USD/JPY Weekly Forecast: Are inflation and the Fed in an abusive relationship?

- US inflation and Treasury rates soar, Fed hikes to follow.

- USD/JPY returns to five-year high above 116.00.

- 10-year Treasury yield closes above 2% on Thursday highest since.

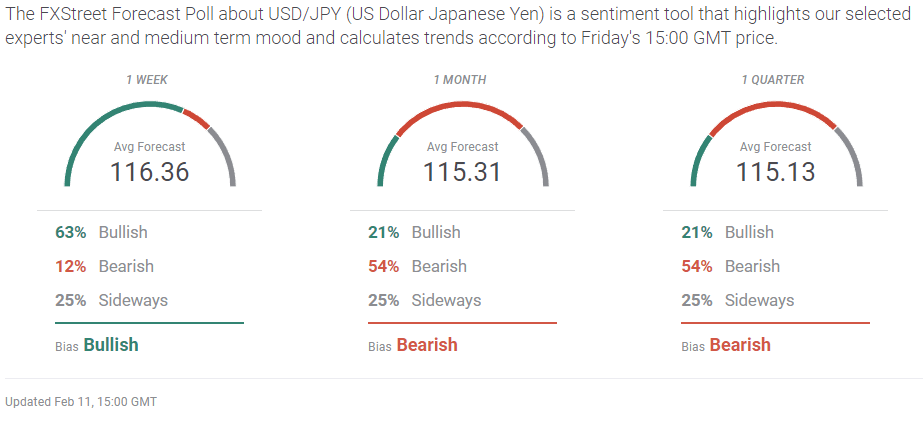

- The FXStreet Forecast Poll expects resistance at 116.35 to hold.

Interest rates have returned to the forefront in US markets. January’s inflation report spurred a major rally in Treasury yields that sent stocks reeling and the USD/JPY to 116.34 within a point of its five-year high at 116.35.

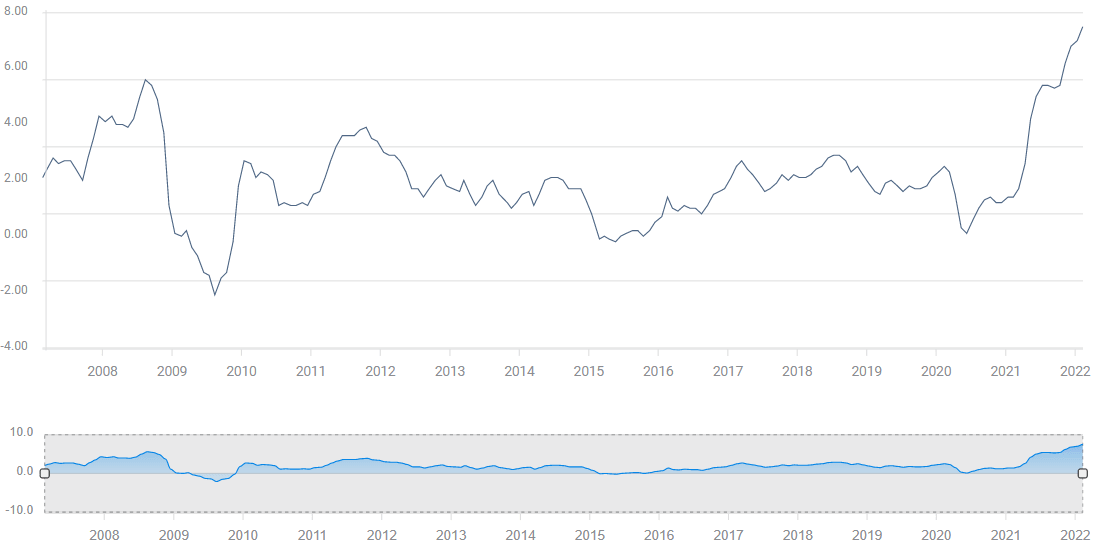

Annual US consumer inflation rose to 7.5% in January from 7% in December. It was the fifth monthly rise in a row, the highest annual rate since February 1982 and a more than four-fold increase from the 1.7% pace 12 months earlier. The consensus market forecast was 7.3%.

CPI

FXStreet

The Core Consumer Price Index (CPI), which eliminates the costs of food and gasoline, rose to 6% from 5.7% in December for the highest yearly rate since August 1982. The prediction was 5.9%. Monthly increases were 0.5% for overall CPI and 0.6% for core index.

As has been common in this burst of soaring prices, many necessary items have become far more expensive than the general inflation rate. Gasoline was 40% higher over 12 months, fuel oil, used to heat many older homes, was 46.5% more dear, electricity 10.4%. Food costs climbed 7.4% but the index for meats, poultry, fish and eggs rose 12.2%. For many consumers the devotion of scarce resources to food and fuel will drain voluntary consumption. Retail Sales rose just 0.1% in the fourth quarter, in an economy 70% dependent on consumer spending, that is an ominous sign.

