USD/JPY Forecast: Mildly pressured amid a cautious mood

USD/JPY Current price: 109.60

- A hedge fund liquidation dents the market’s sentiment.

- Bank of Japan Governor Kuroda reiterated they will maintain their ultra-loose policy.

- USD/JPY holds on to higher ground with a limited bearish scope.

Investors are cautious at the start of the week amid news that a hedge fund that had significant positions in different firms was forced to liquidate late on Friday. Credit Suisse and Nomura reported significant losses as a result of the $20 billion block-sale. Equities markets opened in the red, although the impact seems to be fading as the day goes by. Nevertheless, the US opening could see some wild action. The USD/JPY pair trades lower in range in the 109.50 price zone, as safe-haven assets are getting some demand.

The Bank of Japan published the Summary of Opinions, and Governor Haruhiko Kuroda spoke afterwards, repeating well-known concepts. Kuroda said that the central bank will continue with its ultra-loose monetary policy, adding that it will take time to hit the 2% inflation target. His words had no impact on markets but added to the dismal mood. The US will publish today the March Dallas Fed Manufacturing Business Index.

USD/JPY short-term technical outlook

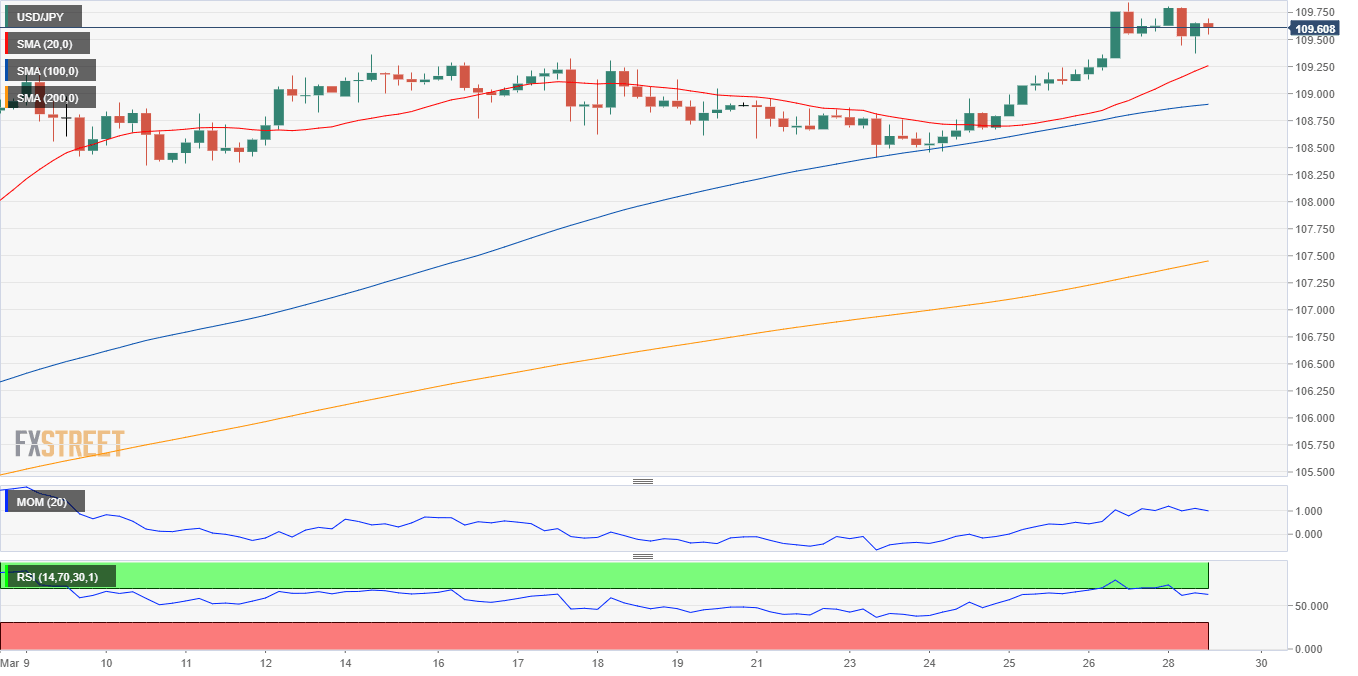

The USD/JPY pair is technically bullish in the near-term, with the downward potential still limited. The 4-hour chart shows that it’s developing above all of its moving averages, with the 20 SMA advancing above the larger ones. The Momentum indicator eased from its highs but remains within positive levels while the RSI consolidates around 65. The pair bottomed for the day at 109.35, the level to break to see it falling further.

Support levels: 109.35 108.90 108.50

Resistance levels: 109.85 110.10 110.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.