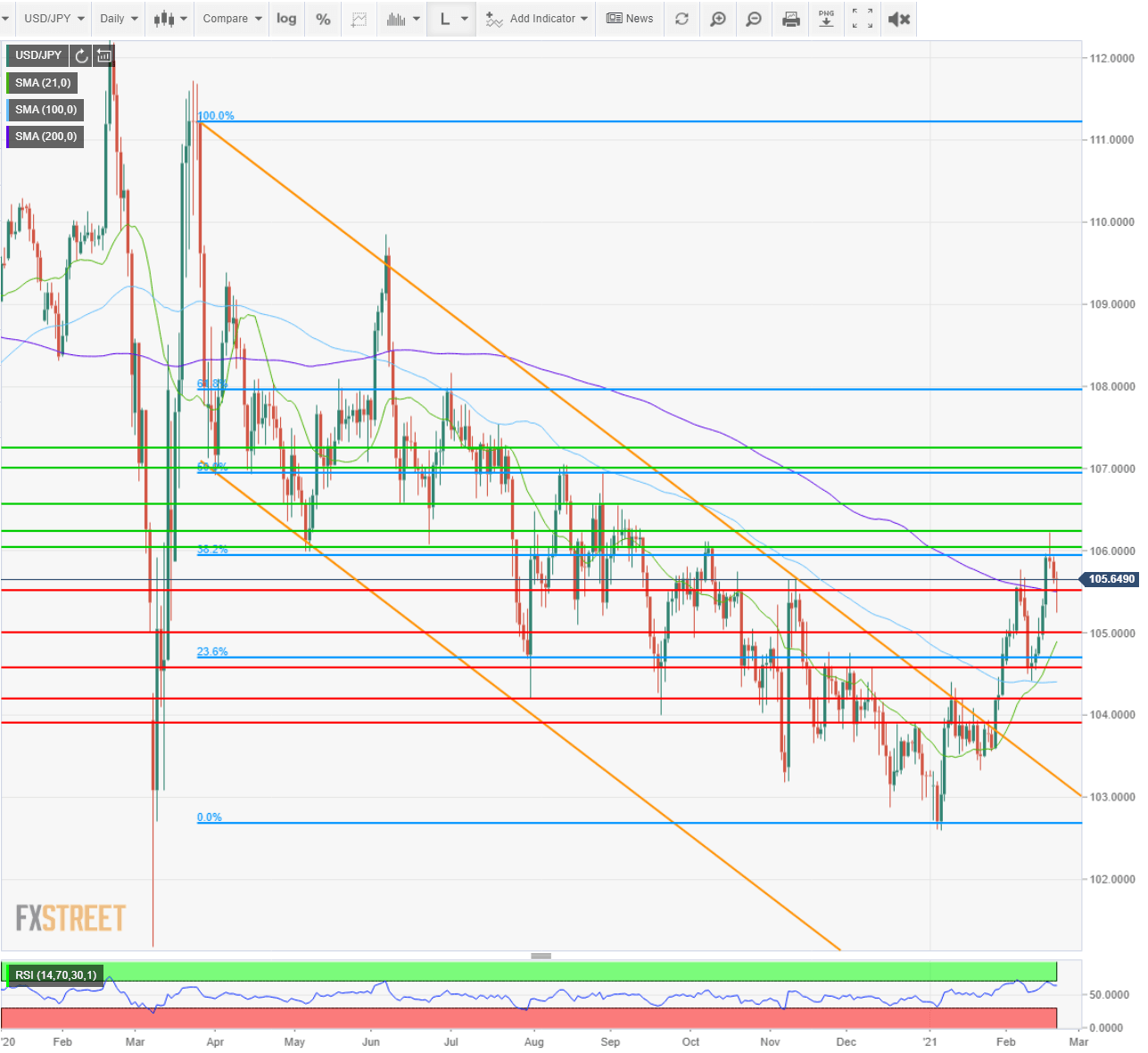

- USD/JPY reaches a five-month high at 106.23 on Wednesday.

