The Canadian dollar improved for a second straight week, as USD/CAD dropped 170 points. The pair closed at 1.3974, its lowest level in 4 weeks. This week’s highlight is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Federal Reserve was cautious in its policy statement, lowering the chances of a hike in March, and US durables looked awful last week. Canadian GDP posted a gain of 0.3%, matching the forecast.

Updates:

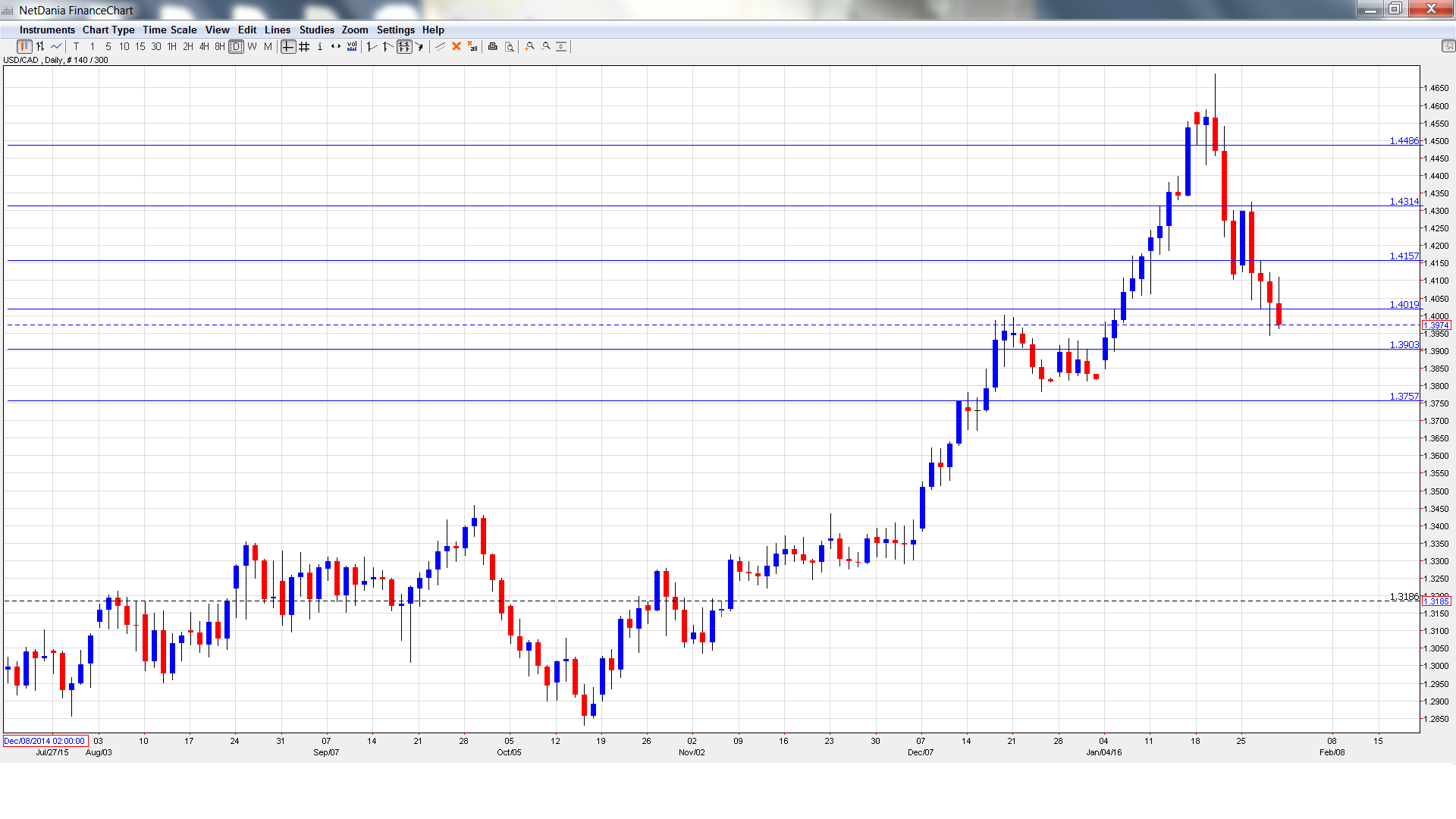

USD/CAD daily graph with support and resistance lines on it.

RBC Manufacturing PMI: Monday, 14:30. This PMI has posted five straight readings below the 50 point-level, indicative of ongoing contraction in the manufacturing sector. Will the index push above the 50 line in the January report?

Employment Change: Friday, 13:30. This key indicator can have a sharp impact on the movement of USD/CAD. The indicator rebounded in December with an excellent gain of 22.8 thousand, crushing the estimate of 10.4 thousand. The unemployment rate has been steady, coming in at 7.1% in the past two months.

Trade Balance: Friday, 8:30. Canada’s trade deficit narrowed to C$-2.0 billion, better than the forecast of C$-2.6 billion. Will the deficit continue to drop in the December report?

Ivey PMI: Friday, 15:00. The index plunged in December to 49.9 points, compared to 63.6 points a month earlier. This weak figure missed expectations and marked a 9-month low. The markets are expecting a slight improvement, with the estimate standing at 50.3 points.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.4143 and quickly climbed to a high of 1.4325. The pair reversed directions and dropped to a low of 1.3943, breaking below support at 1.4019. USD/CAD closed the week at 1.3974.

Technical lines, from top to bottom

We start with resistance at 1.4480. This line was an important cushion in April 2000.

1.4310 is the next line of resistance.

1.4159 has strengthened as USD/CAD trades at lower levels.

1.4019 has switched to a resistance role. It is a weak line and could see further action early in the week.

The round number of 1.39 is the next support line.

1.3757 was a cap in December.

1.3587 is the final line for now.

I am bullish on USD/CAD

The Canadian dollar has posted strong gains in the past two weeks, but is still vulnerable, trading close to the 1.40 line. The US economy continues to outperform the Canadian economy, and the markets will be speculating about a March rate hike in the US, a move which would bolster the greenback.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.