EUR/USD

No short-term momentum.

EUR/USD is trading mixed. Yet, the short-term technical structure still suggests a further bearish move. Hourly resistance lies at 1.1068 (intraday high) and hourly support is given at 1.0957 (24/02/2016 low). Expected to show continued weakness.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

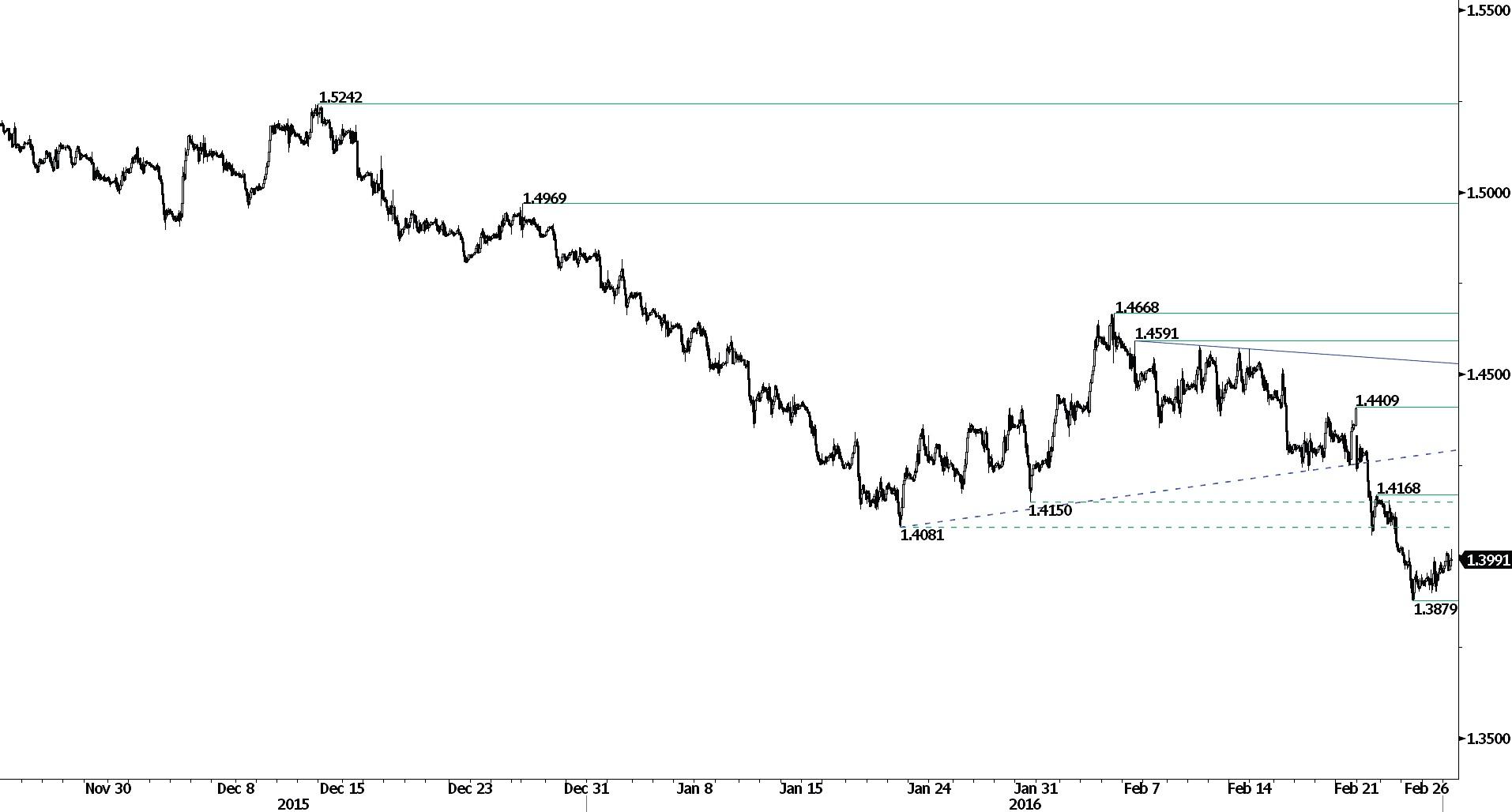

GBP/USD

Rising slowly.

