EUR/USD

Declining sharply.

EUR/USD has moved sharply lower breaking supports at 1.1105 (23/09/2015 low) and 1.1087 (03/09/2015 low) on Draghi's declaration yesterday. Hourly resistance is given at 1.1387 (20/10/2015 low). Stronger resistance can be found at 1.1561 (26/08/2015 low). Expected consolidation.

Since March 2015, the pair is improving. Key supports can be found at 1.0458 (16/03/2015 low) and 1.0000 (psychological support). The technical structure favours an eventual break higher. Strong resistance is given at 1.1871(12/01/2015)

GBP/USD

Moving sideways.

GBP/USD is consolidating. Support lies at 1.5202 (13/10/2015 low) and hourly resistance can be found at 1.5529 (18/09/2015 high). A long as prices remain in this range, there is no clear mid-term momentum. Expected momentum towards resistance at 1.5529.

In the longer term, the technical structure looks like a recovery as long as support given at 1.5089 stands. A full retracement of the 2013-2014 rise is expected.

USD/JPY

Moving higher.

USD/JPY is pushing higher. The pair is now targeting strong resistance is given at 121.75 (28/08/2015 high). Hourly support still lies at found at 118.07 (15/10/2015 low).

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

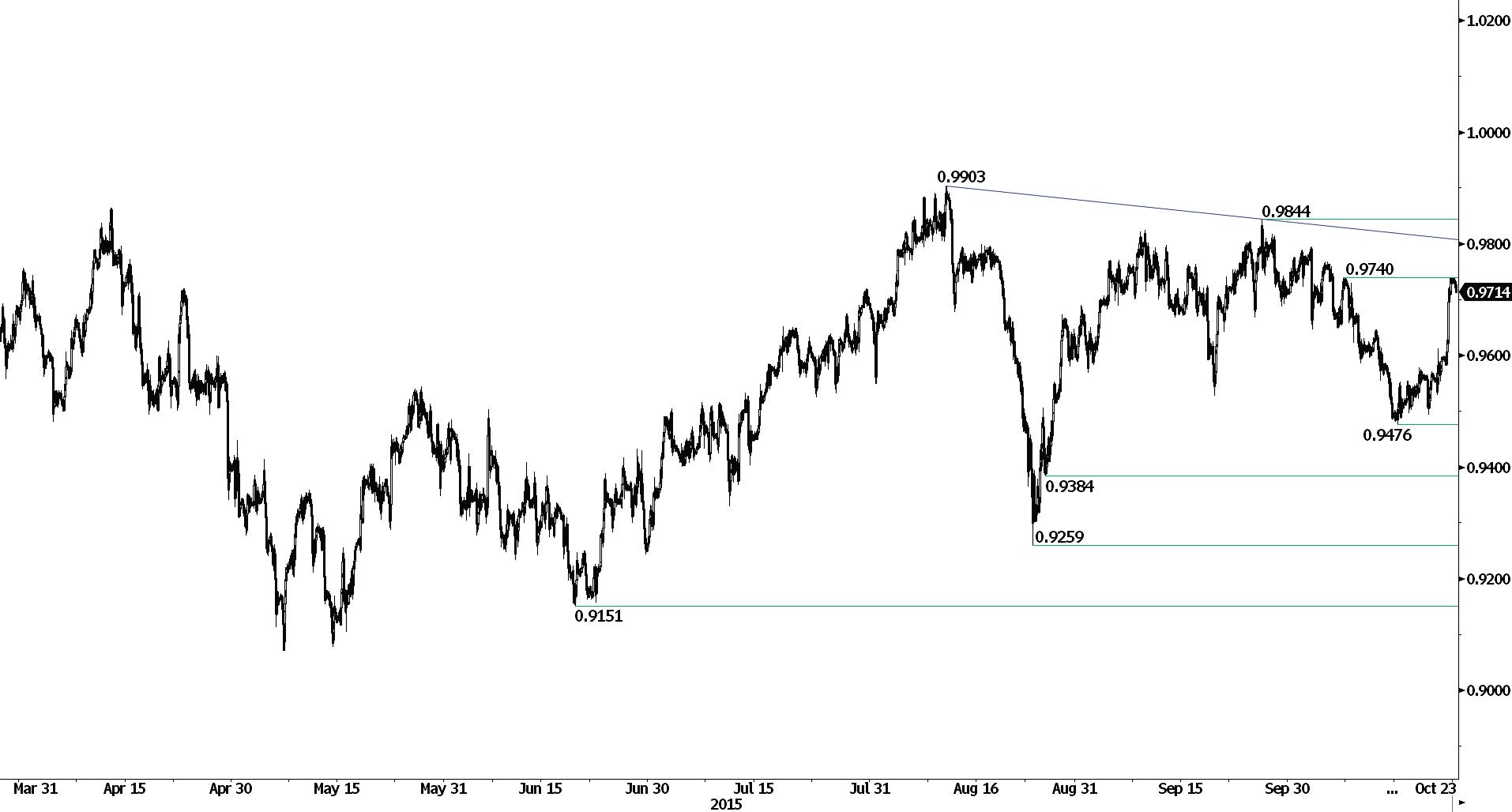

USD/CHF

Bouncing back on resistance at 0.9740.

USD/CHF has moved sharply higher before bouncing back on resistance at 0.9740 (07/10/20150 low). Hourly support is given at 0.9476 (15/10/2015 low). Expected consolidation.

In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).

USD/CAD

Bearish consolidation.

USD/CAD's momentum has shifted to positive as hourly resistance at 1.3080 (13/10/2015 low) has been broken. Hourly support is given at 1.2832 (15/10/2015 low). Expected continued consolidation of the pair before targeting 1.3200.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Support can be found at 1.1731 (06/01/2015 low).

AUD/USD

Short-term downside momentum.

AUD/USD remains in a short-term downside momentum. The very short-term technical structure is negative. A break of the hourly resistance at 0.7382 (12/10/2015 high) is necessary to reverse the current short-term trend. Hourly support lies at 0.6893 (04/09/2015 low). Expected to show continued weakness.

In the long-term, there is no sign to suggest the end of the current downtrend. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

