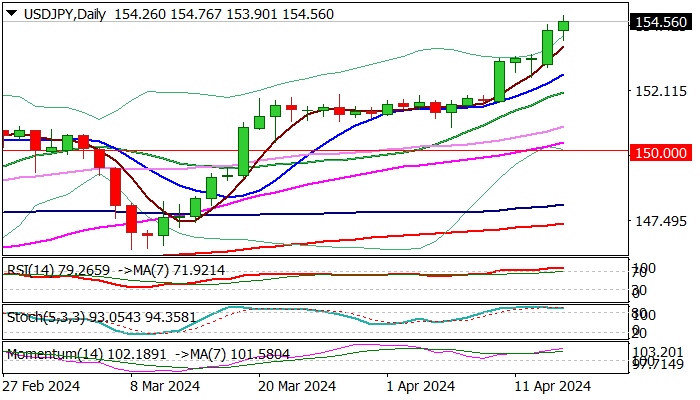

USDJPY neared 155.00 barrier on Tuesday, as the latest bullish acceleration extends into fifth straight day.

The dollar continues to benefit from growing signals about the strength of the US economy which may further delay the start of Fed rate cuts, while yen remains under increased pressure from strong dollar and a wide gap between monetary policies of two central banks (Fed and BOJ).

Technical studies remain strongly overbought on daily chart and suggest that some profit taking could be seen in coming session, while renewed talks about Japan’s intervention at 155 zone add to uncertainty.

Dips should find solid ground above former breakpoints at 152 zone to mark a healthy correction and keep larger bulls intact for fresh push higher and possible attack at 1990 peak (155.77).

Conversely, loss of 152 handle would open way for deeper correction.

Res: 155.00; 155.29; 155.77; 156.00

Sup: 154.00; 153.68; 152.66; 152.00

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.