USD/JPY Forecast: Increased bearish potential

USD/JPY Current price: 105.25

- US Treasury yields held ground, but Wall Street remained under pressure.

- Japan will publish the December Leading Economic Index estimated at 94.9.

- USD/JPY is at risk of falling despite a modest intraday advance.

The USD/JPY pair is ending the day with modest gains in the 105.20 price zone, recovering from an intraday low of 104.92. US indexes plunged after the opening amid a tech-led sell-off, although Federal Reserve Powell poured some cold water on the slide, as his words hinted quantitative easing is here to stay. Meanwhile, US Treasury yields held ground. The yield on the benchmark 10-year Treasury note pivoted around 1.35%, where it finished the day.

Japanese markets were closed due to a local holiday but will resume working on Wednesday. The country will publish the December Leading Economic Index, previously estimated at 94.9. The Coincident Index for the same period is expected at 87.8.

USD/JPY short-term technical outlook

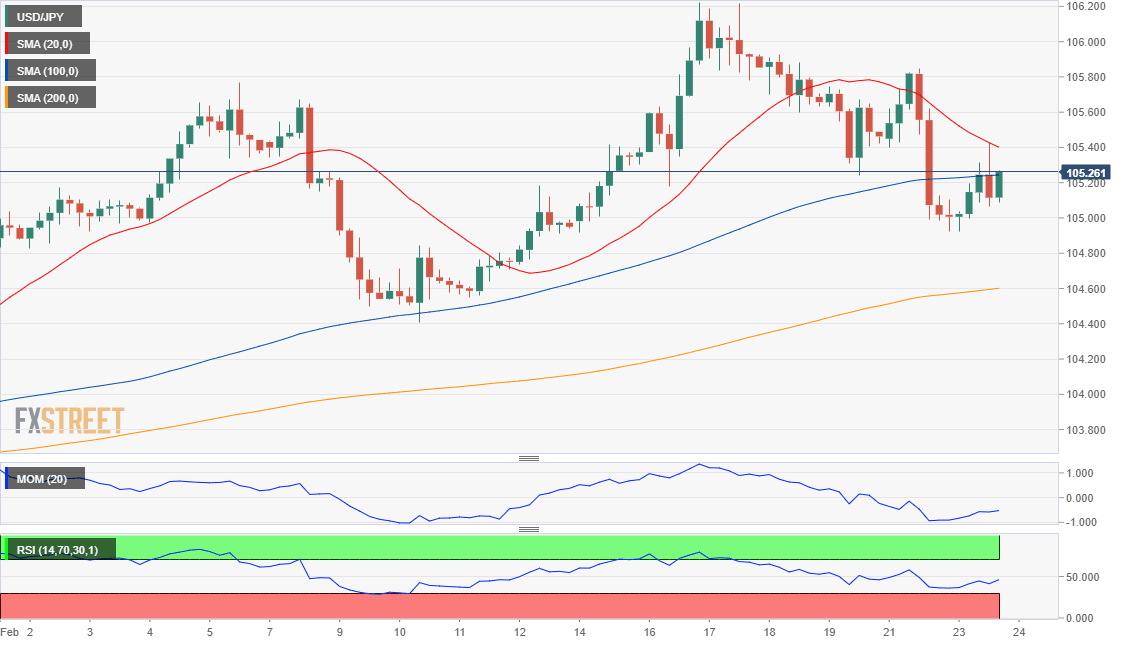

From a technical perspective, the USD/JPY pair has a limited bullish scope in the near-term. The 4-hour chart shows that the advances were rejected by sellers aligned around a bearish 20 SMA. The price is currently hovering around a mildly bullish 100 SMA, as technical indicators turned flat below their midlines. The advance could gather momentum if the pair surpasses the 105.60 level.

Support levels: 104.95 104.50 104.10

Resistance levels: 105.60 105.95 106.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.