USD/JPY Current price: 103.66

- Poor macroeconomic data and coronavirus-related concerns weigh on the market’s mood.

- Japanese National inflation contracted by 1.2% YoY in December.

- USD/JPY is technically neutral, bullish only beyond 104.40.

The USD/JPY pair is trading around 103.60, modestly up for the day, as the dollar is grabbing some attention. The market’s mood turned sour, with equities under strong selling pressure and US Treasury yields ticking lower in pre-opening trading. It doesn’t seem to be a clear catalyst behind the U-turn in sentiment, although poor UK Retail Sales figures and mixed growth data coming from the EU exacerbate the dismal sentiment in the current London session. Also, concerns about lockdown extensions and tighter restrictive measures weigh on the sentiment.

Japanese data published at the beginning of the day resulted mixed. December National inflation worsened from -0.9% to -1.2% YoY, slightly better than anticipated. The core reading which excludes fresh food prices, printed at -1%. The preliminary estimate of the January Jibun Bank Manufacturing PMI contracted to 49.7 from 50 in the previous month, missing expectations of 50.5. The US will publish today December Existing Home Sales, and Markit preliminary estimates of manufacturing and services output.

USD/JPY short-term technical outlook

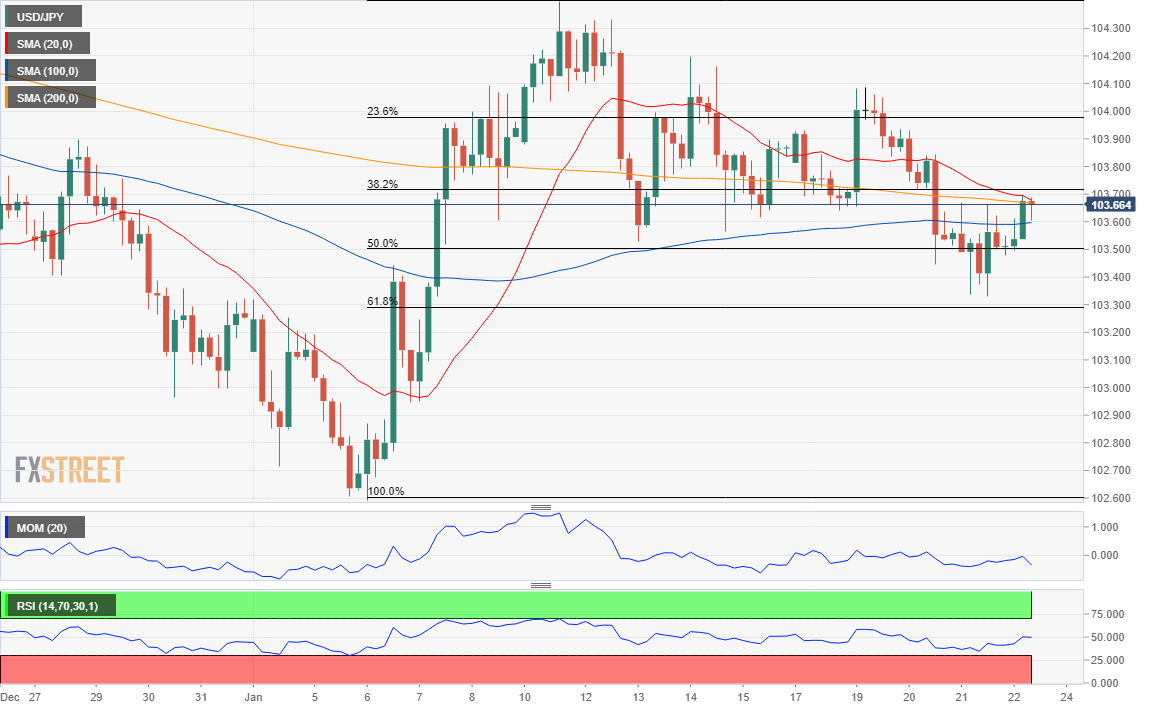

The USD/JPY pair is trading just below the 38.2% retracement of its January’s rally, after flirting with the 61.8% retracement earlier in the week. The 4-hour chart shows that the price is developing between directionless moving averages, while technical indicators advance within negative levels. The bullish potential is limited as long as the pair remains below the 104.30/40 price zone, while the risk of a steeper decline would increase on a break below 103.25.

Support levels: 103.25 102.90 102.55

Resistance levels: 104.05 104.40 104.80

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.