EUR/USD

Approaching the hourly resistance at 1.2743.

EUR/USD is grinding higher towards the hourly resistance at 1.2743. A break of this level is needed to alleviate concerns of a further decline towards the key support at 1.2501. Another resistance stands at 1.2845 (16/10/2014 high), while an hourly support can be found at 1.2614.

In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) has opened the way for a decline towards the strong support at 1.2043 (24/07/2012 low). As a result, the recent strength in EUR/USD is seen as a countertrend move. A key resistance stands at 1.2995 (16/09/2014 high).

Await fresh signal.

GBP/USD

Is the recent pick-up in buying interest sustainable?

GBP/USD has bounced near the hourly support defined by the 61.8% retracement (1.5995). However, the technical structure favour a bearish bias as long as prices remain below the resistance area between 1.6184 (21/10/2014 high) and 1.6227. An initial support lies at 1.6071 (intraday low).

In the longer term, given the significant deterioration of the technical structure since July, the strong resistance area between 1.6525 (19/09/2014 high) and 1.6644 (01/09/2014 high) is expected to cap any upside in the coming months. Monitor the current consolidation phase near the strong support at 1.5855 (12/11/2013 low).

Await fresh signal.

USD/JPY

Monitor the rising channel.

USD/JPY has weakened near the resistance implied by its recent high at 108.35. The break of the initial support at 107.79 (24/10/2014 low) favours a short-term corrective phase. Hourly supports are now given by the rising channel (around 107.57) and 107.10. Another resistance can be found at 108.74.

A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. Despite the recent decline near the major resistance at 110.66 (15/08/2008 high), a gradual move higher is eventually favoured. Another resistance can be found at 114.66 (27/12/2007 high). A key support lies at 105.44 (02/01/2014 high).

Await fresh signal.

USD/CHF

Approaching the support at 0.9473.

USD/CHF has weakened near the resistance at 0.9562. However, as long as the hourly support at 0.9473 holds, a bullish bias is still favoured. Another support stands at 0.9368, whereas another resistance can be found at 0.9593.

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. As a result, the recent weakness is seen as a countertrend move. A key support can be found at 0.9301 (16/09/2014 low). A resistance now lies at 0.9691 (06/10/2014 high).

Await fresh signal.

USD/CAD

Consolidation.

USD/CAD has broken its rising channel. However, monitor the short-term horizontal range between 1.1184 and 1.1296. A key resistance stands at 1.1385. Another support lies at 1.1161.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. The recent move above the resistance at 1.1279 (20/03/2014 high) confirms this bullish outlook. Strong supports can be found at 1.1072 (02/10/2014 low) and 1.0811 (29/08/2014 low).

Await fresh signal.

AUD/USD

Challenging its resistance at 0.8833.

AUD/USD continues to improve after the break of the short-term declining channel. The hourly resistance at 0.8833 is challenged. A key resistance stands at 0.8897. Hourly supports can be found at 0.8788 and 0.8719.

In the long-term, the underlying trend is negative. Despite the recent successful test of the strong support at 0.8660 (24/01/2014 low), the long-term technical structure favours further decline. A key resistance stands at 0.9112 (16/09/2014 high). Another strong support lies at 0.8067 (25/05/2010 low).

Await fresh signal.

GBP/JPY

Monitor the resistance at 174.37.

GBP/JPY has thus far failed to break the resistance implied by the 50% retracement (174.37). However, as long as the hourly support at 172.98 holds, the short-term momentum remains supportive. Another support stands at 171.08, whereas another key resistance can be found at 175.91.

In the long-term, the trend is positive as long as the strong support area between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low) holds. However, the sharp reversal near the psychological threshold at 180.00 and the fading 200-day moving average indicate a weakening trend.

Await fresh signal.

EUR/JPY

Grinding higher.

EUR/JPY continues to rebound after the successful test of its key support at 134.11 (20/11/2013 low). However, the key resistance at 137.95 is likely to cap the short-term upside potential. Hourly supports can be found at 136.50 and 135.21.

The long-term technical structure remains positive as long as the key support at 134.11 (20/11/2013 low) holds. However, the break of the support at 135.73 and the declining slope of the 200-day moving average signal a weakening long-term trend. A resistance can be found at 141.23 (19/09/2014 high).

Await fresh signal.

EUR/GBP

Remains weak.

EUR/GBP has declined after its successful test of the key resistance at 0.8034. The breach of the hourly support at 0.7871 (23/10/2014 low) suggests a lack of buying interest. The shortterm technical structure remains weak as long as prices are below the hourly resistance at 0.7942 (21/10/2014 high). Another support can be found at 0.7821 (03/10/2014 low).

