USD/TRY outlook: Turkish lira remains in a free fall after election

USD/TRY

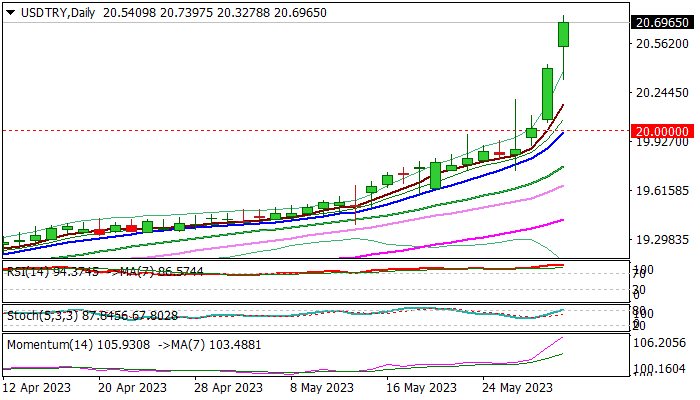

The USDTRY is holding in a sharp post-election bullish acceleration for the second consecutive day, hitting a series of new record highs, with the last one at 20.74 zone, posted on Wednesday, after a gap higher opening.

Lira’s sentiment soured further as markets digested the election results and awaiting next steps of President Erdogan, who is preparing to shape his new cabinet as well as the direction of economic policy, after winning another term as the President of Turkey.

Fresh rally eyes initial target at 21.00 (round-figure) and Fibo projection at 21.45, with limited price adjustments on overbought daily and weekly studies, expected to offer better buying opportunities for now.

Broken psychological 20.00 level reverted to strong support, which should contain extended dips and keep bulls intact.

Markets will be closely watching and assessing Erdogan’s steps, although his latest decision, particularly in lowering interest rates during a record high inflation and keeping close ties with both, Russia and United States during the war in Ukraine, proved to be quite unpopular among the Western economists and politicians, which may increase pressure on Turkish currency in coming weeks and months.

Res: 20.7400; 21.0000; 21.4550; 22.0000

Sup: 21.0000; 20.4226; 20.3278; 20.1666

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.