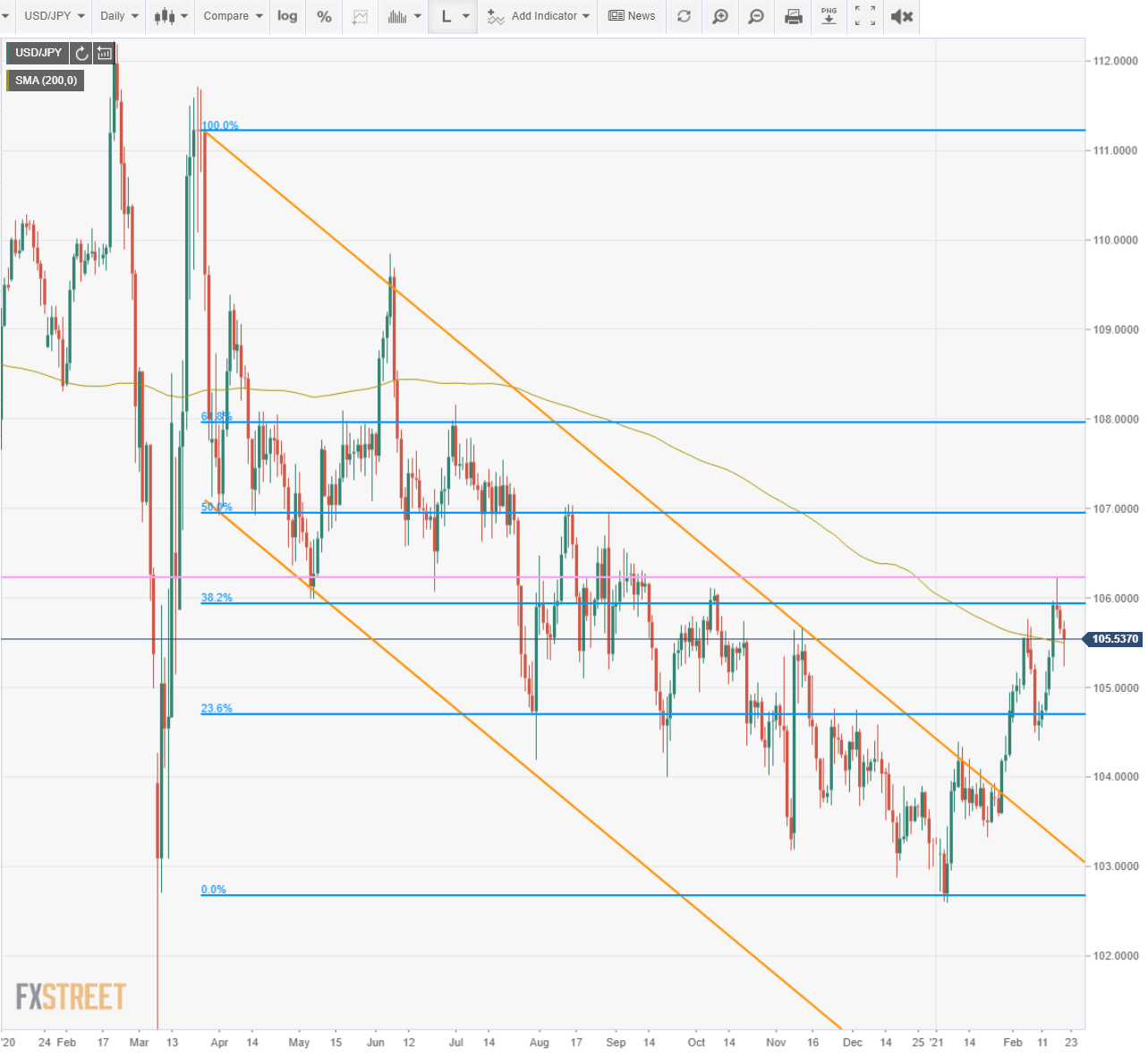

- Technical pull back at the 38.2% Fibonacci of the March to January decline.

- Dollar supported by the recent rise in US Treasury rates.

