USD/JPY – EUR/JPY

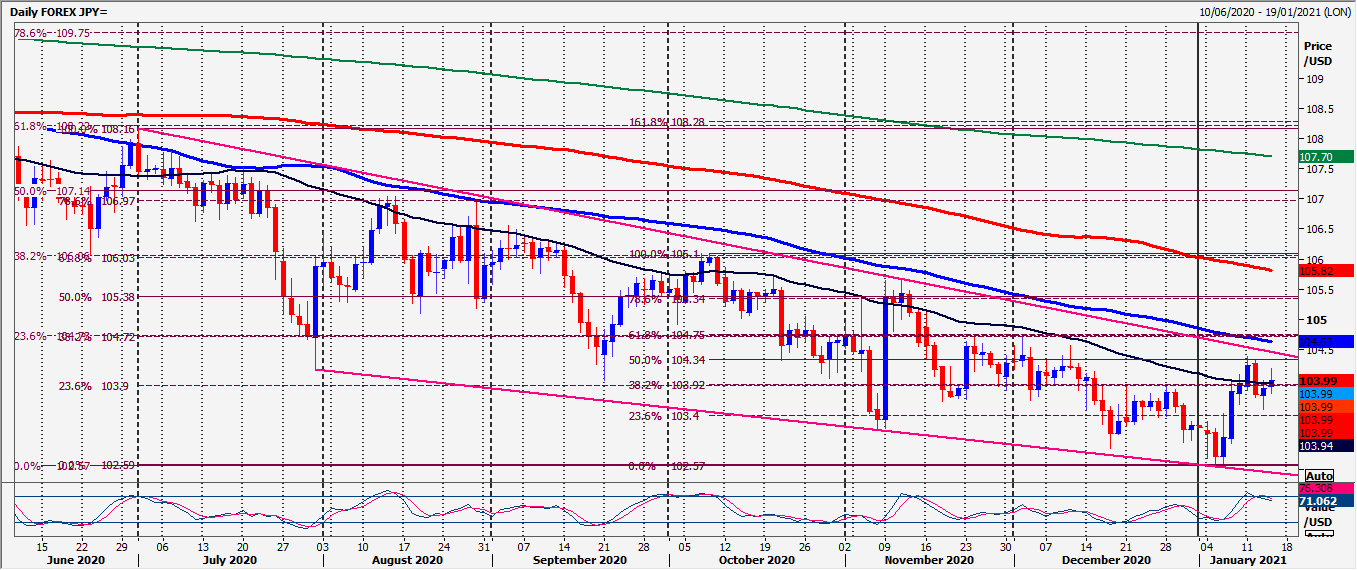

USDJPY longs at our buying opportunity at 103.60/50 worked perfectly on the bounce from 103.51 to first resistance at 103.90/104.00.

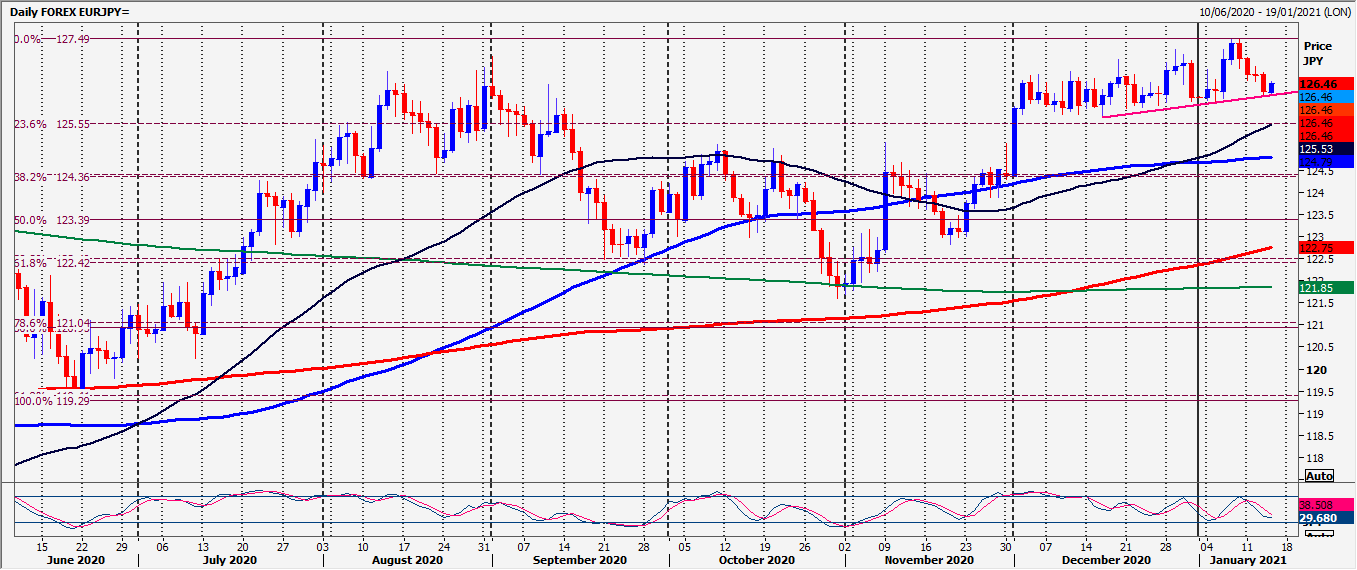

EURJPY topped exactly at first resistance at 126.70/60 to target 126.15/05.

Daily Analysis

USDJPY longs at our buying opportunity at 103.60/50 hit first resistance at 103.90/104.00. If we hold above 104.00 look for 104.35/45 today. A selling opportunity at 104.65/75 with stops above 104.90. A break higher is a strong buy signal.

Be ready to sell a break below 103.35 for 103.00/90, perhaps as far as 102.75/65.

EURJPY holding first resistance at 126.70/60 targets 126.15/05, perhaps as far as support at 125.80/70.

First resistance at 126.60/70. Shorts need stops above 126.80 for 127.10/20 before resistance at the 2019 high at 127.40/50. A break higher is a clear buy signal targeting 127.90/99 then 128.20/25. We look for strong resistance at 128.65/75.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.