GBP/USD keeps on consolidating. Hourly support lies at 1.3879 (24/02/2016 low) and hourly resistance is given at 1.4168 (22/02/2016 high). The technical structure suggests further decline. The road is wide open to stronger support at 1.3657 (11/03/2009 low).

The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

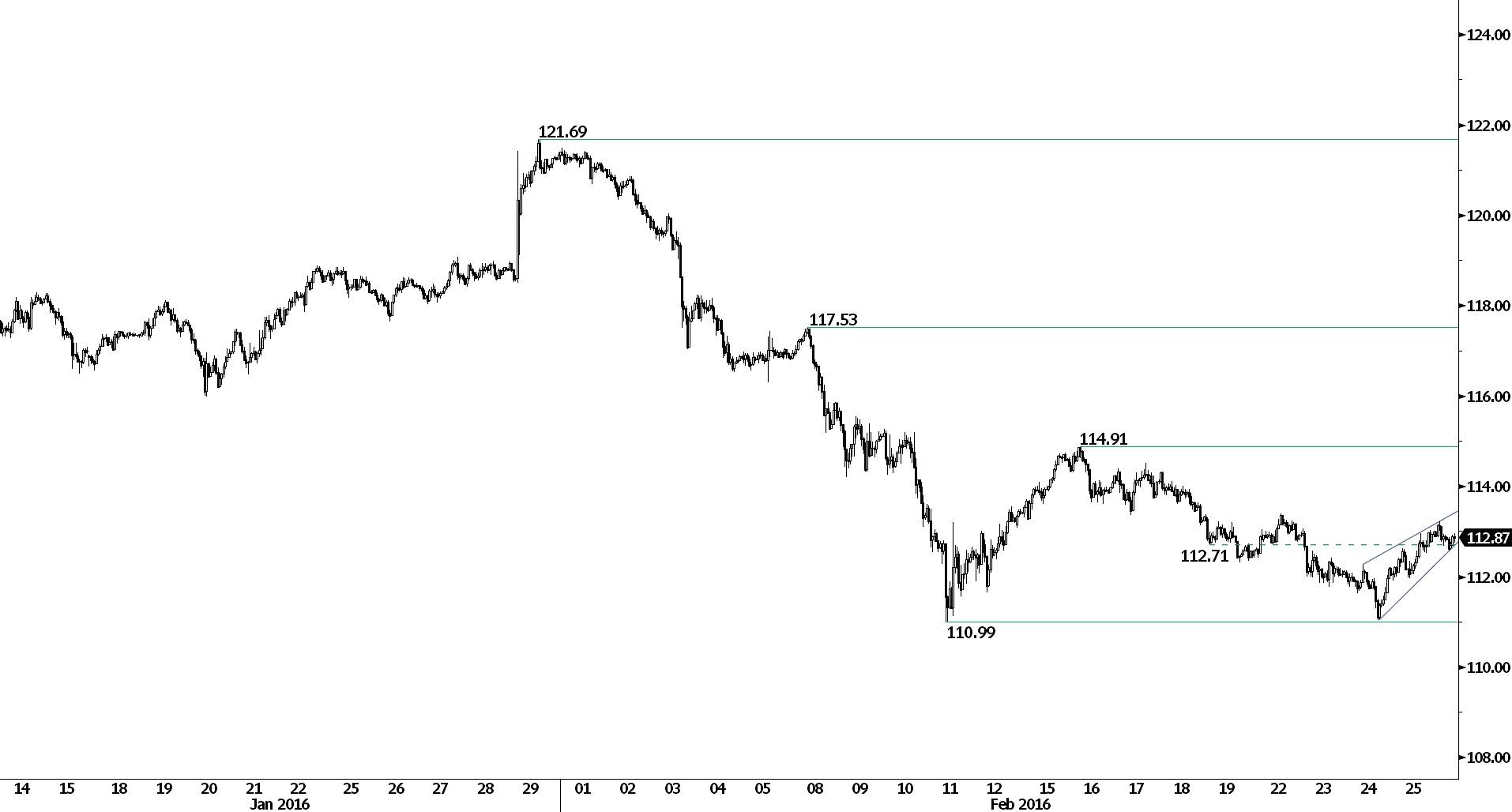

USD/JPY

Short-term bullish momentum is growing.

USD/JPY has bounced back from 110.99 despite the medium-term technical structure is clearly negative. Hourly resistance can be found at 113.22 (intraday high). Stronger resistance is given at 114.91 (16/02/2016 high). Expected to further increase.