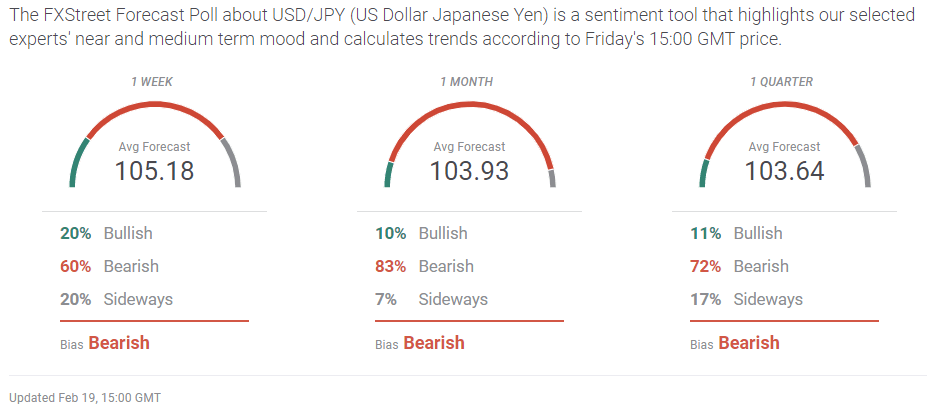

- FXStreet Forecast Poll illustrates potential weakness for the USD/JPY.

The USD/JPY touched a five-month high on Wednesday at 106.23 boosted by stellar US Retail Sales, but the cap to this year's 3.5% gain was brief as the pair succumbed to profit-taking and reports that the Bank of Japan may be reconsidering its loose monetary policy.

Ten months of steady decline for the USD/JPY ended on January 27 with the breach of the descending channel and movement since has confirmed the trend reversal. Dollar strength has been largely a function of rising US interest rates, the yield on the 10-year Treasury has gained about 40 basis points this year to 1.336% (10:41 am EST, 2/19) most of that in February.

Anticipation of an additional consumer push for the US economy from a new stimulus package has also aided the dollar though continuing difficulties in the labor market have been a restraint.

A comment from Bank of Japan Governor Haruhiko Kuroda that exports and gross domestic product have recovered almost all of the ground lost during the pandemic that came while he noted the institution's pending monetary policy review provided yen support on Friday. After the prior review the Policy Board said that it “may increase or decrease the amount of purchases depending on market conditions.” Mr. Kuroda said the bank would be alert for financial risks associated with its extended easing policy.

As has been true for many months US statistics had more influence on the USD/JPY than their counterparts from Tokyo.

Japanese data was modestly better in January with the Jibun Bank Manufacturing PMI returning to expansion at 50.6. Exports rose 6.4% while imports dropped 9.5% narrowing the trade balance for the first time since June. Machinery Orders in December rose to 6.4% on the month from 2% in November and to 11.8% on the year from -11.3%.

American economic statistics were mostly positive particularly the aforementioned Retail Sales which suggests heavy consumer spending when the new stimulus package is finally passed. Inflation received a boost in January with the annual Producer Price Index (PPI) quadrupling to 1.3% from 0.3% bringing it to the highest rate since August 2009. Industrial Production rose 0.9% in January and has averaged 1.05% for the last four months.

Initial Jobless Claims rose unexpectedly in the latest week, underlining the rising number of business failures after almost a year of economic and business restrictions. Strong home sales in January and Building Permits at the highest level since the housing bubble more than a decade ago, promise construction jobs once the winter weather that covers three-quarters of the country relents.

Technically, Wednesday's halt at the 38.2% Fibonacci level of the March to January pandemic descent, was the second pause in Dollar yen's rise this year. The swift return to dollar strength both times is another confirmation of the trend reversal. Since breaking the downtrend on January 27 the USD/JPY has gained 2.5%.

USD/JPY outlook

The rise in US Treasury rates, particularly the commercial referent of the 10-year, continues to provide support for the USD/JPY. Behind the yield increase is the assumption that US economic growth will speed up as the year ages and the stimulus package brings a surge in consumer spending.

US 10-year Treasury yield

FXStreet

Thus far, US economic data, with the exception of the labor market, has borne out that supposition. Employment is normally a lagging indicator, the last to improve as the economy exits a downturn and there is no reason to expect that to change. If anything the return to robust job growth in the US and elsewhere will be slower than normal as businesses continue to fail in the aftermath of the pandemic lockdown.

As long as the prospects for the US economy are positive and interest rates are bouyant the USD/JPY should continue to move higher.

