USD/JPY

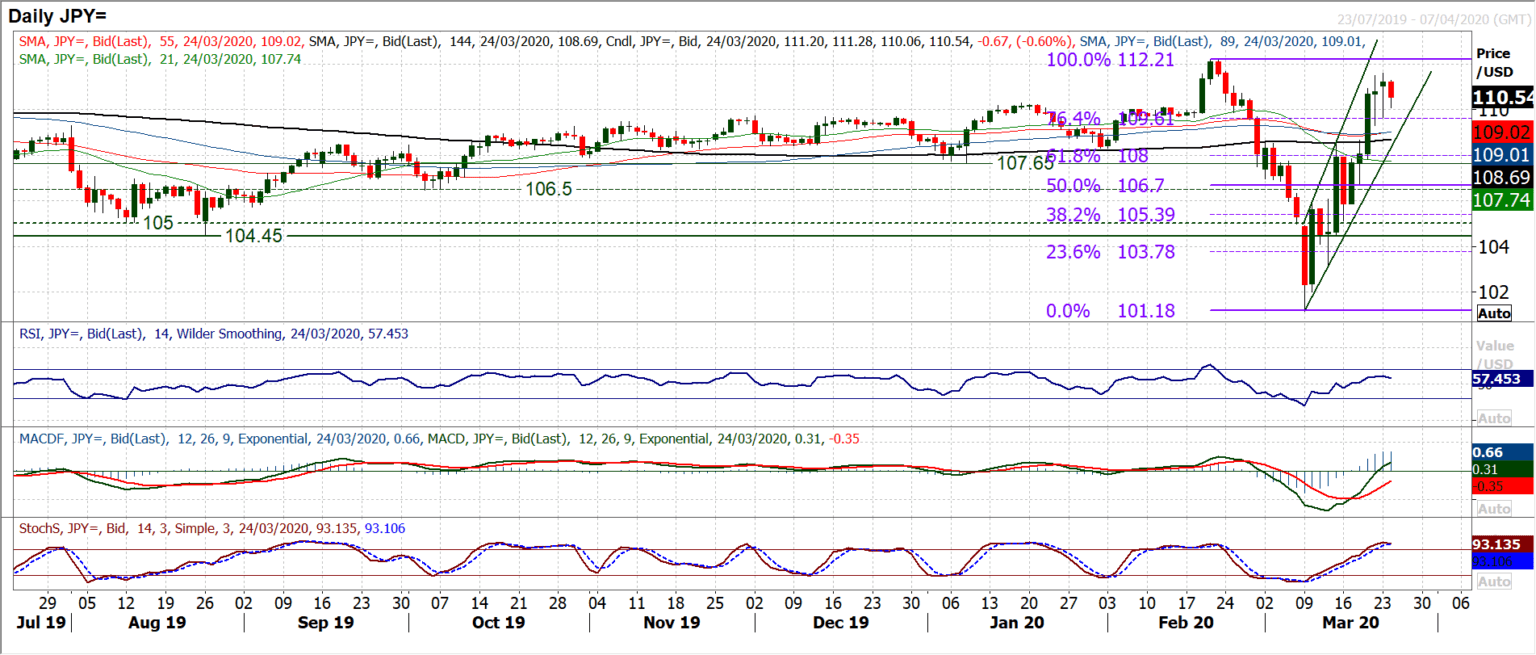

The sharp uptrend channel of the past two weeks has continued higher and is now within touching distance of the key February high of 112.20. However, the pace of the run higher has just begun to dissipate slightly in the past couple of sessions, with only marginal positive closes, but also including long lower shadows on the candlesticks. Coming into the European session., the early decline is also playing into this. The long lower shadows of the past two sessions are warnings that the sellers (profit-takers) are threatening to mobilize, but cannot quite get their ducks in a row yet. It will be interesting to see how the Europeans respond to this early decline. A failure to buy into the weakness could suggest that the bull run is waning. We have mentioned the consistent use of the Fibonacci retracements (of 112.20/101.20) on numerous occasions during the two week bull run. Once more, this was seen in yesterday’s session, where the 76.4% Fib (at 109.60) became a basis of support (for yesterday’s low at 109.65). This level takes on added importance now, were it to be broken (especially on a closing basis) as it complete a small top pattern on the hourly chart (that would be confirmed below support at 109.30. It is interesting to see RSI just beginning to roll over this morning, back under 60, whilst Stochastics are also beginning to tick over. Resistance has been left initially at 111.60 under the key 112.20 February high. There are marginal negative divergences developing on hourly RSI and hourly MACD. Hourly RSI under 40 and hourly MACD under neutral would suggest development of a corrective move.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.