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

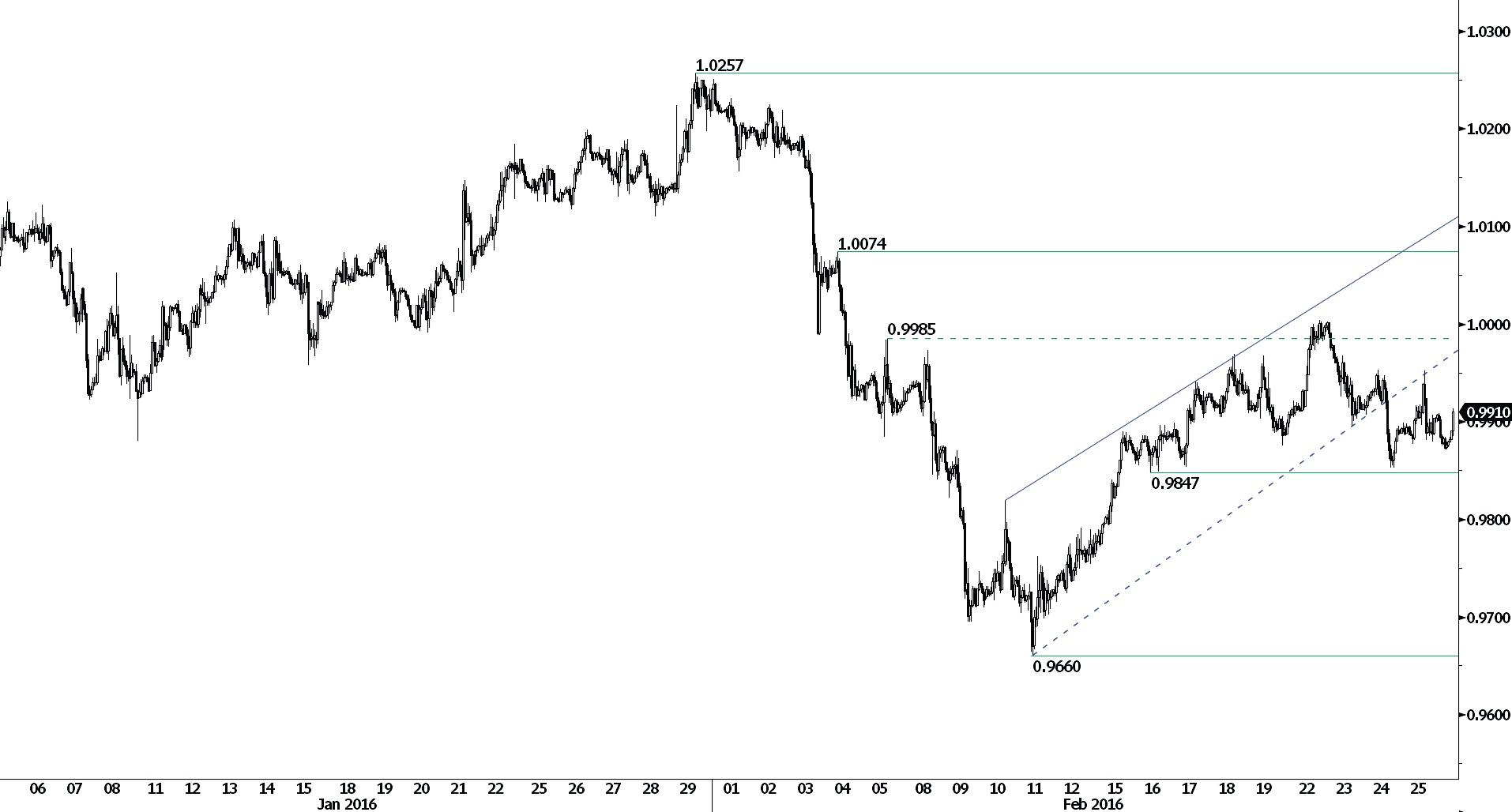

USD/CHF

Trading in range.

USD/CHF has exited uptrend channel. Hourly support is given at 0.9847 (16/02/2016 low). Hourly resistance is given at 1.0003 (22/02/2016 high). The bullish momentum has faded. Expected to see further weakening toward support at 0.9847.