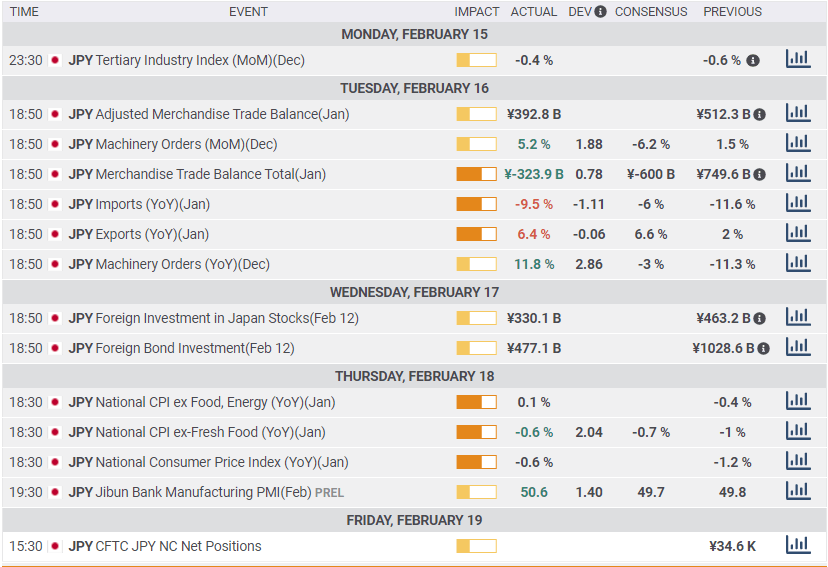

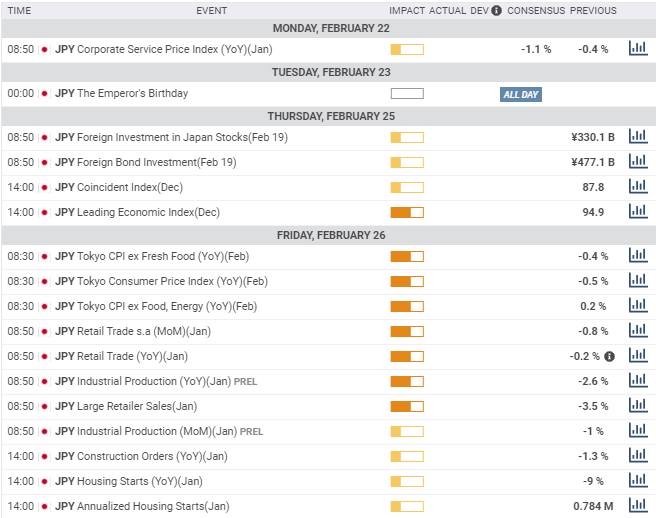

Japan statistics February 15-February 19

Better than forecast data for fourth quarter GDP and trade in January provided little support for the yen as the USD/JPY followed US Treasury rates higher. Deflation continued to improve as the January annual rate was half that of December.

Monday

Fourth quarter GDP advanced 12.7% on an annualized base and 3% quarterly, beating the forecasts at 9.5% and 2.3%. Industrial Production dropped 1% on the month in December and 2.6% on the year better than the predictions and the November results, -1.6% and -3.1% for both respectively. Capacity Utilization rose 0.8% in December after falling 2.9% prior.

Tuesday

The Tertiary Industry Index, which gauges the domestic service sector, fell 0.4% in December following a revised 0.6% decline in November.

Wednesday

Machinery Orders in December rose 5.2% reversing the -6.2% forecast and adding to the 1.5% gain in November. Annual Machinery Orders jumped 11.8%, on a -3% prediction and November's 11.3% decline. It was the best yearly increase since June 2019. Exports rose 6.4% (YoY) in January slightly less than the 6.6% estimate but more than three times the 2% gain in December. It was the first back-to-back increases since October and November 2018. Imports fell 9.5%, half again as much as the -6% projection, though better than the -11.6% December result. The string of negative months is 21. The Merchandise Trade Balance in January was ¥-323.9 billion, about half the ¥-6 billion forecast. The balance was ¥749.6 billion in December.

Friday

National CPI fell 0.6% (YoY) in January, half the December rate of -1.2% and National CPI ex Fresh Food dropped 0.6% following December's -1% figure. The Jibun Bank Manufacturing PMI rose to 50.6 in February beating its 49.7 forecast and 49.8 prior reading.