Treasury rates were the force behind Thursday’s currency and equity volatility.

Interest rates on US Treasury securities moved sharply higher across the entire yield curve on Thursday. The return on the 2-year Treasury soared 24 basis points to 1.59% bringing it back to the level of December 2019. The 10-year note, a reference for many commercial rates, added 11 points to 2.035%, its first close above 2% since July 2019. The yield on the 5-year Treasury climbed 15 basis points to 1.95% and the 30-year return rose 7 points to 2.30%. All Treasury durations except the 30-year long bond ended the day yielding more than where they were at the start of the COVID-19 pandemic in March 2020.

To the close on Thursday the 10-year Treasury yield had gained 52 basis points and the 2-year had added 86 points in the New Year.

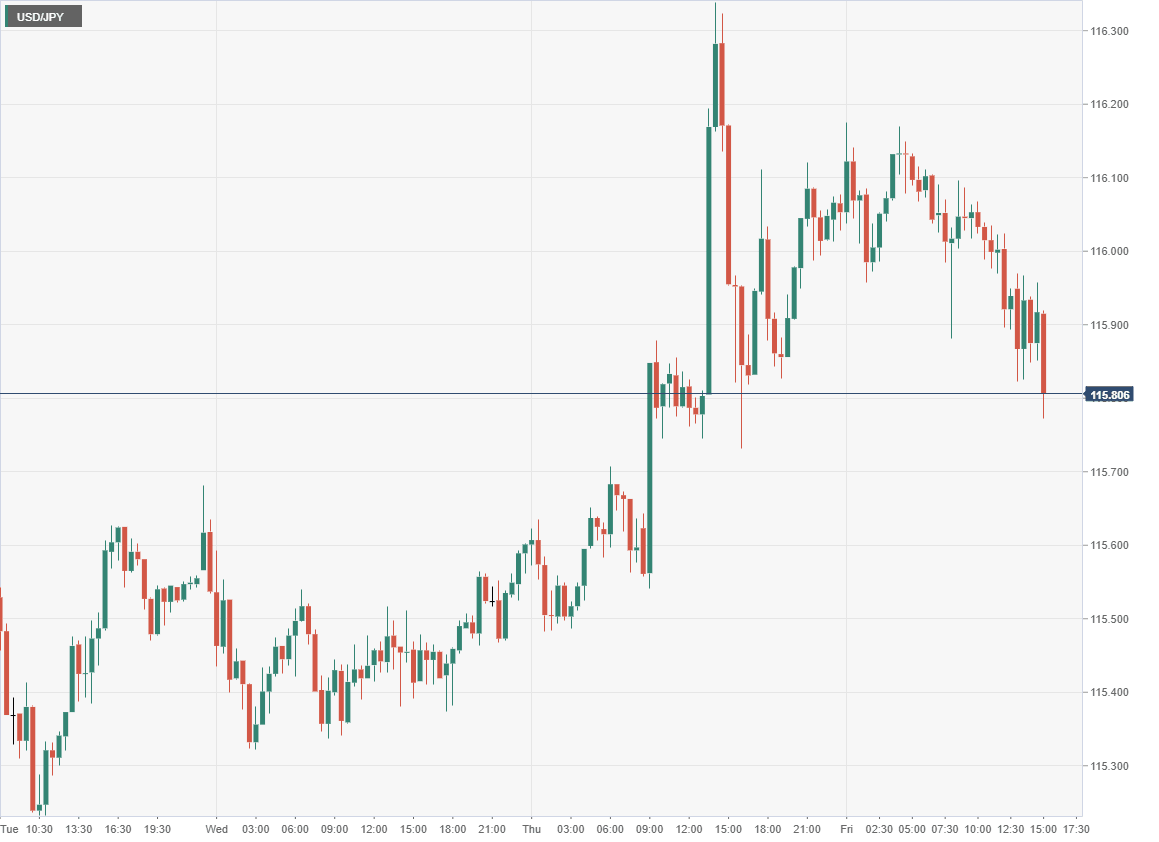

Currency markets at first followed rising Treasury yields. In the first hour after the 8:30 am New York time CPI release, the dollar improved in every major pair. The USD/JPY rose from 115.80 to 116.34, the euro dropped from 1.1436 to 1.1375 and sterling fell from 1.1579 to 1.3523. The USD/CAD rose from 1.2677 to 1.2919.

The dollar surge was brief. In the next two hours, the dollar lost all of its gains in every pair except the USD/JPY which returned to just above the CPI start line at 115.83.