In the longer term, the underlying downtrend favours a test of the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) at minimum. A decisive break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

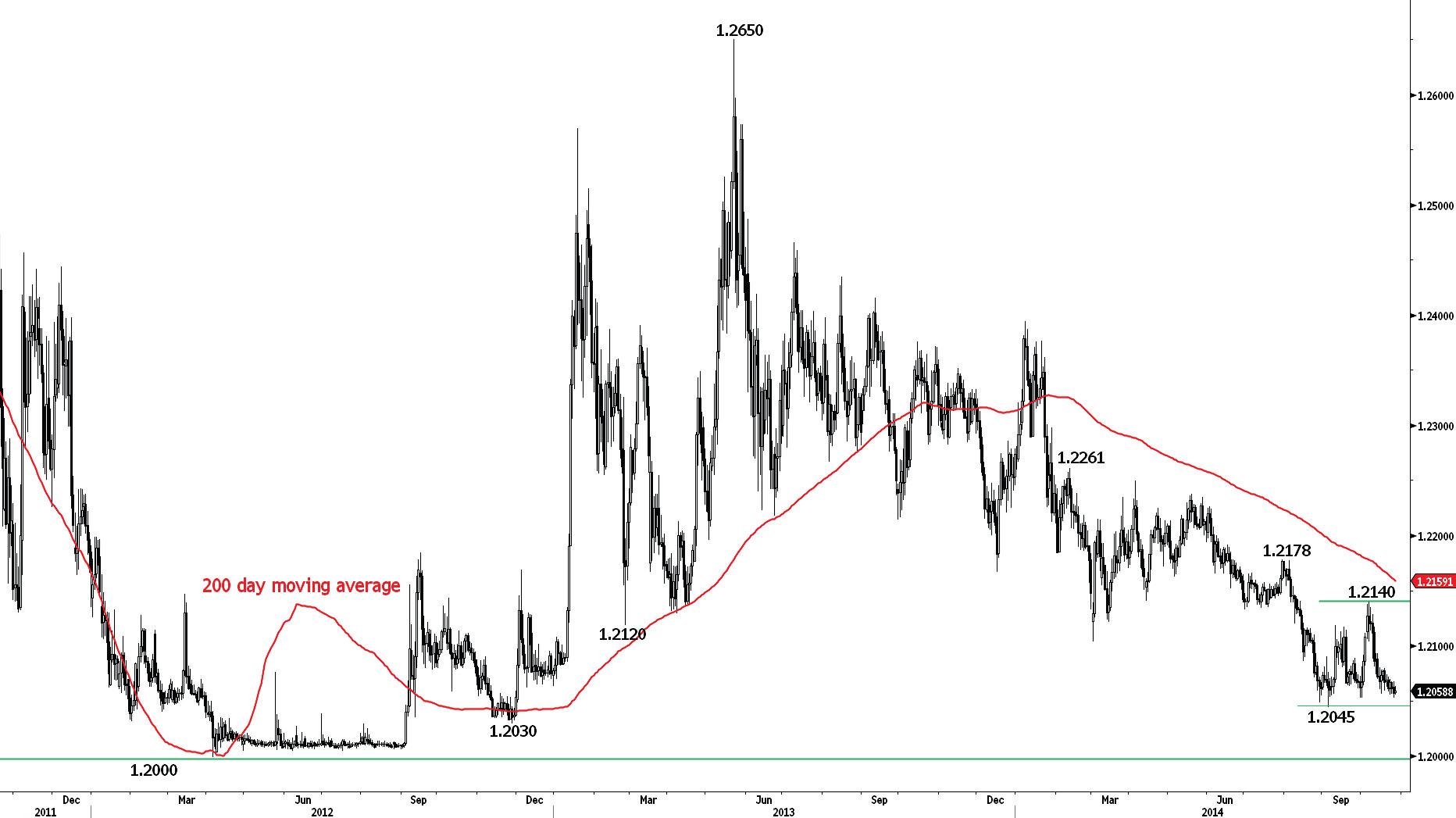

Approaching the support at 1.2045.

EUR/CHF is moving within a succession of lower highs. The support at 1.2057 (16/10/2014 low) has been breached. A key support stands at 1.2045. Hourly resistances can be found at 1.2074 (21/10/2014 high) and 1.2080.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is unlikely to be broken. As a result, further sideways moves are expected in the medium-term.

Await fresh signal.

GOLD (in USD)

A second leg lower is likely.

Gold has broken its rising channel and the hourly support at 1232. The hourly support at 1222 has held thus far. However, as long as prices are below the resistance at 1234, the short-term technical structure remains negative. Another hourly support lies at 1217, whereas another hourly resistance can be found at 1245 (23/10/2014 high).

In the long-term, despite the successful test of the strong support at 1181 (28/06/2013 low), the underlying downtrend and the recent 4-year lows in silver favour an eventual break lower. The resistance at 1277 (04/09/2014 high) is likely to cap any rebound in prices. Other supports can be found at 1157 (28/07/2010 low) and 1045 (05/02/2010 low).

Await fresh signal.

SILVER (in USD)

Trying to bounce.

Silver has successfully tested the low of its horizontal range between the support at 17.06 and the resistance at 17.72. However, the hourly resistance at 17.36 needs to be broken to invalidate the current short-term bearish momentum. Another key support stands at 16.68.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.23 (28/06/2013 low) confirms an underlying downtrend and favours further decline towards the strong support at 14.64 (05/02/2010 low). A resistance lies at 18.89 (16/09/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.