FXStreet

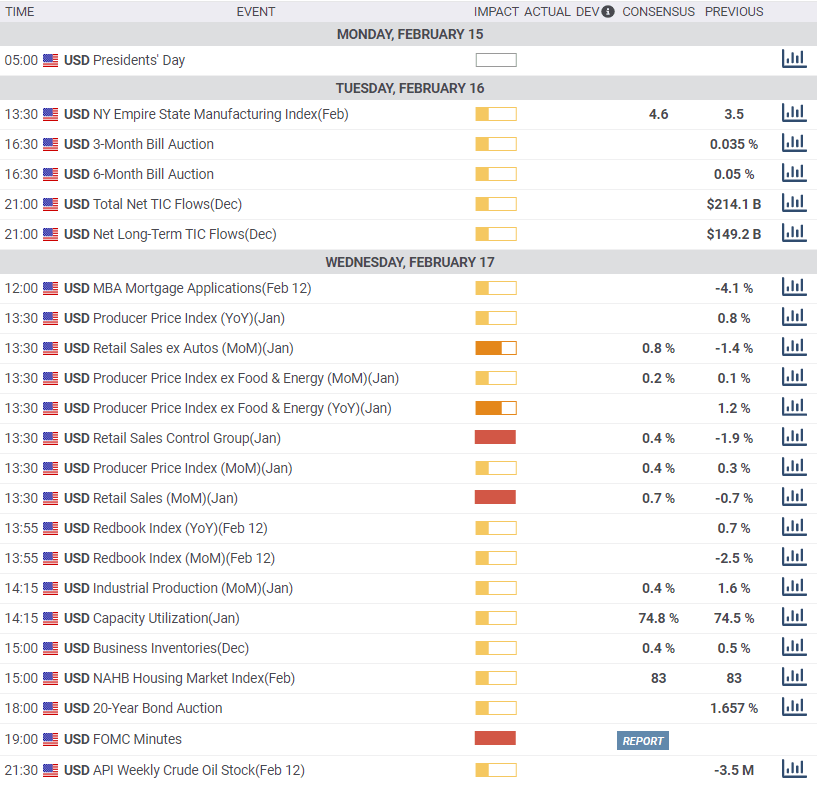

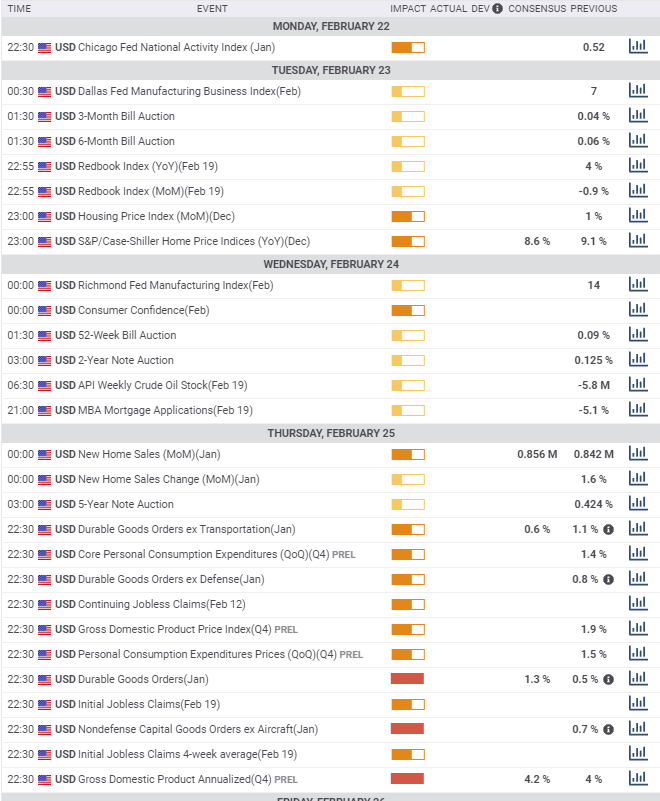

US statistics February 15-February 19

Retail Sales proved US consumers can be counted on to perform their usual prodigies of spending as long as there is cash available. The rise in Initial Jobless Claims indicates that the aftermath of the lockdowns will be longer and more painful than anticipated. Producer Prices hinted that inflation might not be as quiescent as thought.

Wednesday

Retail Sales soared 5.3% in January as consumers took all of their pandemic relief payments to market, far surpassing the 1.1% forecast. The result was more than sufficient to bring the three month holiday season total into the black at a very respectable 2.9% (November -1.4%, December -1%). Sales ex-Autos soared 5.9% on a 1% estimate and the revised 1.8% loss in December. The Retail Sales Control Group led all categories at 6% in January, bringing the total for the season to 2.5% (November -1.1%, December -2.4%). Industrial Production climbed 0.9% in January, almost twice the 0.5% estimate though December was revised to 1.3% from 1.6%. Capacity Utilization rose to 75.6% in January, the best of the pandemic from 74.9%. The Producer Price Index rose 1.3% on the month and 1.7% on the year in January far outstripping the 0.4% and 0.9% forecasts. Core PPI rose 1.2% on the month and 2% on the year, as sharp acceleration from December's 0.1% and 1.2%. The minutes of the January FOMC meeting stressed the hesitant nature of the recovery and the long-term need for economic support.

