USD/JPY

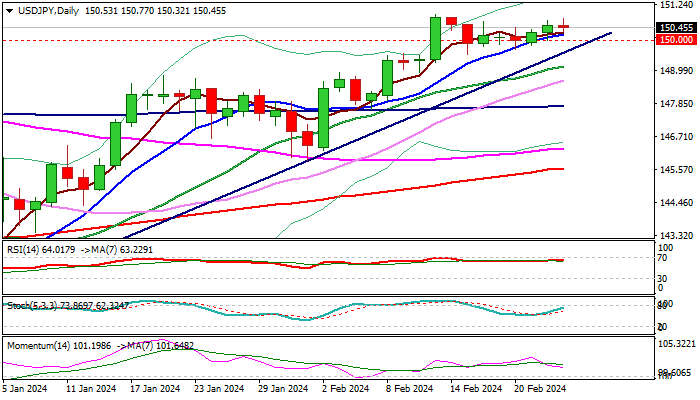

USDJPY edges lower on Friday as traders collect some profits ahead of the weekend but keeps overall bullish structure.

The pair is on track for another weekly gain and the second weekly close above 150 level, which will further boost positive sentiment and keep near-term focus on the upside.

Hawkish signals that the Fed is not in hurry to start cutting rates and overall positive US economic data, add to bullish outlook, along with weaker numbers from Japan’s economic indicators.

Markets shift focus to next week’s releases of Japan’s inflation report and US core PCE (Fed’s gauge for inflation) for fresh signals.

Meanwhile, prolonged consolidation may precede fresh push higher, with price action expected to hold above range floor / bull-trendline off 140.25 (149.68/52) and keep bulls intact.

Break of February’s peak at 150.88 to generate fresh bullish signal for extension towards key barriers at 151.90/94 (2023 2022 peaks) the highest in over three decades.

Res: 150.88; 151.00; 151.43; 151.90.

Sup: 150.30; 150.00; 149.52; 149.11.

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.