EUR/USD

Bouncing.

EUR/USD has bounced after having made significant new lows. Hourly resistances for a short-term countertrend move can now be found at 1.2456 (see also the declining trendline) and 1.2532 (26/11/2014 high). Hourly supports lies at 1.2361 (intraday low) and 1.2280.

In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) calls for a decline towards the strong support at 1.2043 (24/07/2012 low). A key resistance stands at 1.2600 (19/11/2014 high).

Sell limit 2 units at 1.2522, Obj: Close unit 1 at 1.2305, remaining at 1.2070., Stop: 1.2610.

GBP/USD

Short-term succession of lower highs.

GBP/USD continues to move sideways within the horizontal range defined by the support at 1.5593 and the resistance at 1.5826 (see also the declining channel). The recent succession of lower highs suggests a weak buying interest. An hourly resistance lies at 1.5726 (04/12/2014 high).

In the longer term, the break of the support at 1.5855 (12/11/2013 low) confirms an underlying bearish trend. A conservative downside risk is given by a test of the support at 1.5423 (14/08/2013 low). Another support can be found at 1.5102 (02/08/2013 low). A key resistance lies at 1.5945 (11/11/2014 high).

Await fresh signal.

USD/JPY

Challenging the 120 psychological resistance.

USD/JPY continues its sharp rise and is now moving above the psychological resistance at 120.00. A major resistance stands at 124.14 (22/06/2007 high). Hourly supports are given by 119.13 (03/12/2014 low) and by the short-term rising trendline (around 118.81).

A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Given the psychological threshold at 120.00 (see also the 61.8% retracement of the 1998-2011 decline), the major resistance at 124.14 (22/06/2007 high) and the overextended rise, the odds to see a medium-term consolidation phase are elevated. However, there is no sign to suggest the end of the long-term bullish trend.

Await fresh signal.

USD/CHF

Short-term surge in selling pressures.

USD/CHF declined sharply yesterday. However, the steepest rising trendline continues to favour a short-term bullish bias. Hourly supports can now be found at 0.9649 (04/12/2014 low) and 0.9595 (26/11/2014 low). A key resistance stands at 0.9839.

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. A major resistance area stands between 0.9972 (24/07/2012 high) and 1.0067 (01/12/2010 high). A key support can be found at 0.9351 (19/11/2014 low).

Await fresh signal.

USD/CAD

Grinding higher.

USD/CAD is moving above its short-term declining trendline, suggesting an increasing buying interest. An hourly resistance lies at 1.1424 (02/12/2014 high), while a key resistance stands at 1.1467. Hourly supports can be found at 1.1340 (04/12/2014 low) and 1.1317 (61.8% retracement).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, as highlighted by the recent prices behaviour, this expected rise is likely to be very gradual. A strong support stands at 1.1072 (02/10/2014 low).

Await fresh signal.

AUD/USD

Persistent selling pressures underway.

AUD/USD is making new lows confirming persistent selling pressures. Hourly resistances can be found at 0.8467 (03/12/2014 high) and 0.8543 (02/12/2014 high). A support stands at 0.8316 (01/07/2010 low).

In the long-term, the break of the strong support at 0.8660 (24/01/2014 low) confirms the underlying long-term bearish trend and opens the way for further weakness. A strong support stands at 0.8067 (25/05/2010 low). A key resistance can be found at 0.8796 (17/11/2014 high).

Await fresh signal.

GBP/JPY

Remains strong.

GBP/JPY has broken the resistance at 186.13 (20/11/2014 high), confirming an underlying bullish trend. Hourly supports can now be found at 187.30 (intraday low) and 186.27 (intraday low). A psychological resistance lies at 190.00.

In the long-term, the trend is positive as long as the key support at 178.74 (23/09/2014 high) holds. The break of the strong resistance at 180.72 (19/09/2014 high) opens the way for further strength. A key resistance stands at 197.45 (24/09/2008 high). A key support lies at 180.72 (previous resistance).

Await fresh signal.

EUR/JPY

Monitor the resistance at 149.14.

EUR/JPY has broken to the upside out of its short-term horizontal range defined by the support at 147.09 and the resistance at 148.16. Monitor the test of the key resistance at 149.14. An hourly support now lies at 148.12 (intrady low).

The long-term technical structure remains positive as long as the key support at 141.23 (19/09/2014 high) holds. The break of the major resistance at 145.69 opens the way for a further rise towards the psychological resistance at 150.00. Another resistance stands at 157.00 (08/09/2008 high). A key support stands at 144.79.

Await fresh signal.

EUR/GBP

Bouncing.

EUR/GBP bounced sharply yesterday. However, the declining channel is intact and continues to favour a bearish bias. Hourly resistances stand at 0.7941 (02/12/2014 high, see also the declining channel) and 0.7977. Hourly supports can be found at 0.7886 (intraday low) and 0.7833.

In the longer term, the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) has held thus far. However, a decisive break of the resistance at 0.8034 (25/06/2014 high, see also the declining channel and the 200-day moving average) is needed to confirm an improving technical structure.

Sell limit 2 units at 0.7939, Obj: Close unit 1 at 0.7833, remaining at 0.7705., Stop: 0.7987.

