed Fund futures (a product used to hedge interst rate changes) which are pricing in a 0.78 percent rate by the close of next year (a 60bp discount to the FOMC forecast) and 1.38 percent by December of 2016 (a 150 bp difference).

There is significant risk from the central bank’s perspective for the markets to be so far off the guidance they are trying offer. Last minute adjustments by the financial market to policy changes are typically much more violent. Yet, the central bank has contributed heavily to this confusion with mixed signals in its communications. Chairwoman Yellen made a considerable effort to avoid questions in her press conference about the signs that the market’s view didn’t match the Fed’s own rate outlook. We will see if FOMC members will try to rectify this in the week ahead. There are 10 scheduled speeches from 8 Fed members. The balance of their views – with special note of 3 ‘neutral’ 2016 voters (Powell, Dudley and Lockhart) – should be watched closely.

One reason why obfuscation may actually be a strategy from the Fed is that the shift to a tightening policy could upset the fragile balance of complacency that has drove asset prices to record highs, on decades low participation rates and record leverage. The growth in accommodation made by the ECB, BoJ and PBoC may work to offset the withdrawal; but a misstep can be disastrous. A meaningful correction is inevitable over a long-enough time frame. And we are three-years without a 10 percent S&P 500 pullback. Central banks may not be able to keep the peace. And if they fail, risk aversion could give the dollar an even bigger boost.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.