USD/JPY Forecast: Sharp bounce from 104.00 doesn’t grant additional gains

USD/JPY Current price: 104.75

- Japanese markets will remain closed for a second consecutive day amid a local holiday.

- Dollar’s demand imposed itself in a risk-averse environment.

- USD/JPY trades around the 38.% retracement of its latest daily slump.

The USD/JPY pair plunged to 103.99, its lowest since last March, bouncing sharply within US trading hours to end the day with gains around 104.80. Signs of a worsening pandemic and speculation about its effects on economic growth sent investors into safety during the European session, although the pair finally gave up to resurgent dollar’s demand. US Treasury yields, in the meantime, shed some ground but held within familiar levels ahead of Fed’s Powell testimony before Congress this Wednesday. Japanese markets will remain closed this Tuesday as the country celebrated the Autumnal Equinox Day.

USD/JPY short-term technical outlook

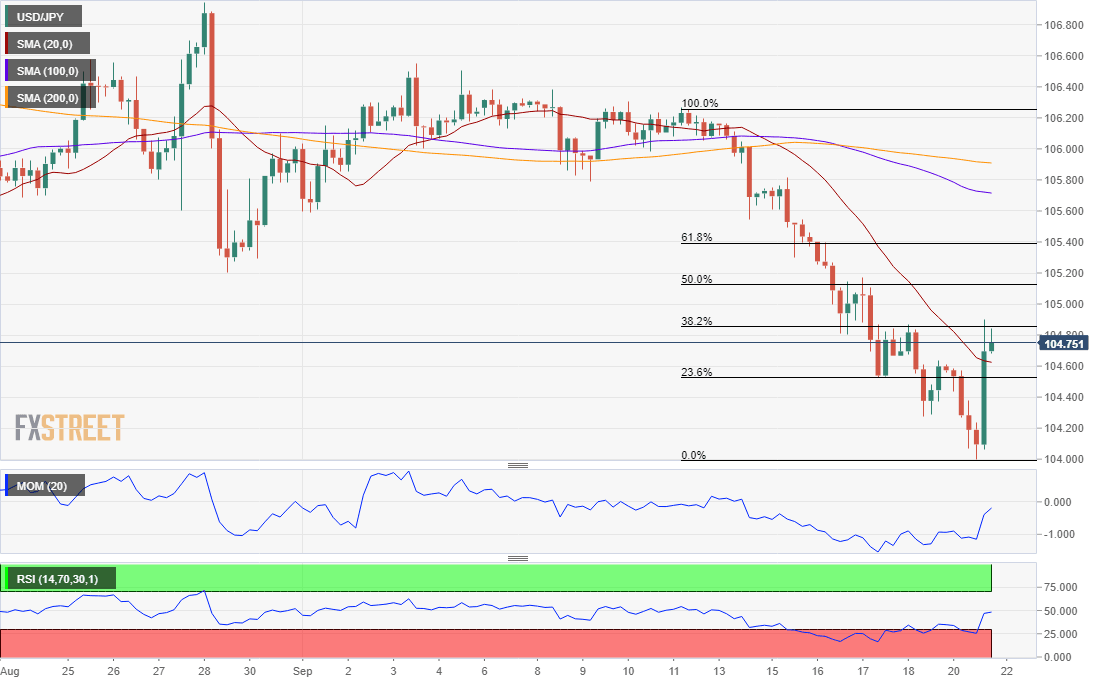

The USD/JPY pair is trading around the 38.2% retracement of its latest daily slump, measured between 106.26 and the mentioned low at 103.99. The 4-hour chart shows that the pair has recovered above its 20 SMA after spending a week below it, while technical indicators bounced from oversold reading to stand at positive levels. The 100 and 200 SMA, however, remain far above the current level, maintaining their bearish slopes. The pair would have better chances of rallying on a break above 105.40, the 61.8% retracement of the mentioned decline.

Support levels: 104.50 104.00 103.65

Resistance levels: 104.90 105.40 105.80

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.