USD/JPY Price Forecast: Bullish potential seems intact, acceptance above 151.00 awaited

- USD/JPY seesaws between tepid gains/minor losses amid mixed fundamental cues.

- Intervention fears and a softer risk tone offer some support to the safe-haven JPY.

- The BoJ rate-hike uncertainty and bets for a less aggressive Fed easing lend support.

The USD/JPY pair struggles to capitalize on its intraday uptick to its highest level since late July and oscillates in a narrow range below the 151.00 round figure during the early part of the European session on Tuesday. The recent breakout above the 150.00 psychological mark prompted some verbal intervention from government officials. Apart from this, a slight deterioration in the global risk sentiment – as depicted by a generally softer tone around the equity markets, offers some support to the safe-haven Japanese Yen (JPY) and acts as a headwind for the currency pair. Furthermore, a modest US Dollar (USD) downtick turns out to be another factor capping the upside for the pair.

That said, the uncertainty over the timing and pace of further rate hikes by the Bank of Japan (BoJ) and bets for a less aggressive policy easing by the Federal Reserve (Fed) suggests that the path of least resistance for the USD/JPY pair is to the upside. The BoJ Governor Kazuo Ueda last week highlighted persistent uncertainties surrounding Japan’s economic recovery and global market conditions, urging caution in assessing the outlook. Moreover, the recent comments from Japanese Prime Minister Shigeru Ishiba added to a layer of uncertainty over the new political leadership's preference for the monetary policy and suggested that the BoJ will not rush to raise interest rates further.

Meanwhile, Dallas Fed President Lorie Logan said on Monday that the central bank will need to be nimble with monetary policy choices amid risks to the inflation goal. Separately, Minneapolis Fed President Neel Kashkari noted that investors should expect a modest pace of rate cuts over the next few quarters, reaffirming bets for a smaller Fed rate cut in November. Apart from this, concerns about the potential for rising deficit spending after the November 5 US Presidential election pushed the US Treasury bond yields to a three-month high. This could further undermine the lower-yielding JPY and limit the USD corrective slide, validating the positive outlook for the USD/JPY pair.

Technical Outlook

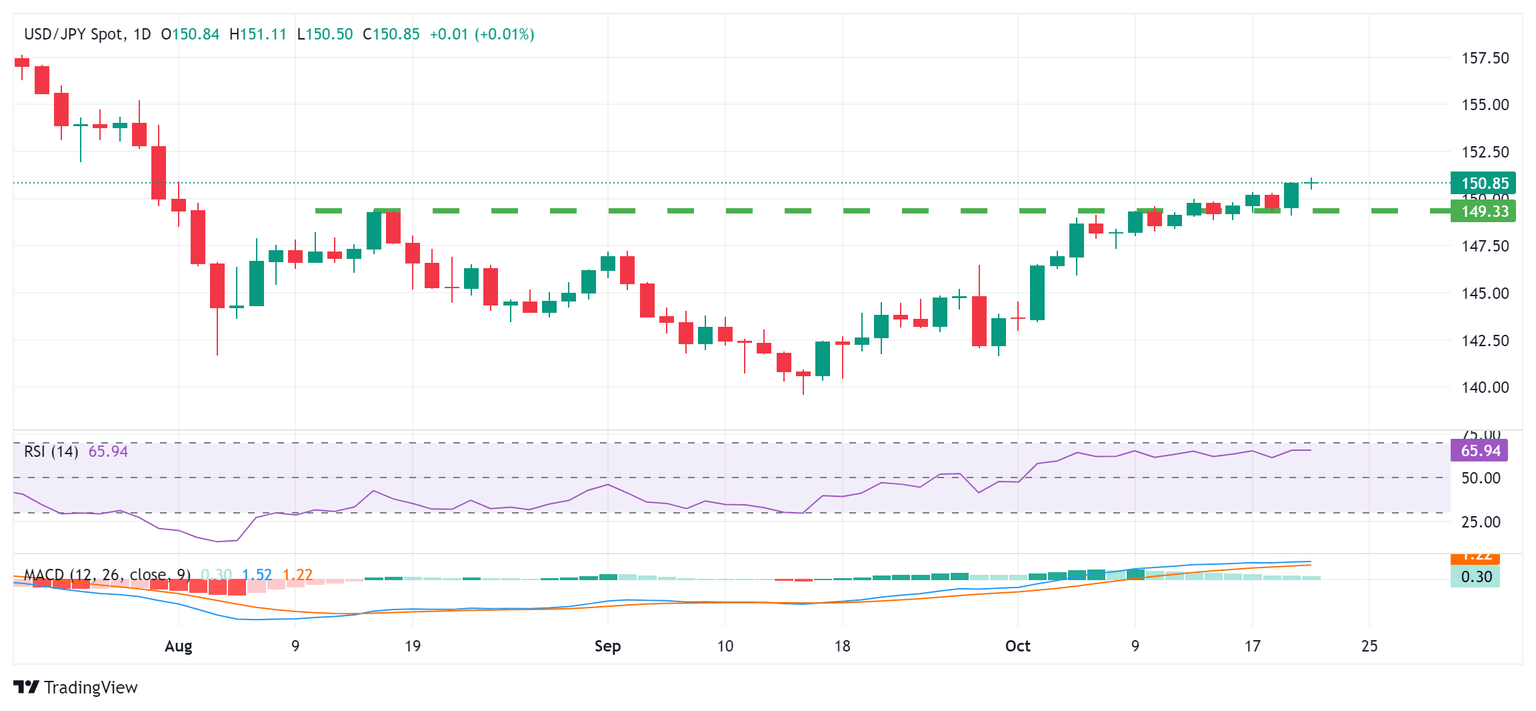

From a technical perspective, bulls might now wait for a sustained strength above the 151.00 mark before placing fresh bets. Given that oscillators on the daily chart are holding comfortably in positive territory, the USD/JPY pair might then climb to the 151.60 area before aiming to reclaim the 152.00 round figure. The momentum could extend further towards the 152.65-152.70 region en route to the 153.00 mark.

On the flip side, the daily swing low, around the 150.50 area, now seems to protect the immediate downside ahead of the 150.30-150.25 region and the 150.00 psychological mark. Any subsequent slide is likely to attract some buyers near the 149.65-149.60 zone and remain limited near the 149.00 round figure. A convincing break below the latter will suggest that the USD/JPY pair's recent move-up witnessed over the past month or so has run its course and shift the near-term bias in favor of bearish traders.

USD/JPY daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.