The EUR/USD reversed more than a figure from 1.1385 to 1.1495. Sterling rose from 1.3527 to1.3644 and the USD/CAD sank from 1.2714 to 1.2636.

Equities reverted to the losing ways that have made 2022 negative for the three US averages.The Dow dropped 526.47 points, 1.47% to 35,241.59. The S&P 500 shed 1.81%, 83.10 points to 4,504.08. The Nasdaq was the biggest loser falling 2.10%, 304.73 points to 14,185.64.

After Thursday’s London close, the dollar revived. The USD/JPY closed at 116.05, about 30 points above its post-CPI low. The EUR/USD finished at 1.1435, 63 points below its CPI top and sterling ended at 1.3554, 90 points down from its US inflation high.

The dollar reversal was aided by comments from St Louis Federal Reserve President James Bullard, a well-known inflation hawk, that the bank should raise the fed funds rate 100 basis points by July. This would entail at least one 0.5% increase over the three FOMC meetings on March 16, May 4 and June 15.

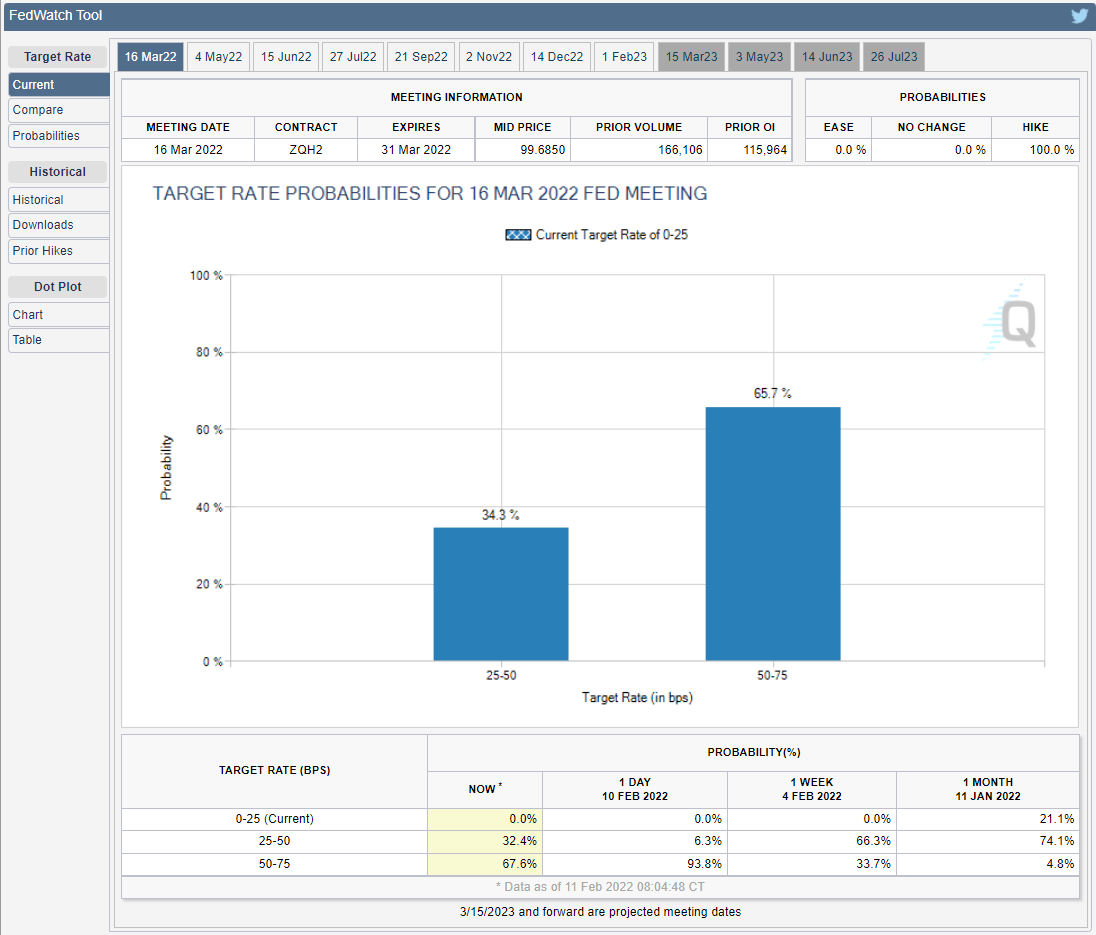

Before the CPI data the debate was whether the Fed would hike 0.5% at the March 16 meeting and the general opinion was that it would not.

The Chicago Mercantile Exchange (CME) FedWatch Tool which uses fed futures to compute the probabilities of rate changes at Fed meetings, had the odds of a 0.5% hike on March 16 at 24% Wednesday evening. After the inflation figures on Thursday the probability rose to near certainly at 92.8%.

