EUR/USD

Making 2 years lows.

EUR/USD has broken the strong support area between 1.2755 and 1.2662, confirming persistent strong selling pressures. Hourly resistances can now be found at 1.2664 (29/09/2014 low) and 1.2715 (29/09/2014 high).

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) opens the way for a decline towards the strong support at 1.2043 (24/07/2012 low). Intermediate supports are given by 1.2500 (psychological support) and 1.2466 (28/08/2012 low).

Short 2 units at 1.2652, Obj: Close 1 unit at 1.2507, remaining at 1.2155, Stop: 1.2710 (Entered: 2014-09-30)

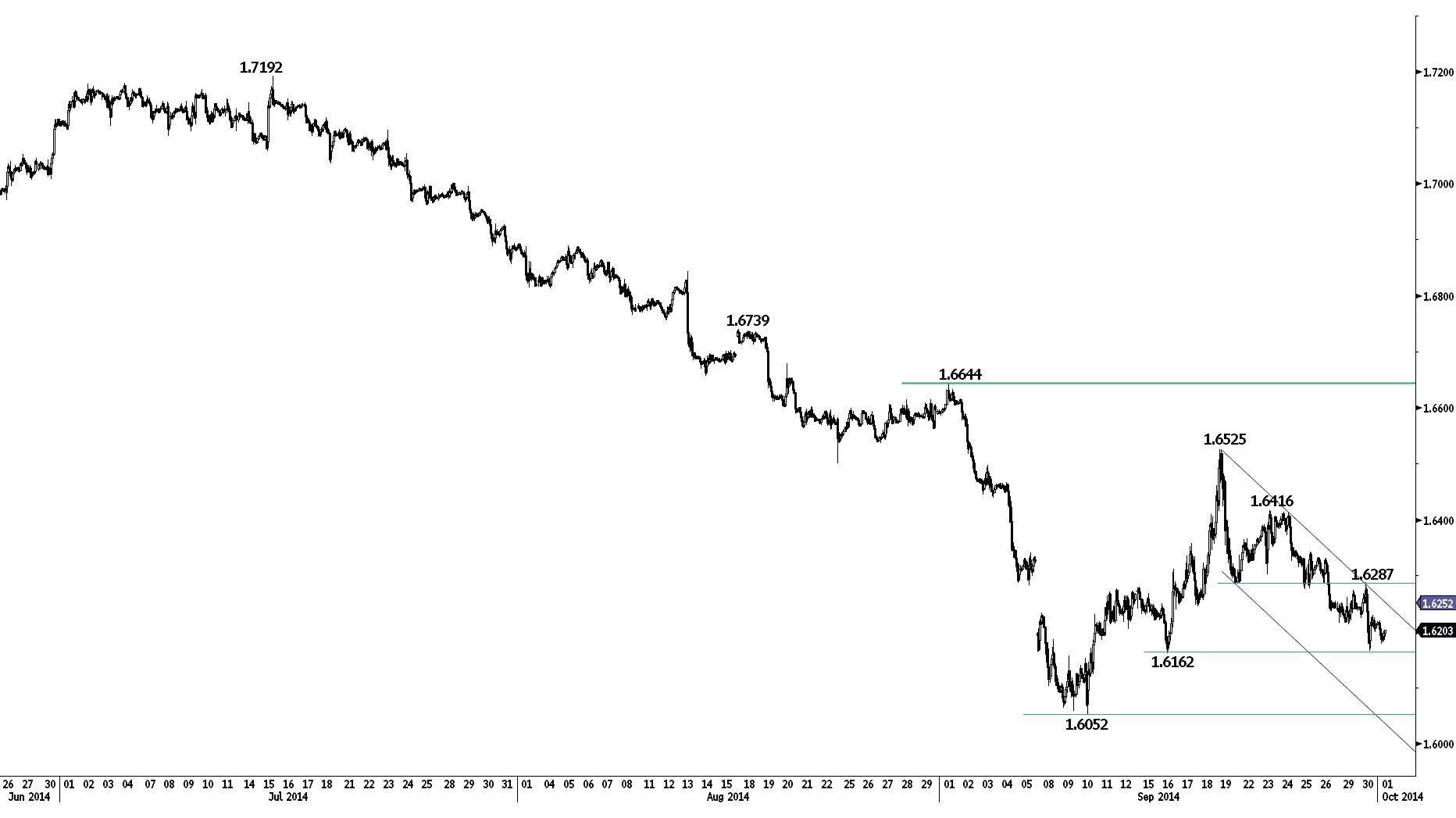

GBP/USD

Drifting lower.

GBP/USD continues to retrace the rebound that started from the low at 1.6052. The hourly support at 1.6162 (16/09/2014 low) is challenged. Hourly resistances are given by the declining channel (around 1.6252) and 1.6287.

In the longer term, the collapse in prices after having reached 4-year highs has created a strong resistance at 1.7192, which is unlikely to be broken in the coming months. We favour a medium-term consolidation phase with supports at 1.6052 and 1.5855 (12/11/2013 low) and a resistance at 1.6644.

Await fresh signal.

USD/JPY

Grinding higher.

USD/JPY has broken the resistance at 109.46 (19/09/2014 high) and is now close to the major resistance at 110.66 (15/08/2008 high). Hourly supports can now be found at 109.50 (intraday low) and 109.13 (29/09/2014 low). A strong support stands at 108.26.

A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The recent new highs confirm a strong underlying bullish trend. A break of the major resistance at 110.66 (15/08/2008 high, see also the 50% retracement from the 1998's top) is eventually favoured. Another resistance can be found at 114.66 (27/12/2007 high).