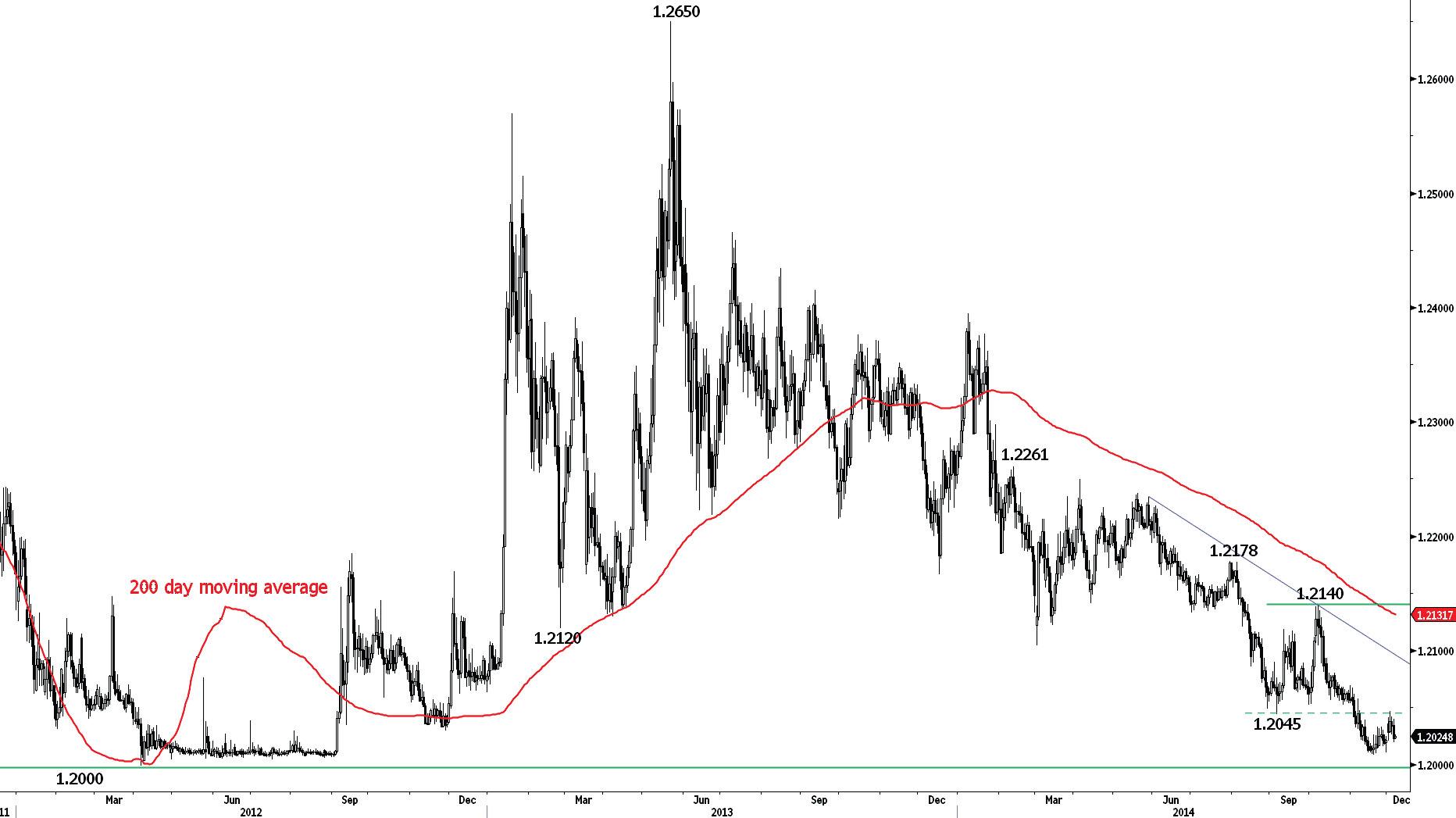

EUR/CHF

Buying interest remains shallow.

EUR/CHF's recent strength is unimpressive, highlighting a light buying interest. An hourly resistance area can be found between 1.2045 (previous support) and 1.2058 (06/11/2014 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which will be enforced with the "utmost determination". For the time being, a break of this threshold is very unlikely. As a result, further tight sideways moves are favoured.

Await fresh signal.

GOLD (in USD)

Continues to consolidate.

Gold has thus far only retraced 38.2% of its Monday's rise, suggesting a persistent buying interest. Hourly supports lie at 1191 (38.2% retracement of Monday's rise) and 1170 (intraday low). Resistances can be found at 1221 (01/12/2014 high) and 1236 (28/10/2014 high, see also the declining trendline).

In the long-term, the move below the strong support at 1181 (28/06/2013 low) confirms the underlying downtrend and opens the way for further declines towards the strong support at 1027 (28/10/2009 low). A break of the strong resistance at 1255 (21/10/2014 high) is needed to invalidate this bearish outlook.

Await fresh signal.

SILVER (in USD)

Consolidating below the resistance at 16.73.

Silver continues to consolidate after having bounced sharply near the strong support at 14.64. The current mild price weakness suggests a strong short-term buying interest. A key resistance stands at 16.73 (25/11/2014 high, see also the declining trendline). Another resistance lies at 17.04 (15/10/2014 low). Hourly supports can be found at 15.89 (38.2% of Monday's rise) and 15.52 (intraday low).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Although the strong support at 14.66 (05/02/2010 low) has held thus far, the lack of any base formation continues to favour a bearish bias. A resistance lies at 17.80 (15/10/2014 high). Another key support can be found at 11.77 (20/04/2009 low).

Buy stop 1 unit at 16.83, Obj: Close position at 17.28., Stop: 16.64.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.