CME

The odds have since dropped back to 65.7%.

Speculation will now move to the disposition of the Fed's $9 trillion balance sheet acquired over the last decade.

Federal Reserve Chair Jerome Powell has said that the bank will begin a reduction of its portfolio sometime after bond buying ceases in March. Until Thursday that had been assumed to mean a month subsequent to the program termination.

A passive roll-off of the Fed’s maturing assets or active sales would send a powerful rate signal to credit markets, ensuring much higher Treasury and commercial rates. This will be the main topic for Chair Powell in his presentation and news conference on March 16.

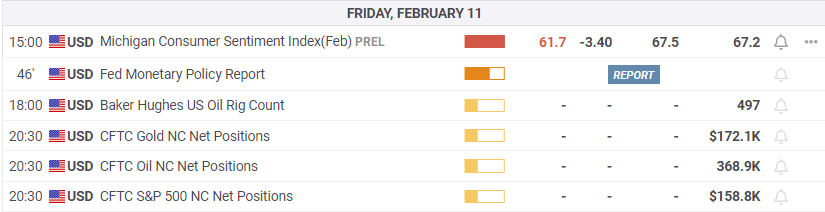

The Michigan Consumer Sentiment Index for February dropped unexpectedly to 61.7, its lowest score in over a decade, from 67.2 and underlines the risk to the US economy should consumers pull back on spending. It had been forecast to rise to 67.5.