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

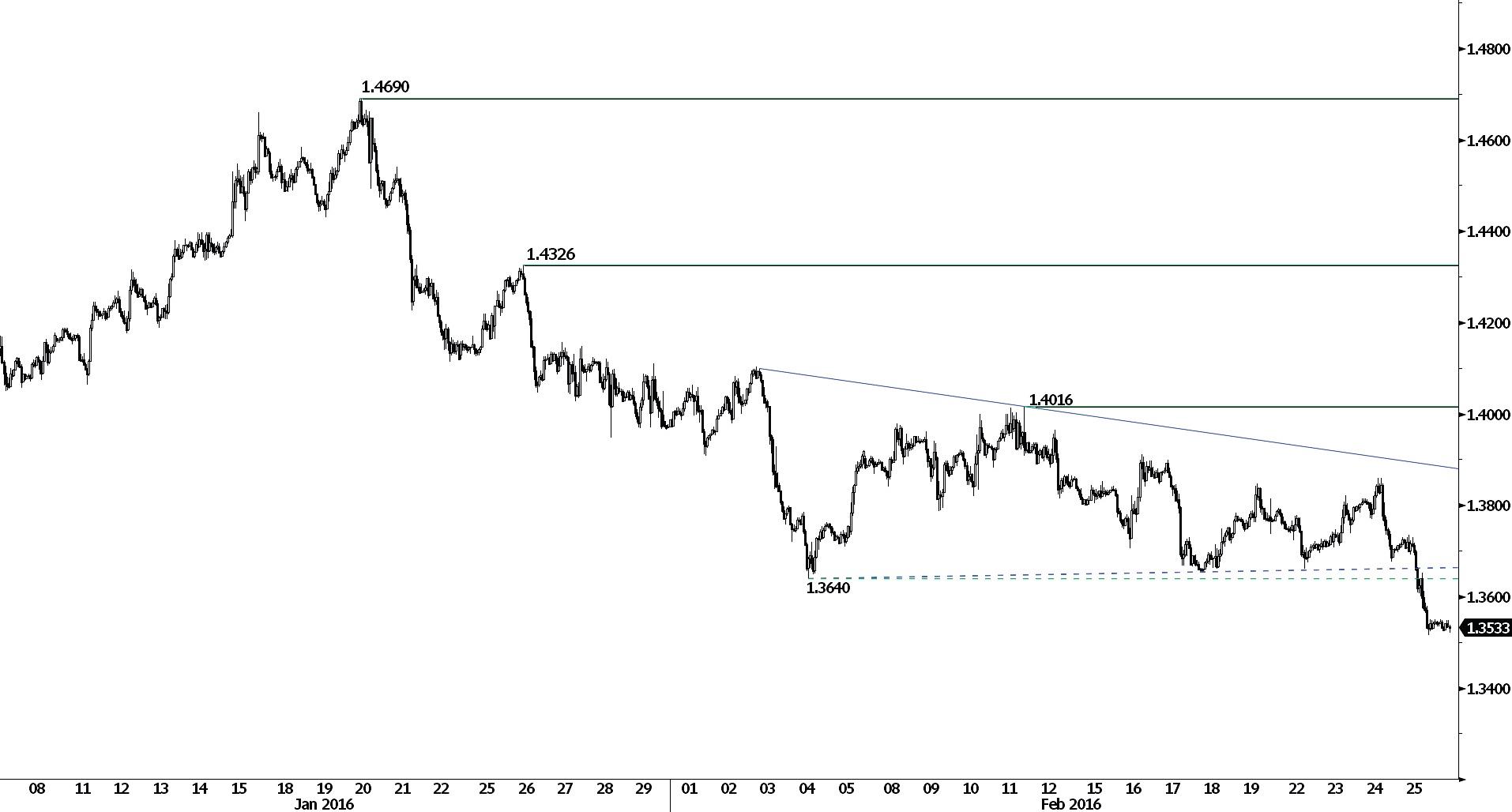

USD/CAD

Bearish breakout.

USD/CAD has sharply declined. The pair has erased strong support area around 1.3700 (04/02/2016 low) and is now pausing. Hourly resistance can be found at 1.3735 (25/02/2016 high). Expected to see further weakening.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Strong resistance is given at 1.4948 (21/03/2003 high). Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

