USD/CAD's upside could be tested [Video]

![USD/CAD's upside could be tested [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/one-hundred-canadian-dollar-bills-5599431_XtraLarge.jpg)

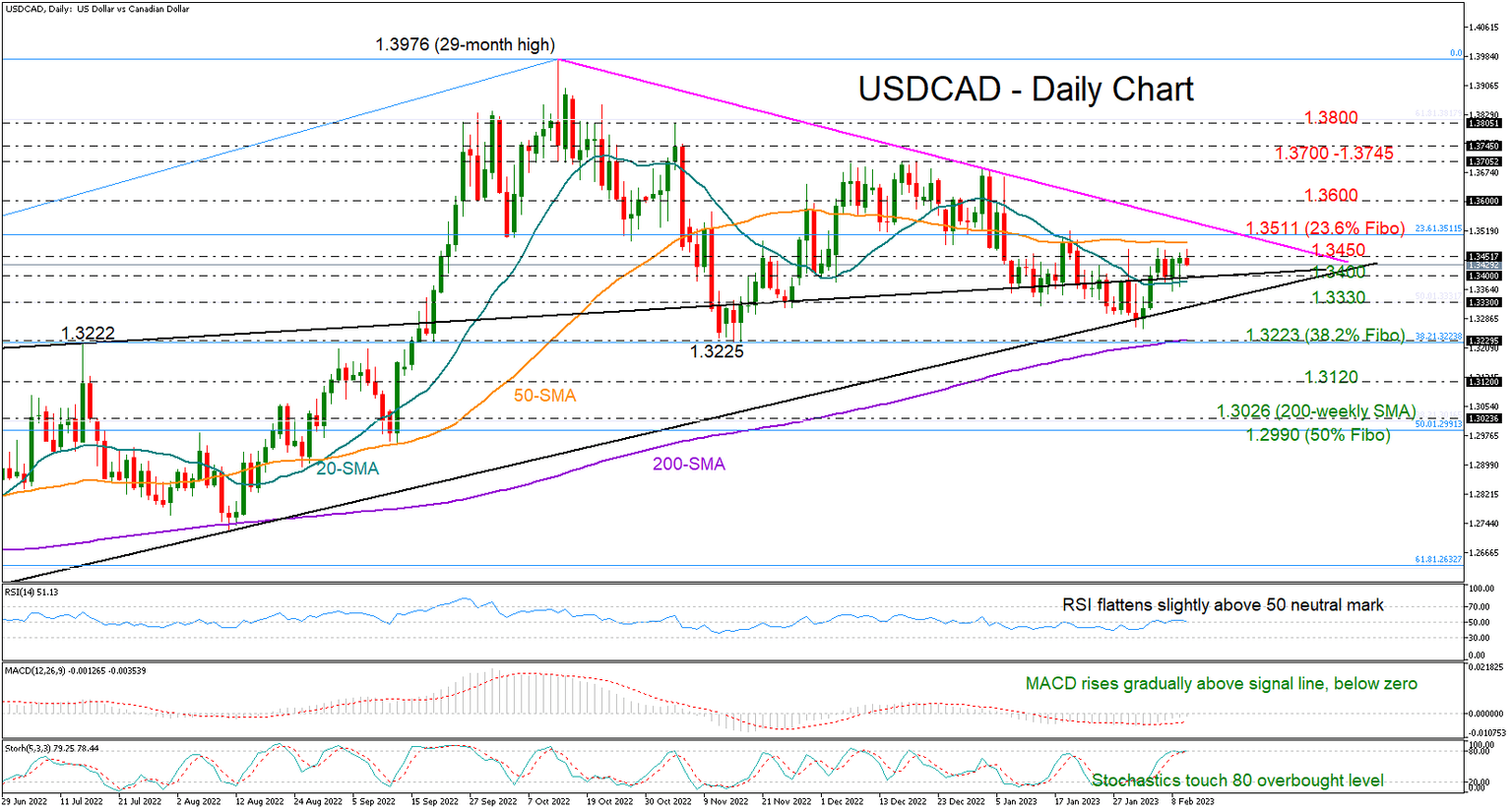

USDCAD has been on the sidelines this week, constrained between the familiar 1.3450 resistance and key upward-sloping line from August 2021 at 1.3400.

The technical picture is leaning softly to the bullish side as the RSI is flattening slightly above its 50 neutral mark. Meanwhile, the MACD is gradually recovering above its red signal line but within the negative zone, while the Stochastic oscillator has already reached its 80 overbought level, reflecting fading upside pressures ahead of the Canadian employment report.

Nevertheless, sentiment will remain jittery if the pair continues to face limitations around the 23.6% Fibonacci retracement of the 1.2006-1.3976 upleg at 1.3511. The tentative resistance trendline from October’s top of 1.3976 is cementing that ceiling. Hence, a clear close above that wall would attract buyers' attention, likely lifting the price straight to the 1.3600 number. Then, another victory here may prompt an extension towards the 1.3700-1.3745 boundary.

In the event of a downside reversal, the bears will fight for a break below the 1.3400 floor and the 20-day simple moving average (SMA) with scope to reach the support trendline from June’s low at 1.3330. Slightly lower, the 200-day SMA could immediately calm selling tendencies near the 38.2% Fibonacci of 1.3223. If it fails, the decline may pick up steam towards the 1.3130 handle.

Summing up, USDCAD is maintaining a neutral short- and medium-term outlook. A decisive close above 1.3511 or below 1.3330 could navigate the market accordingly.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.