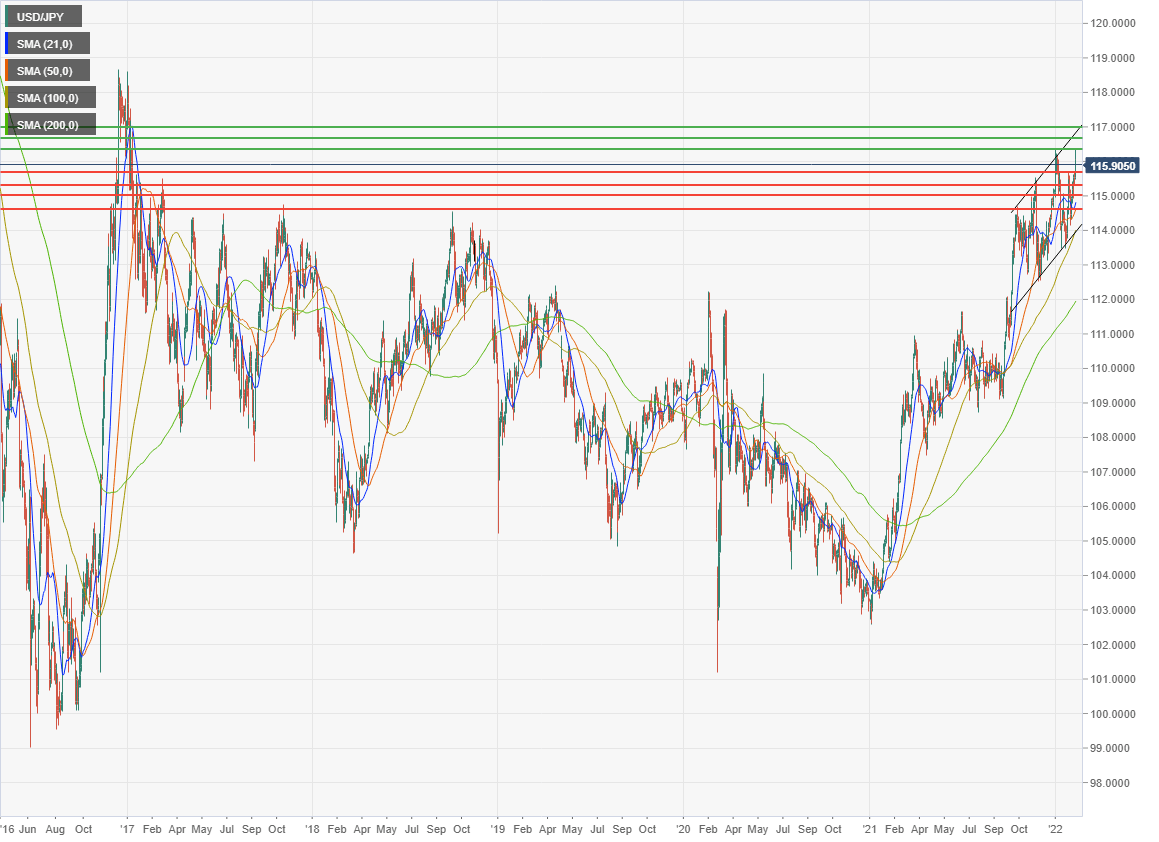

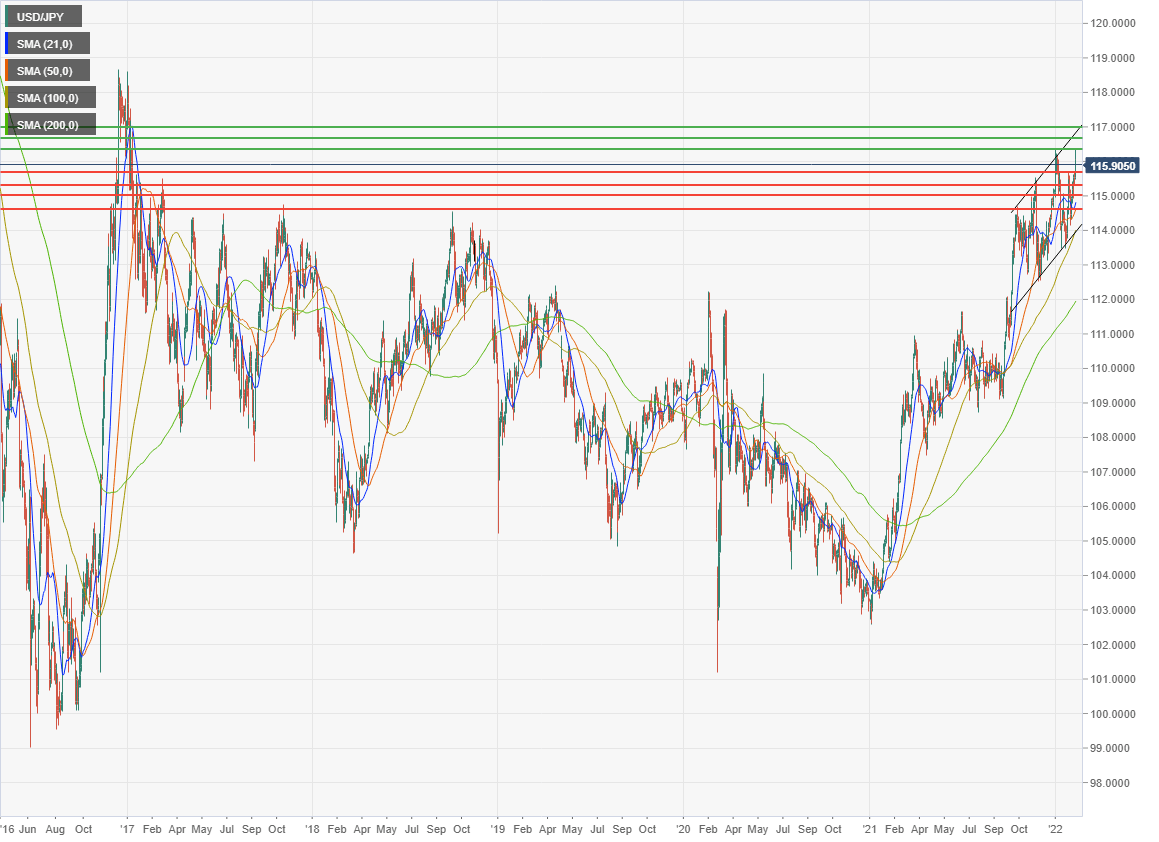

Where does this massive reordering of the US interest rate picture leave the USD/JPY? .

Treasury rates have risen far more than those on Japanese Government Bonds (JGB). The spread on the 2-year note was 82 basis points against JGBs on December 31, it was 163 points at Thursday’s close. The spread on 10-year securities expanded from 144 points favoring the US at year end to 180 on Thursday. Consequently, only the USD/JPY, of all the dollar pairs, is trading near its five-year high.

Japanese economic data was disappointing. Labor Cash Earnings and Household Spending for December, both at -0.2%, missed their respective forecasts of 0.1% and 0.3%. The Eco Watchers Survey that tracks regional economic trends dropped sharply in January, to 37.9 from 57.5 for the current Index and to 42.5 from 50.3 for the outlook measure. The producer Price Index (PPI) climbed 0.6% in January and 8.6% for the year, better than the 0.4% and 8.2% forecasts.

USD/JPY outlook

The dramatic escalation of interest rates in the US and the Fed’s very likely participation is the main current for the USD/JPY. The Bank of Japan (BoJ) is the one major central bank that is not expected to tighten domestic monetary conditions over the next several months. A change of heart by the BoJ governors is always possible but the bank has not raised its base rate since 2007. Even the European Central Bank (ECB), the most dovish of the major institutions, has recognized the danger of inflation.