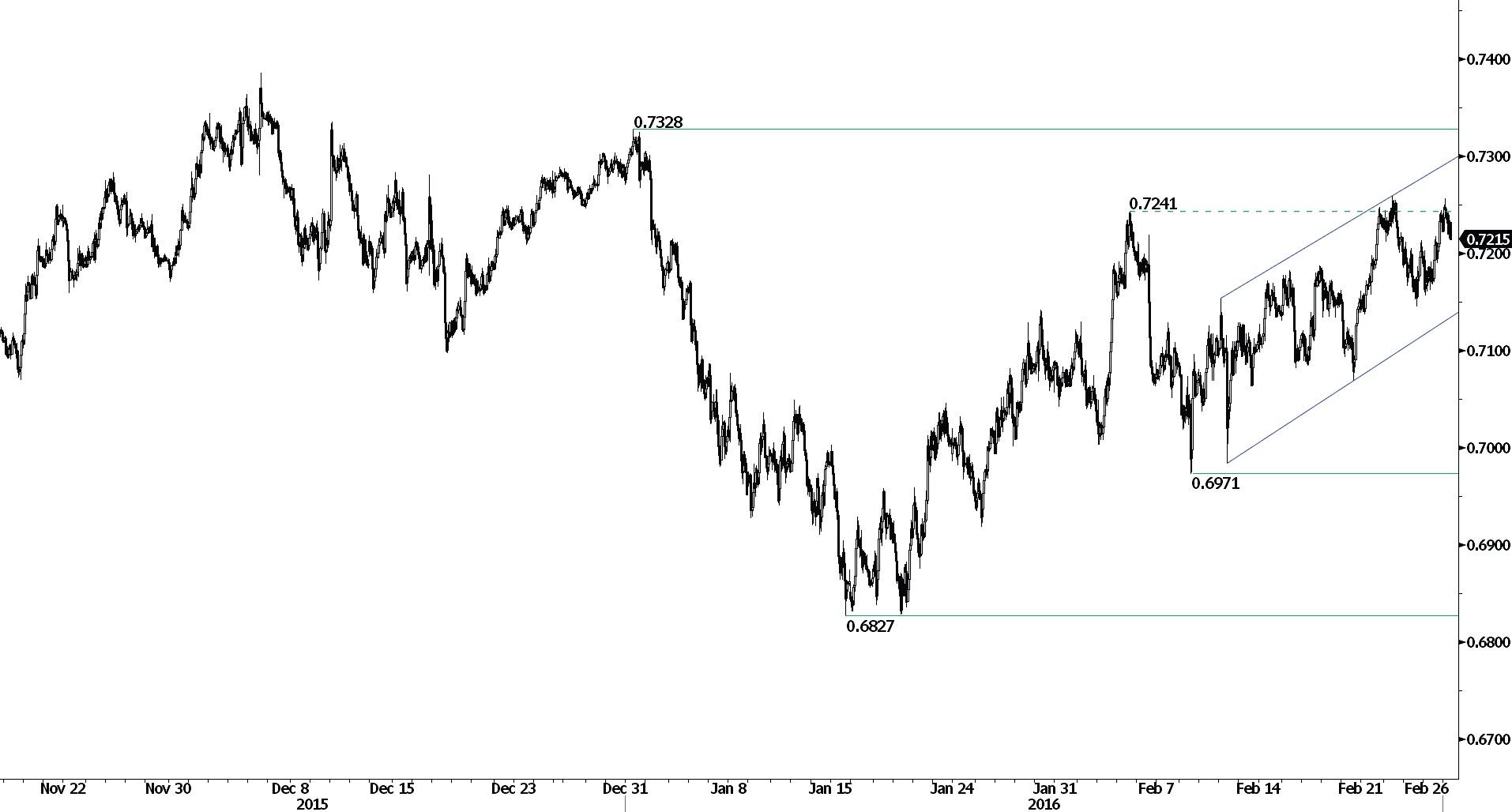

AUD/USD

Riding higher.

AUD/USD is back above 0.7200. Strong hourly resistance is given at 0.7328 (31/12/2015 high). Support lies at 0.7146 (24/02/2016 low). Expected to keep on pushing higher.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is approaching the 200-dma which confirms fading selling pressures.

EUR/CHF

Holding below 1.1000.

EUR/CHF's selling pressures continues. Hourly support can be found at 1.0865 (24/02/2016 low) is on target. Hourly resistance lies at 1.0946 (25/02/2016 high). The technical structure suggests further weakening.

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Bullish consolidation.

EUR/JPY's breakout of support implied by the lower bound of the downtrend channel has paved the way for further decline. Yet, the pair is still in a consolidation phase. Hourly support is given at 122.46 (24/02/2016 low) and hourly resistance can be found at 124.23 (intraday high). Expected to further decrease.

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key support at 124.97 (13/06/2013 low) has been broken. Stronger support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Bullish.

EUR/GBP is trading around its year-highs. The very short-term technical structure suggests a bullish growing momentum toward psychological level at 0.8000. Hourly support is given at 0.7776 (23/02/2016 low).

In the long-term, the technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8066 (10/09/2014 high).

GOLD (in USD)

Low volatility.

Gold's bullish momentum continues. The metal is pushing slightly higher. Hourly supports lies at 1201(18/02/2016 low) and 1191 (16/02/2016 low). Daily resistance can be found at 1263 (11/02/2016 high).

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Weakening.

Silver is clearly consolidating around the 15.00 level. The metal should not test hourly support at 14.89 (10/02/2016 low). Hourly resistance can be found at 15.58 (24/02/2016 high). Expected to bounce higher.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Short-term bullish.

Crude oil's volatility is still strong for the time being. In the context of oil oversupply, we consider that there is still room for further downside moves. Yet, the higher highs suggest that oil is in a short-term bullish momentum. Hourly support stand at 28.70 (16/02/2016 low) and hourly resistance can be found at 33.60 (04/02/2016 high). Expected to see continued strength in the short-term.

In the long-term, crude oil is on a sharp decline and is of course no showing any signs of recovery. Strong support at 24.82 (13/11/2002) is now on target. Crude oil is holding way below its 200-Day Moving Average (setting up at around 47). There are currently no signs that a reverse trend may happen.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.