Thursday

Housing Starts slid 6% in January to 1.58 million (annualized) from 1.68 million in December as much of the country lingered under snow cover. Building Permits jumped 10.4% to 1.881 million, the highest since the housing bubble, indicating a pending boom as soon as the weather permits. The Philadelphia Fed Manufacturing Survey dropped to 23.1 in February, better than the 20 predictions but down from 26.5 in January. Initial Jobless Claims rose to 861,000 in the February 12 week from 848,000 prior, 765,000 had been forecast. Continuing Claims were 4.494 million on February 5, down from 4.558 the week before.

Friday

Markit manufacturing PMI slipped to 58.5 in February from 59.2. Services PMI rose to 58.9 from 58.3 and the Composite PMI rose 0.1 to 58.8. Existing Home Sales, 90% of the US market increased 0.6% in January to 6.69 million (annualized) from 0.9% and 6.65 million in December. The forecasts had been -1.5% and 6.61 million. Except for the sales rate in October 6.86 million, and November 6.71 million, it was the strongest annual sales since the housing bubble of 2006-2008.

FXStreet

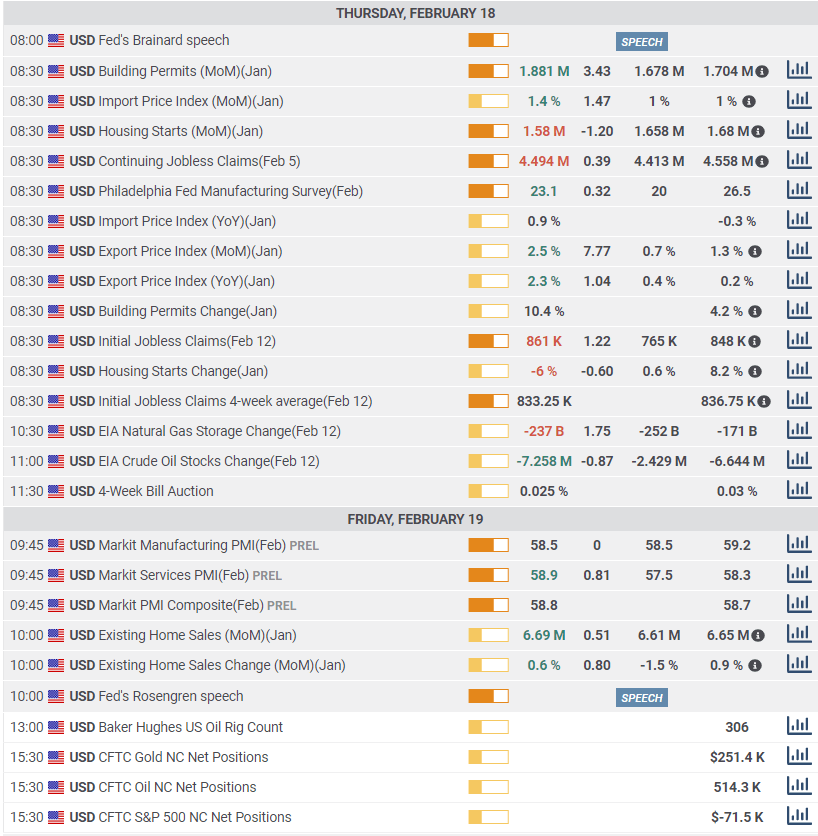

Japan statistics February 22-February 26

Tokyo consumer prices will give the first look at February figures, periodic deflation is a long-term and recurring problem for the Japanese economy and will not move the yen.

Monday

The Corporate Service Price index (CSPI) from the Bank of Japan, which measures the price of services traded among companies, is forecast to drop 1.1% in January after -0.4% in December.

Tuesday

The Emperor's Birthday Holiday

Thursday

Revisions to the Coincident and Leading Economic Indexes for December are due. The initial figures were 87.8 and 94.9.