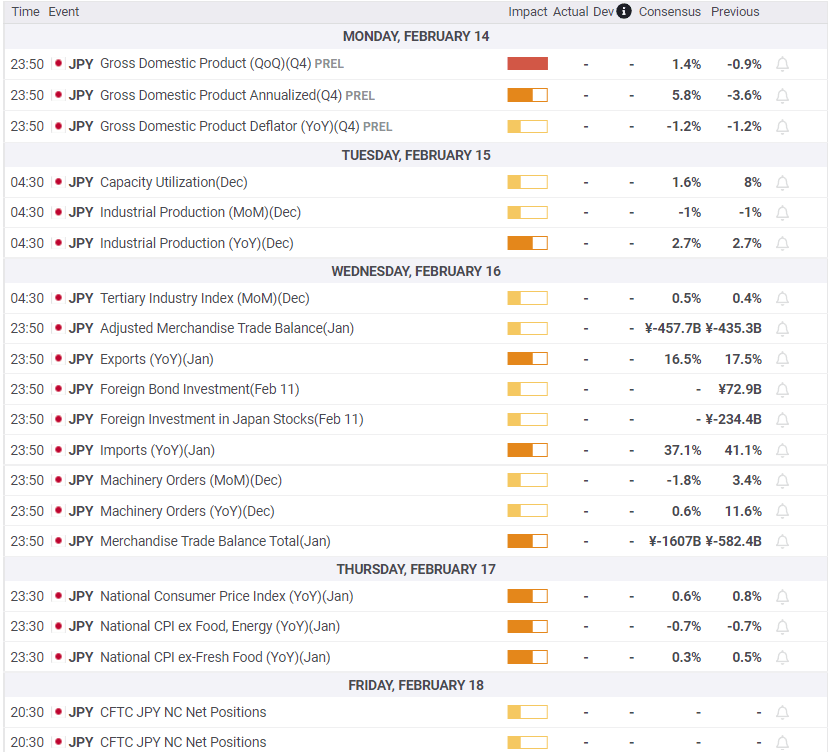

In the coming week, Japanese fourth quarter annualized GDP at 5.8% is expected to reverse the 3.6% decline in the third. Imports and Exports for January are predicted to show continuing improvement while Industrial Production of the year should be unchanged. National CPI for January will continue deflationary in the core index and slip in the overall.