GBP/JPY

Riding short-term uptrend channel.

GBP/JPY is still moving higher, but at a slower pace. Hourly support can be found at 180.24 (04/09/2015 low). However, there is no clear midterm momentum. Expected to show the end of this short-term bullish move.

In the long-term, the lack of any medium-term bearish reversal pattern favours a bullish bias. The successful test of the strong support at 175.51 (03/02/2015 low) signals persistent buying interest. Key resistances stand at 197.45 (26/09/2008 high). A major support area can be found between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low).

EUR/JPY

Monitoring the 50% Fibonacci retracement.

EUR/JPY has broken the 38.2% Fibonacci retracement. Hourly resistance is located at 137.45 (17/09/2015 high) and hourly support lies at 132.23 (04/09/2015 low). Expected consolidation.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Declining sharply

EUR/GBP has declined sharply and has broken hourly support at 0.7302 (25/09/2015 low). The pair has bounced back on support at 0.7196 (22/09/2015 low). Expected further bounce.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

EUR/CHF

Monitoring support at 1.0783.

EUR/CHF is pushing higher. Hourly resistance can be found at 1.0982 (25/08/2015 high). Hourly support lies at 1.0783(16/10/2015 low).

The EUR/CHF is digesting its 15 January sharp decline. A key resistance stands at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

GOLD

Short-term bearish.

Gold has consolidated lower but the shortterm technical structure is negative. Hourly resistance is given at 1205 (18/06/2015 high). Hourly support can be found at 1093 (12/08/2015 low). Expected to show continued weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. Although the key support at 1132 (07/11/2014 low) has been broken, a break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Short-term downside momentum is growing.

Silver is moving sideways. The pair is gaining enough traction to target resistance at 16.27 (22/06/2015 high). Hourly support is given at 15.40 (08/10/2015 low). Expected to show continued consolidation before pushing higher.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. The strong support at 14.66 (05/02/2010 low) has been broken and prices have then consolidated. A key resistance stands at 18.89 (16/09/2014 high).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.