USD/JPY Price Forecast: Awaits Fed/BoJ policy updates before the next leg down

- USD/JPY consolidates its recent losses to over a one-year low touched on Monday.

- The divergent Fed-BoJ policy expectations continue to act as a headwind for the pair.

- Bears now look to the Fed/BoJ policy meetings before positioning for further losses.

The USD/JPY pair struggles to capitalize on the overnight modest bounce from the vicinity of mid-139.00s, or the lowest level since July 2023 and seesaws between tepid gains/minor losses through the early European session on Tuesday. Traders now seem reluctant and opt to wait for this week's key central bank event risks before positioning for the next leg of a directional move. The US Federal Reserve (Fed) will announce its decision at the end of a two-day meeting on Wednesday, which will be followed by the Bank of Japan (BoJ) policy update on Friday.

In the meantime, some repositioning trade allows the US Dollar (USD) to move away from the 2024 low and lends some support to the USD/JPY pair. Any meaningful recovery, however, still seems elusive in the wake of the divergent Fed-BoJ policy expectations. The markets have been pricing in the possibility of a more aggressive policy easing by the Fed amid signs of easing inflationary pressures. This drags the yield on the rate-sensitive 2-year US government bond to its lowest since September 2022 and the benchmark 10-year US Treasury yield to its lowest since June 2023.

Meanwhile, the recent hawkish signals from the BoJ officials suggested that the Japanese central bank will again raise interest rates by the end of this year. Apart from this, fresh concerns about an economic slowdown in China, fueled by a string of downbeat data released over the weekend, along with persistent geopolitical risks, could underpin the safe-haven Japanese Yen (JPY). This might further contribute to capping the USD/JPY pair and warrants caution before confirming that spot prices have bottomed out in the near term or positioning for any meaningful appreciation.

On the economic data front, the New York Empire State Manufacturing Index came in at 11.5 for September and indicated that business activity grew for the first time in nearly a year. The reading was better than the -3.9 expected and the -4.7 previous, albeit did little to impress the USD bulls. Market participants now look to the release of the US Retail Sales data for short-term impetus later during the North American session. The focus, however, will remain on the crucial Fed/BoJ monetary policy meetings, suggesting that the immediate market reaction is likely to be short-lived.

Technical Outlook

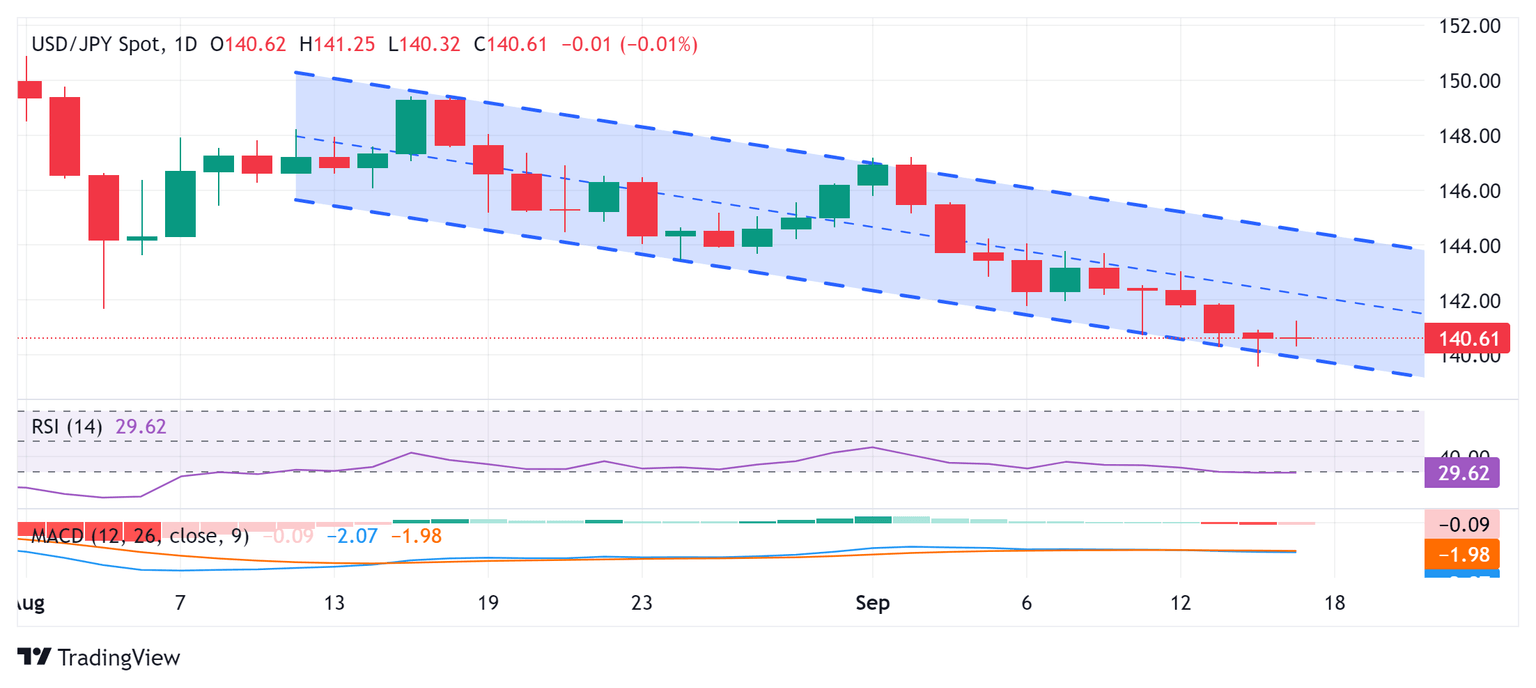

From a technical perspective, the lack of any buying interest suggests that the path of least resistance for the USD/JPY pair remains to the downside. That said, spot prices, so far, have managed to defend a support marked by the lower boundary of a short-term descending trend channel. Moreover, the Relative Strength Index (RSI) on the daily chart is flashing slightly oversold conditions. This, in turn, makes it prudent to wait for some near-term consolidation or a modest bounce before positioning for the next leg of a downfall.

In the meantime, the daily swing high, around the 141.25 region, now seems to act as an immediate hurdle, above which a bout of a short covering could allow the USD/JPY pair to reclaim the 142.00 mark. Some follow-through buying has the potential to lift spot prices to the 142.80-142.85 resistance, though any subsequent move-up is more likely to remain capped near the 143.00 round figure.

On the flip side, the 140.00 psychological mark now seems to protect the immediate downside ahead of the YTD low, around the 139.60-139.55 region touched on Monday. Failure to defend the said support levels will confirm a breakdown through the short-term descending channel and make the USD/JPY pair vulnerable. The downward trajectory could then extend further towards the 139.00 mark en route to the 138.65-138.60 intermediate support and July 2023 swing low, around the 138.00 round figure.

USD/JPY daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.