Recommendations:

High risk: Buy the AUDUSD at the market, SL 0.9100, targets 0.9250, 0.930, 0.95.

Low risk: Buy the EURUSD at 1.2900, SL 1.2730, targets 1.30, 1.34, 1.40.

Analysis:

The EURUSD has fallen during last week as we expected. The weekly chart on EURUSD displays a candlestick close to a pin, and the price action during last week also showed a rather deep pocket of bulls supporting the euro. This might indicate that the retest of the lower edge of the trading range (1.2750-1.29) is unlikely at the moment. We would avoid entering any positions in EURUSD next week except if the pair falls below 1.29.

The USDJPY has broken outside its uncertainty wedge to the upside. And it would be logical for the pair to go revisit its previous high in the 103.xx. However, the bearish engulfing candle formed on a daily level and the steepness of the fall that occurred on Friday suggests that the retest of 103 either won’t happen in the coming week, either that the indecision pattern is still in formation. We would not trade this pair for now.

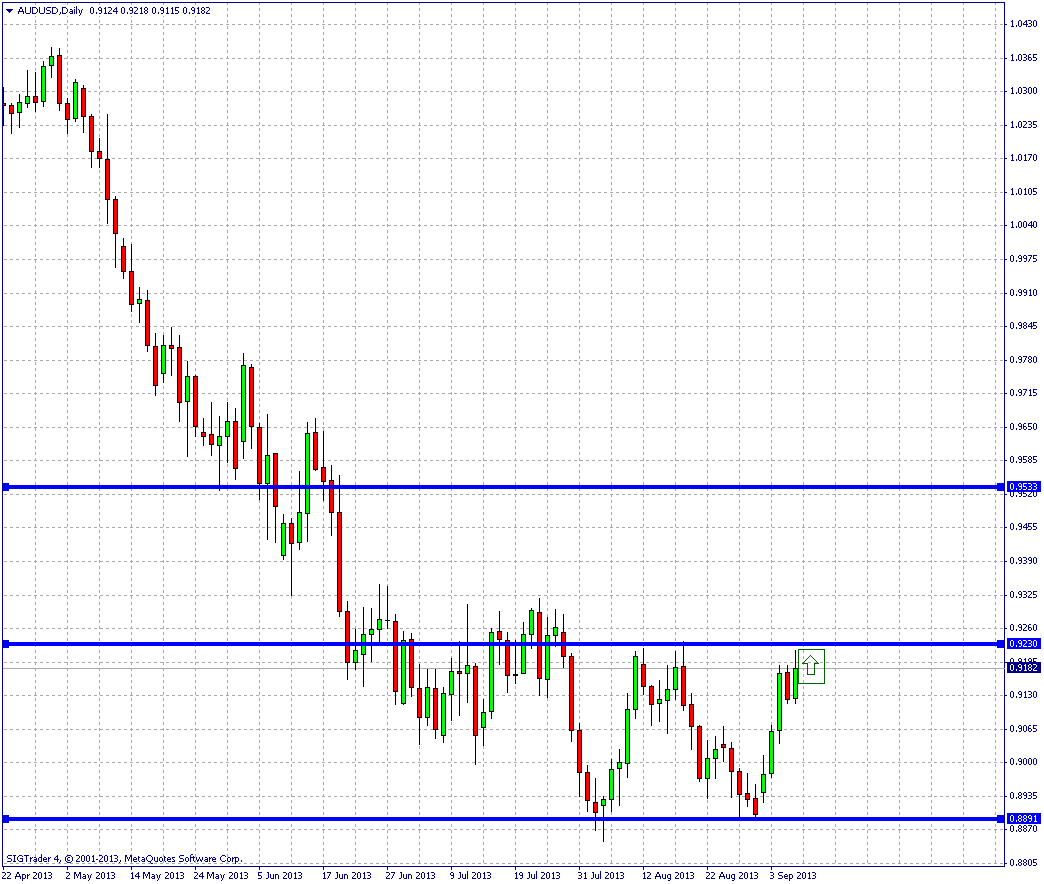

The AUDUSD finished the week closer to 0.92, and is now displaying bullish characteristics. The resistance around 0.92 has not been crossed, but once this barrier is broken, the chances that we reach 0.95 are very high. The risky way to trade this is to enter immediately long on Monday. The more conservative way is to wait for the market to close convincingly above 0.9250 and to enter in the direction of the trend.

Finally the GBPUSD is also showing signs of a bullish trend, but it is rather weak, and side way action might continue in this pair.

USDJPY Daily chart

AUDUSD Daily chart

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.