A pullback has been unfolding last week after the climatic run up hitting the overbought of the up channel together with testing of the supply zone at 3500–3550. In Week 41 market roundup, I mentioned the possibility of testing the all time high level in S&P 500, which I still stand for because:

-

Last week’s reaction in S&P 500 comes with slight increasing of supply yet the results were not threatening yet, suggested some buying come in to stop the price from falling further.

-

The up momentum in Week 41 could still propel the market to test all time high judging on Week 42 pullback and the supple level.

The Dow Jones U.S. Delivery Services Index as mentioned in Week 41 still outperforms the market with the stocks such as EXPD, ATSG, FDX, UPS mentioned continue to rally up.

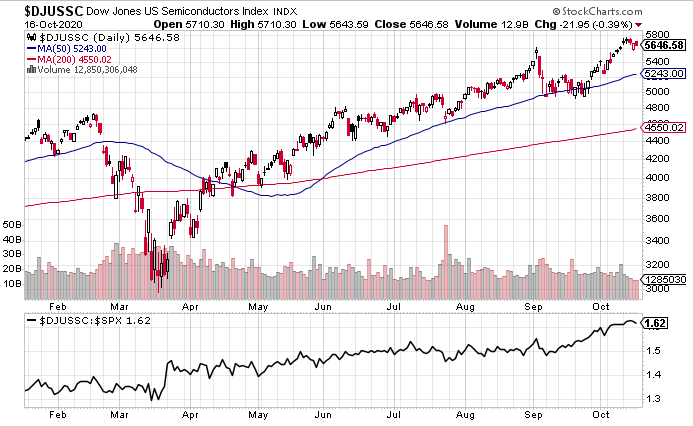

Industry Group for Study — Dow Jones US Semiconductors Index (DJUSSC)

This week I would like to share the Semiconductors Index (DJUSSC) since it has been an outperforming group for many weeks. In terms of the price structure, it broke all time high with a pullback still unfolding. The previous rally breaking the all time high level could be a sign of strength rally with the current pullback as a test to complete the structure before launching the markup phase.

Some interesting stocks to watch: AOSL (Alpha and Omega Semiconductor Ltd.), TSM (Taiwan Semiconductor Mfg), SWKS (Skyworks Solutions Inc.), ON (ON Semiconductor Corp.), IFNNY (Infineon Technologies AG). I can’t include all the stocks I watch so do check out other big names and interesting stocks within this group.

Ever wonder when is the best time to exit your trade? Remember to think about the one thing that I explain in the video when you make the decision on when to exit your trade. Check out the video below:

Stock Watchlist — Malaysia

VS (V.S INDUSTRY BHD) — As anticipated last Sunday, VS hit all time high. Support is at 2.4.

JHM (JHM CONSOLIDATION BHD) — As anticipated last Sunday on breakout from the symmetrical triangle pattern, JHM broke out and close at 1.89.

FRONTKN (FRONTKEN CORPORATION BHD) — A break above 3.75 could see FRONTKN to test 4.0 and beyond.

FPGROUP (FOUNDPAC GROUP BERHAD) — Attempt to break above 1.07 resistance with a reaction unfolds immediately. A break above 1.07 is needed to challenge higher resistance at 1.20.

MI (MI TECHNOVATION BERHAD) — On its way to test the all time high at 4.65.

PENTA (PENTAMASTER CORPORATION BHD) — Resistance is at 5.36. It is likely to continue to trend up.

Stock Watchlist — US

MSFT (MICROSOFT) — When the support at 217 can hold, MSFT should test 233.

FB (FACEBOOK) — Attempt to break above 280 but draw out some supply. More time to spend within the trading range between 250–279.

SE (SEA Limited) — In reaction mode testing the support at 162-165. Supply has been decreasing. SE is likely to trend higher.

JD (JD.com) — It almost tested 86 with increasing of supply. It is likely to challenge the all time high at 86.4.

NET (CLOUDFLARE) — Last Monday NET had its best day, up 23%. Short term trading range between 54–62.

LVGO (LIVONGO HEALTH) — LVGO tested the resistance at 150 with a mild pullback. It is likely to break above the resistance and to trend higher.

PTON (PELOTON) — last week there is no sign for PTON to slow down. However, supply spiked on last Friday, which could be the change of character bar to stop the up move. A break below 127 will kick start the pullback to find its support. 113–120 is an area of support.

BABA (Alibaba Group Holdings) — Hit all time high with relatively healthy supply. BABA is expected to trend higher.

BTG (B2GOLD CORP) — A break above 7 could see BTG to test 7.5.

FSLY (FASTLY INC) — FSLY had its biggest down day, dropped 27% on 15 oct 2020. However, it is still within 74–118 trading range. Need to monitor the supply level in conjunction with the price action closely to judge if this is a distribution structure.

SQ (SQUARE INC) — after hitting all time high SQ only has a shallow pullback. It is likely to trend higher.

APPS (DIGITAL TURBINE INC) — Continue to trend higher with support at 37, 35.

AVGO (BROADCOM INC) — After hitting all time high AVGO is in a reaction mode testing the support at 375. If the support holds, it will trend higher.

PENN (PENN NATIONAL GAMING INC) — It is heading to test the resistance at 75. Support is at 57-63.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.