USD/JPY Price Forecast: Extends the range play ahead of Japan’s CPI on Friday

- USD/JPY attracts fresh sellers on Thursday, though the downside remains cushioned.

- The BoJ rate-hike uncertainty and a positive risk tone caps gains for the safe-haven JPY.

- Traders also seem reluctant ahead of Fed speaks and Japan’s National Core CPI on Friday.

The USD/JPY pair struggles to capitalize on the previous day's move up to a fresh weekly top and meets with a fresh supply on Thursday, albeit it remains confined in a familiar range. Investors remain concerned about the risk of a further escalation of geopolitical tensions after Russian President Vladimir Putin lowered the threshold for nuclear strikes on Tuesday. Furthermore, the potential for intervention from Japan and the prospects for further policy tightening by the Bank of Japan (BoJ) provides a goodish lift to the Japanese Yen (JPY)

Ueda said earlier today that the BoJ will seriously take into account foreign exchange rate movements while compiling its economic and price forecasts. The JPY weakness earlier this year had pushed up import costs and inflation, which was among the factors that led to the BoJ's decision to raise interest rates in July. This, in turn, leaves the door open for another interest rate hike as early as next month. This, along with a modest US Dollar (USD) downtick, keeps the USD/JPY pair depressed below the 155.00 mark through the early European session.

The markets, however, are still pricing in an even chance of a 25-basis-point rate hike and an on-hold decision at the final BoJ policy meeting of this year on December 18-19. Apart from this, the upbeat market mood holds back the JPY bulls from placing aggressive bets. Apart from this, elevated US Treasury bond yields, bolstered by expectations that US President-elect Donald Trump's proposed expansionary policies will boost inflation and limit the scope for the Federal Reserve (Fed) to cut rates, also contribute to capping the lower-yielding JPY.

Meanwhile, several FOMC members, including Fed Chair Jerome Powell, recently cautioned on further policy easing. In fact, Lisa Cook, a member of the Federal Reserve Board of Governors, noted on Wednesday that the central bank might get forced into a pause on interest rate cuts if inflation progress slows down. Separately, Fed Governor Michelle Bowman said that the progress on inflation appears to have stalled and that the central bank should pursue a cautious approach. This, in turn, lends some support to the buck and the USD/JPY pair.

Traders now look forward to the US economic docket – featuring the release of the usual Weekly Initial Jobless Claims, the Philly Fed Manufacturing Index and Existing Home Sales data. Apart from this, speeches by a slew of influential Fed officials, along with the US bond yields, will drive the USD demand and the USD/JPY pair. The focus will then shift to Japan's National Core Consumer Price Index (CPI) on Friday, which will be among the factors that the BoJ will consider at its next meeting and infuse some volatility around JPY pairs during the Asian session on Friday.

Technical Outlook

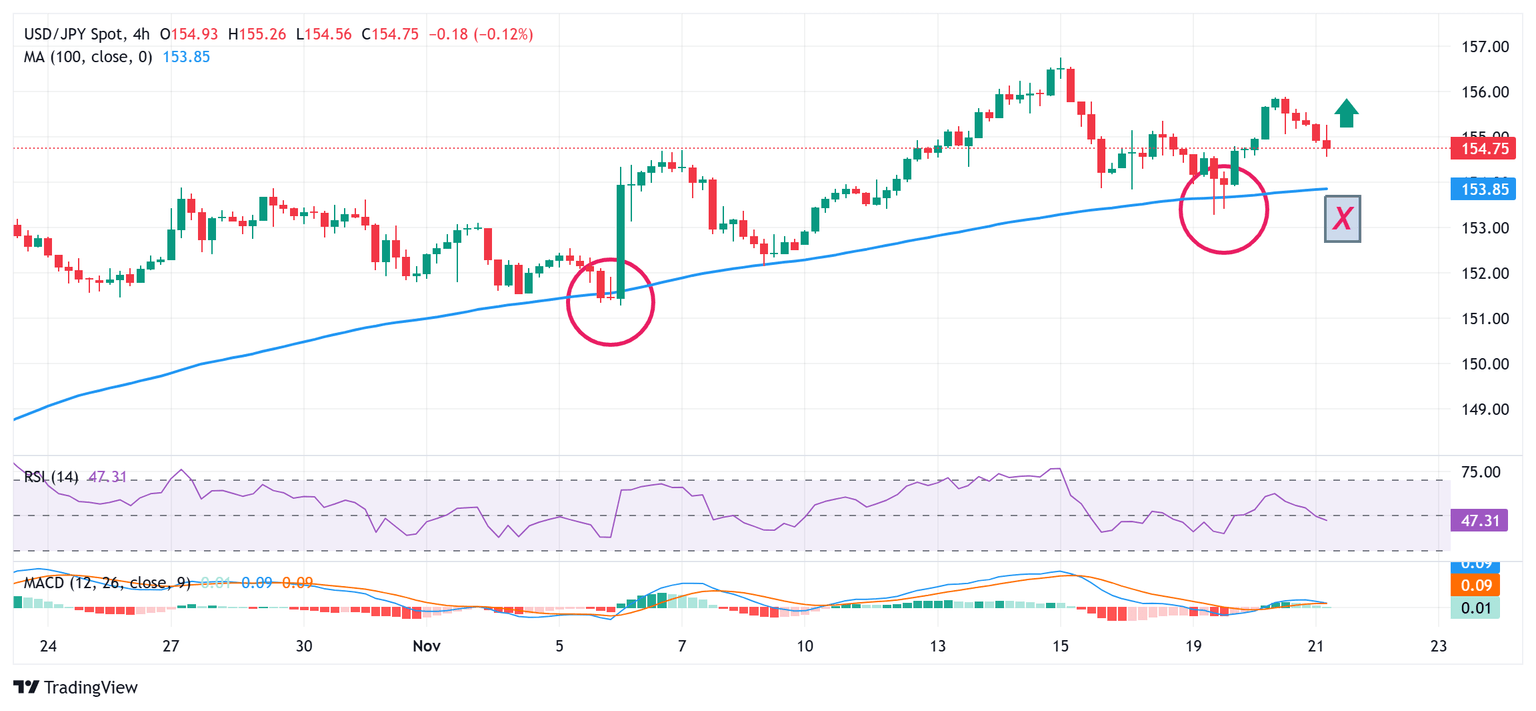

From a technical perspective, the USD/JPY pair has been showing some resilience below the 100-period Simple Moving Average (SMA) on the 4-hour chart. Moreover, oscillators on the daily chart are holding in positive territory and suggest that any further slide is more likely to attract some dip-buyers near the 154.65-154.60 region. This should help limit the downside near the 154.00 mark (200-period SMA), which should act as a key pivotal point.

Meanwhile, a convincing break below the aforementioned support might expose the weekly swing low, around the 153.25 area touched on Tuesday. This is followed by the 153.00 round-figure mark, which if broken decisively might be seen as a fresh trigger for bearish traders and pave the way for some meaningful corrective decline from a multi-month peak, around the 156.75 region set last week.

On the flip side, the Asian session peak, around the 155.40 area, now seems to act as an immediate hurdle, above which the USD/JPY pair could make a fresh attempt to reclaim the 156.00 mark. Some follow-through buying could lift spot prices back to the 156.75 area. The upward trajectory could extend further beyond the 157.00 round figure, towards testing the next relevant hurdle near the 157.30-157.35 supply zone.

USD/JPY 4-hour chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.