USDJPY

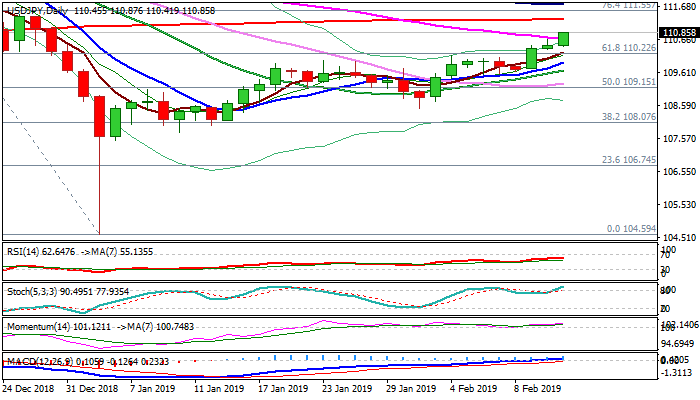

The pair maintains positive tone on Wednesday and eyes psychological / option 111.00 barrier after fresh acceleration in early US trading broke above important barrier at 111.66 (55SMA). Close above here is needed to generate bullish signal for extension of recovery leg from 104.59 (3 Jan spike low) and test of 200SMA (111.27). Renewed risk appetite keeps safe-haven yen in defense and boosts the greenback. Rising bullish momentum supports the advance, but overbought stochastic warns of stronger hesitation on approach to 111.00/27 pivots. Broken Fibo 61.8% barrier (110.22) is reinforced by rising 5SMA and expected to ideally contain dips and guard pivotal 10/20SMA's (109.93/69 respectively).

Res: 111.00; 111.27; 111.55; 111.72

Sup: 110.66; 110.22; 109.93; 109.69

Interested in USDJPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.