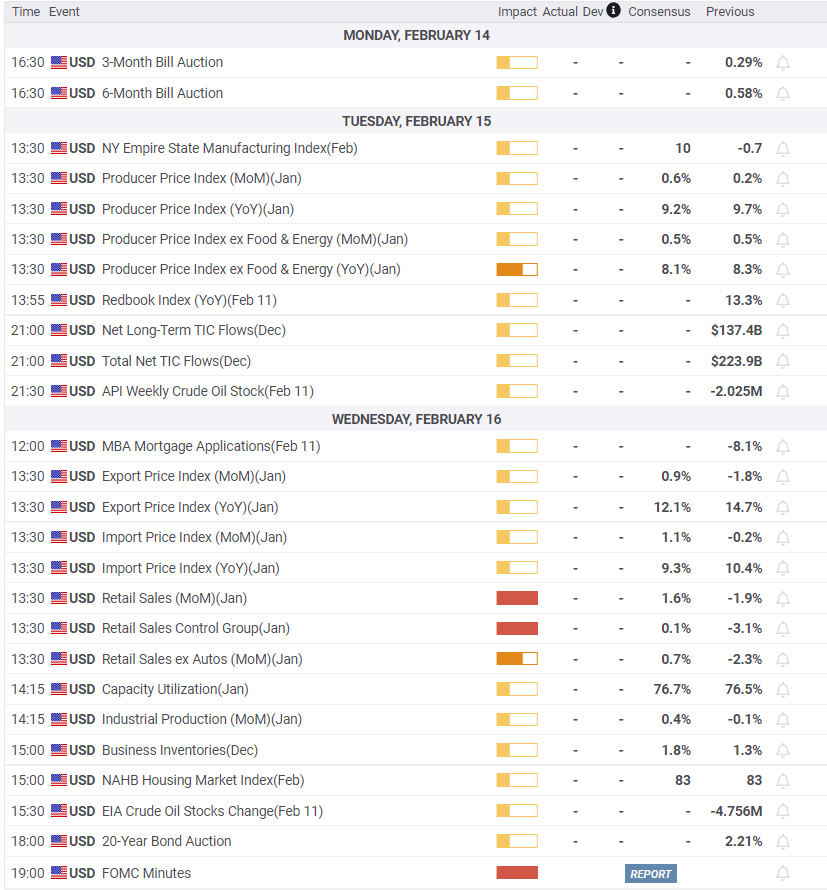

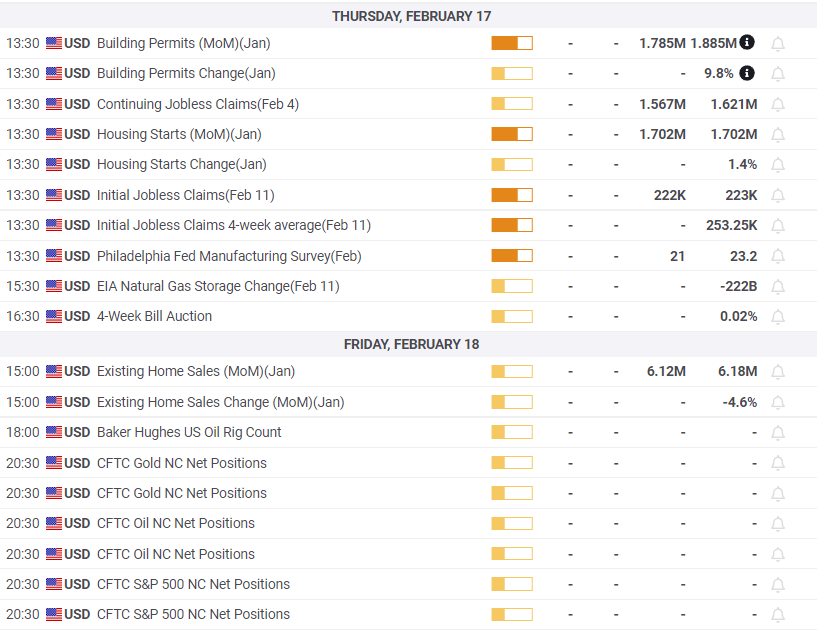

Retail Sales are the most relevant US data. Sales were stagnant in the fourth quarter. If the expected 1.6% increase does not occur, concerns for the US economy will spread to the all-important consumer sector.

Treasury rates in the US are headed higher and they will take the USD/JPY with them. The immediate goal is 116.35, then 116.65 followed by 117.00.

As we noted on Thursday, the inflation debacle in the US has many authors, but only one institution is responsible for correcting the errors, the Federal Reserve.

