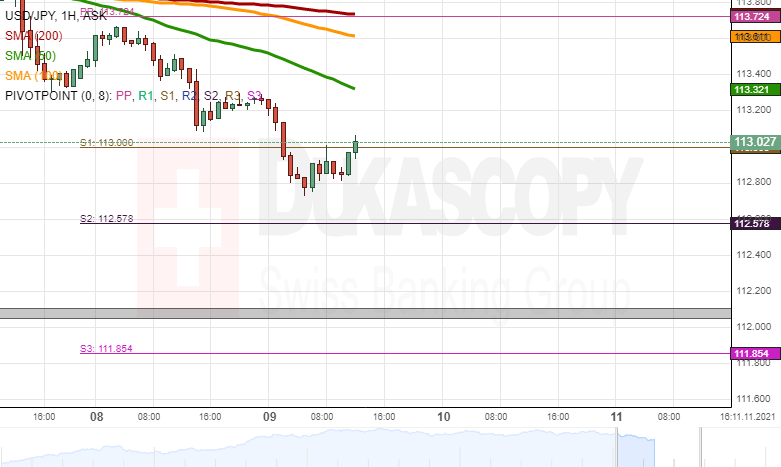

USD/JPY analysis: Trades below 113.00

USD/JPY

On Monday, the decline of the USD/JPY currency pair reached below the support of the 113.00 mark, which was strengthened by the weekly S1 simple pivot point. On Tuesday, the rate retraced back up and confirmed the 113.00 level as resistance. Namely, the pair moved back up and bounced off the 113.00 mark.

If the rate continues to decline, the next target for the decline could be the weekly S2 simple pivot point at 112.58. Below the pivot point, the 112.50 mark might provide support, before the USD/JPY reaches the September high-level zone at 112.05/112.10.

However, a recovery of the pair above the 113.00 mark might find resistance in the 50-hour simple moving average at 113.30. Above the 50-hour SMA, the 100-hour SMA at 113.60 could serve as resistance. In addition, the 200-hour SMA and the weekly simple pivot point at 113.72 are likely set to also provide downwards pressure.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.