USD/JPY Forecast: Back to its comfort zone around 107.00

USD/JPY Current price: 106.93

- Japanese Tokyo inflation resulted at 0.3% YoY in June, well below the market’s forecast.

- US core PCE inflation is foreseen at 0.9% in May, below the previous 1.0%.

- USD/JPY could turn bearish below the 106.60 support level.

The American dollar is giving up some of its latest gains, which pushes USD/JPY sub-107.00 this Friday. Asian equities traded mixed, while European ones gain some ground, following the lead of Wall Street and reversing the negative tone of the previous days. Nevertheless, concerns remain as the number of new coronavirus cases in the US hit yesterday another record high of roughly 40,200 in just 24 hours. As the situation worsens, an economic comeback moves farther away.

Japan published Tokyo June inflation at the beginning of the day, which came in at 0.3% YoY, well below the 0.6% expected, although the core reading, which excludes fresh food, met the market’s expectations at 0.2%.

The US will publish today May Personal Income and Personal Spending figures, which include the core PCE inflation, the Fed’s favorite inflation measure, foreseen at 0.9%. from 1.0% previously. The country will also publish the final version of the Michigan Consumer Sentiment Index for June, seen upwardly revised to 79 from 78.9.

USD/JPY short-term technical outlook

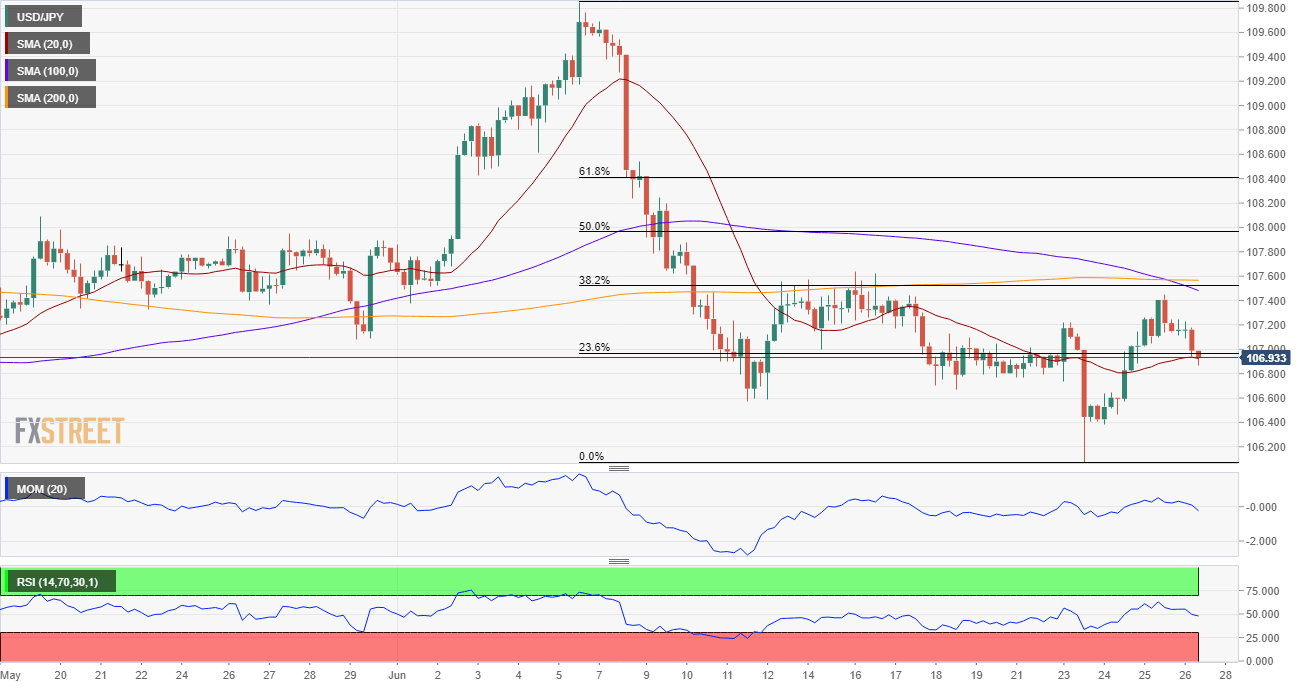

The USD/JPY pair is trading around the 23.6% retracement of its latest daily slump, after nearing the 38.2% retracement of the same decline earlier this week. The pair is neutral-to-bearish, according to the 4-hour chart, as it remains below its 100 and 200 SMA, which converge around the mentioned Fibonacci 38.2% retracement, as the pair battles with a directionless 20 SMA. Technical indicators, in the meantime, remain flat around their midlines.

Support levels: 106.60 106.25 105.80

Resistance levels: 107.10 107.50 107.90

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.