Japan statistics February 7–February 11

FXStreet

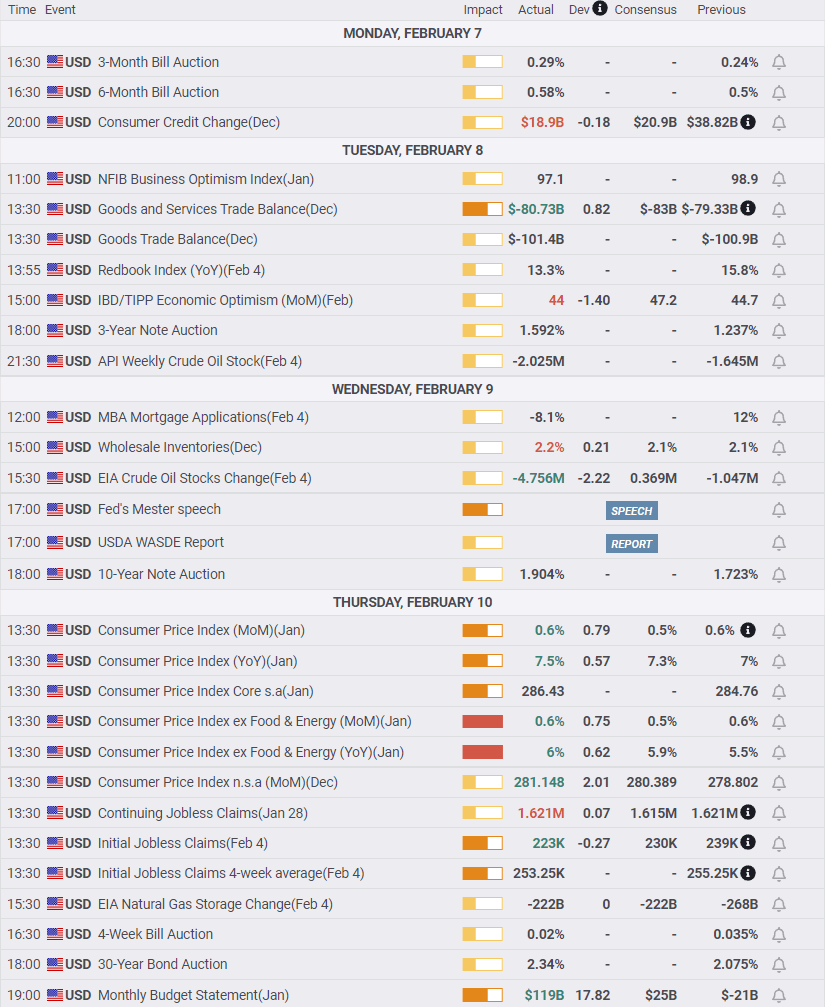

US statistics February 7–February 11

FXStreet

Japan statistics February 14–February 18

FXStreet

US statistics February 14–February 18

FXStreet

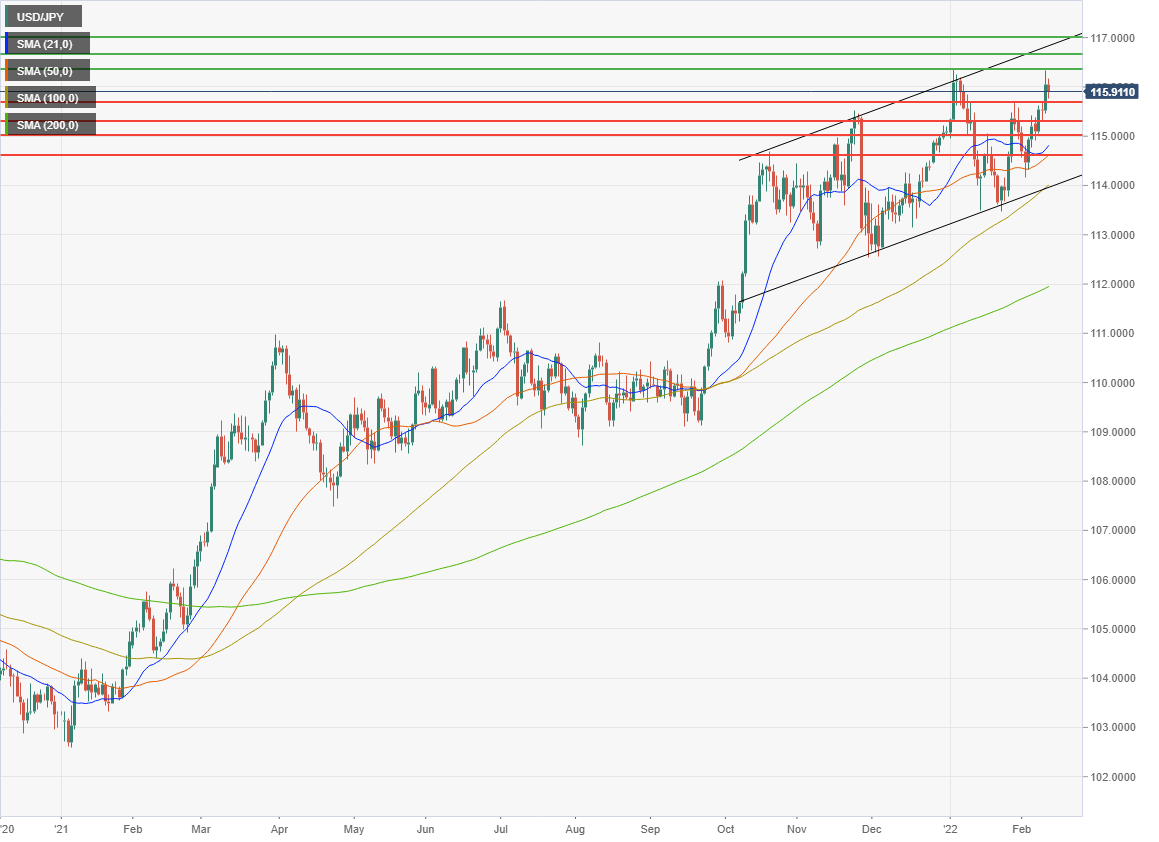

USD/JPY technical outlook

The MACD (Moving Average Convergence Divergence) price to signal line spread reached its greatest extent this week since the positive cross on January 27. The USD/JPY decline from January 28 to February 2 had brought the price line back to the signal but it did not cross and the distance between them has been increasing since and remains a positive signal for the USD/JPY. The Relative Strength Index (RSI) made its closest approach to overbought status on Thursday but the minor retreat on Friday did not diminish the upward momentum.. Volatility remained subdued in Average True Range (ATR) but can be expected to rise when the USD/JPY moves above the old high at 116.35.

The 21-day moving average (MA) at 114.82 and the 50-day MA at 114.63 provide a band of support that centers on the 115.70 support line. Both averages have marked trading lows numerous times since the October 8 and 11 ascents that brought the USD/JPY to its current trading range. In contrast the occasions where either MA provided resistance a market top are far fewer, as would be expected in a rising market.

Immediate resistance at 116.35 is based on the early January visit and Thursday's brief foray. Beyond that resistance indicators reference trading levels from late December 2017 and January 2017 which will carry little weight when the USD/JPY penetrates into the zone above 116.50.

Resistance: 116.35, 116.65, 117.00

Support: 115.70, 115.30, 115.00, 114.60

FXStreet Forecast Poll

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.