Friday

Retail Trade (sales) for January is scheduled. December was -0.8% (MoM) and -0.2% (YoY). Large Retailer Sales fell 3.5% in December, January is listed. Industrial Production dropped 1% (MoM) and 2.6% (YoY) in December, the preliminary numbers for January are due at 8:50 am (JST). Housing Starts sank 9% in December (YoY) to 784,000 annualized. The January figures are due at 2:00 pm (JST). Tokyo CPI for February: January saw -0.5% for the headline, -0.2% core and -0.4% ex Fresh Food, all year-on-year. Industrial Production (YoY) for January will be issued, December fell 1%.

FXStreet

United States statistics February 22-February 26

Monday

Dallas Fed Manufacturing Business Index for February: January was 7. Case-Schiller Home Price Index (YoY) is forecast to gain 8.6% in December after 9.1% in November.

Tuesday

Richmond Fed Manufacturing Index for February: January 14. Conference Board Consumer Confidence for February: January 89.3. Fed Chairman Jerome Powell testifies in the Senate.

Wednesday

Fed Chairman Powell testifies in the House.

Thursday

Durable Foods Orders for January should rise 1.3% following December's revised 0.5% gain, initially 0.2%. Durable Goods Orders ex Transportation are forecast to increase 0.6% from Decembers adjusted 1.1% gain, originally 0.7%. Nondefense Capital Goods ex Aircraft for January: December 0.7% revised from 0.6%. Initial Jobless Claims for February 19 week: prior 861,000. Continuing Claims for February 12 week: prior 4.494 million. Gross Domestic Product for the fourth quarter will receive its first revision, called by the Bureau of Economic Analysis preliminary, the first iteration is called advanced. It is expected to be 4.2% after the initial 4%. New Home Sales in January are expected to rise 1.5% to 856,000 annualized from 1.6% and 842,000 in December.

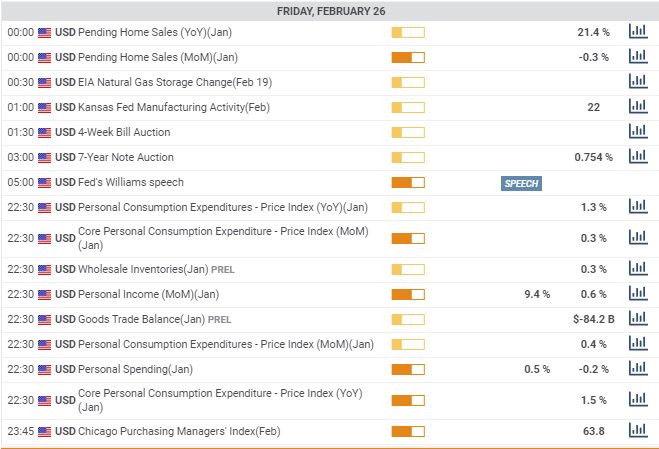

Friday

Kansas Fed Manufacturing Activity Index for February: January 22. The Personal Consumption Expenditure Price Index for January: December 0.4% (MoM), 1.3% (YoY); core 0.3% (MoM), 1.5% (YoY). Personal Income in January is forecast to rise 9.4% after December's 0.6% increase. Personal Spending is expected to increase 0.5% in January after falling 0.2% prior. Wholesale Inventories for January: December 0.3%.

USD/JPY technical outlook

Technical factors have all shifted to supporting the USD/JPY. The Tuesday and Wednesday peaks of the Relative Strength Index (RSI) in overbought territory signalled a mild reversal in the second half of the week. But the rebound from support at 105.50 backed by the 200-day moving average at the same level will likely prove to be the third brief drop since the trend change in early January. Support and resistance lines are equally balanced but the moving averages, 21-day at 104.89, 100-day at 104.40 and the 200-day as above substantially reinforce the rebound propensity after any decline.

The steep climb after the January 27 channel break (2.5%), and the somewhat equivocal US economic data, make profit-taking sales a natural occurance. Interest rates are moving to the dollar's advantage. Unless that direction changes, the technical picture will continue to support the USD/JPY.

RSI-63.66

Resistance: 106.00; 106.25; 106.55; 107.00; 107.25

Support: 105.50; 105.00; 104.55; 104.20; 103.90

FXStreet Forecast Poll

The uniformly bearish view of the FXStreet Forecast Poll envisions a failure of the current USD/JPY trend with the pair returning to lows of December and January. If the BoJ does move to curtail its assest purchases yen strength is a logical conclusion.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.