USD/JPY outlook: Remains at the back foot ahead of key US labor report

USD/JPY

The USDJPY holds in red for the fourth straight day and hit one-week low on Thursday, as markets await release of US May labor report on Friday.

Today’s ADP report showed much stronger than expected hiring in the US private sector, though positive impact was offset by strong downside revision of unit labor cost (Q1 4.2% vs 6.0% f/c, 6.3% prior) while US weekly jobless claims came near expectations.

US NFP would provide more evidence about the situation in the labor market to the US central bank, as bets for another hike in June grow, although the whole picture will be incomplete until June 13, when May inflation report will be released, just day ahead of the end of Fed’s policy meeting.

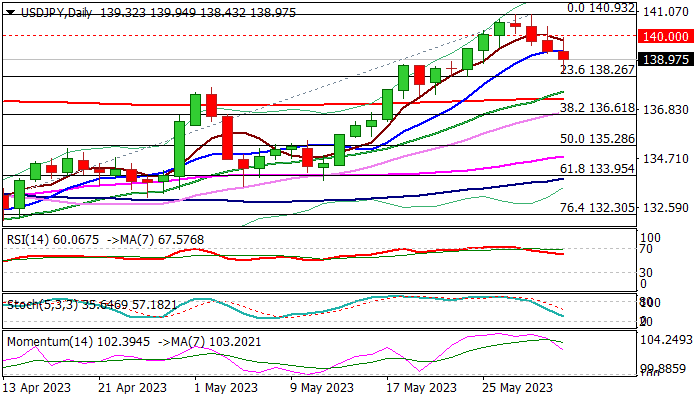

Technical structure on daily chart is weakening on fading bullish momentum and south-heading stochastic and RSI, however, the pullback so far looks like a healthy correction and having more space to extend lower without significantly hurting larger bulls, as moving averages remain in bullish setup and recent formation of 20/200 golden cross, underpins.

Bears pressure initial Fibo support at 138.26 (23.6% of 129.64/140.93 rally) which guards lower pivots at 137.27 (200DMA) and 136.61 (Fibo 38.2%), loss of which would open way for deeper pullback.

Res: 139.36; 140.00; 140.93; 142.25.

Sup: 138.26; 137.61; 137.27; 136.61.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.