Await fresh signal.

USD/CHF

Pushing higher.

USD/CHF has made new highs, confirming persistent buying interest. Hourly supports can be found at 0.9489 and 0.9433 (18/09/2014 high).

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. The break of the strong resistance at 0.9456 (06/09/2013 high) confirms this scenario. Another key resistance lies at 0.9751 (09/07/2013 high). Supports can be found at 0.9301 (16/09/2014 low) and 0.9176 (03/09/2014 low).

Await fresh signal.

USD/CAD

Approaching the key resistance at 1.1279.

USD/CAD is lifted by a strong bullish momentum, as can be seen by the break of the top of the rising channel. Monitor the test of the strong resistance at 1.1279. Hourly supports can be found at 1.1132 (29/09/2014 low) and 1.1053 (24/09/2014 low).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. Strong supports are given by the long-term rising trendline (around 1.0740) and 1.0621 (03/07/2014 low).

Await fresh signal.

AUD/USD

Remains weak.

AUD/USD remains weak despite its strong support at 0.8660. Hourly resistances can be found at 0.8826 (intraday high) and 0.8927 (23/09/2014 high).

In the long-term, the underlying trend is negative. The impulsive decline from the lower high at 0.9505 (01/07/2014 high) does not suggest that the end of this downtrend is near. Monitor the test of the strong support at 0.8660 (24/01/2014 low). Another strong support lies at 0.8067 (25/05/2010 low).

Await fresh signal.

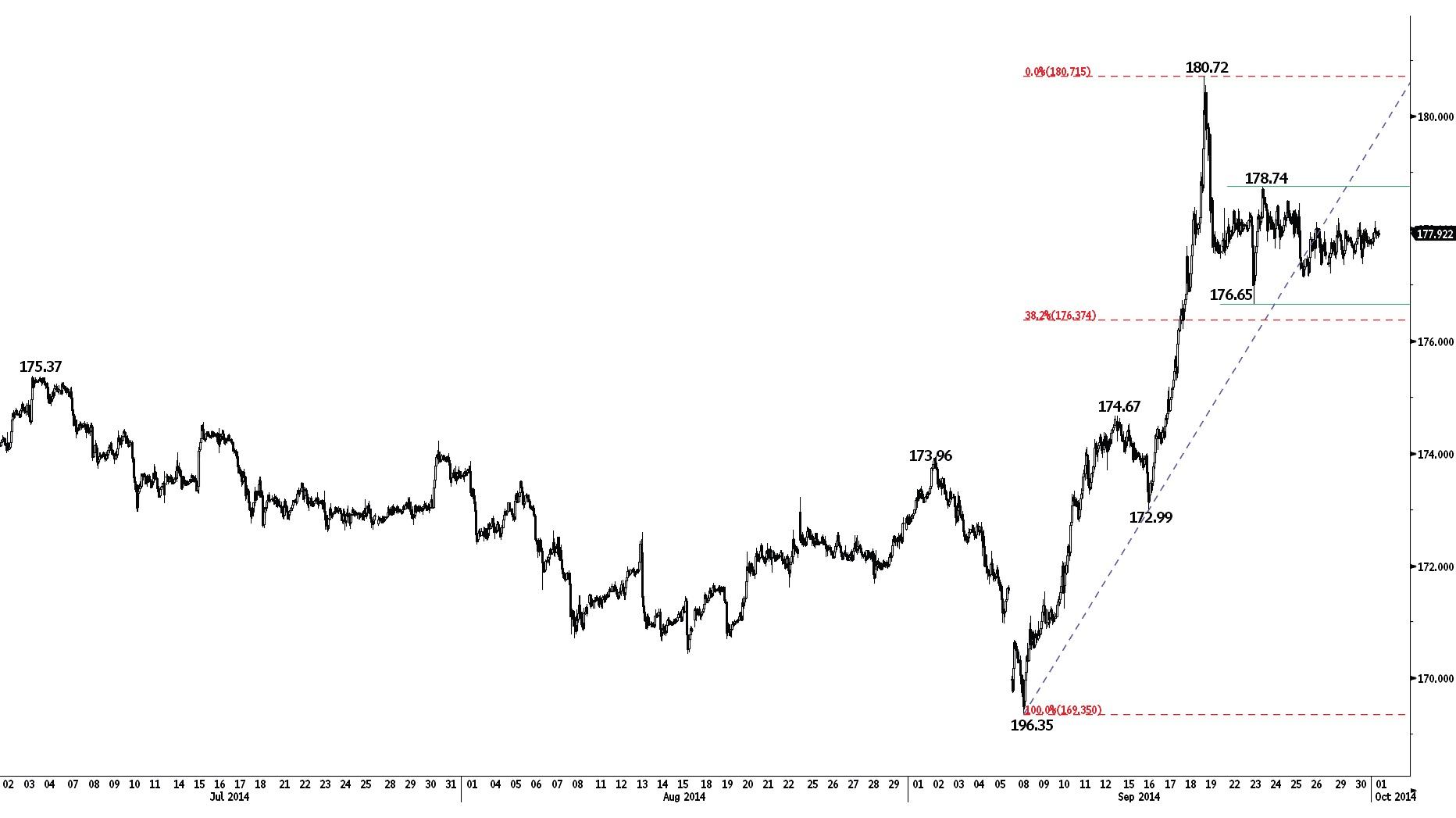

GBP/JPY

Moving sideways.

GBP/JPY made a sharp bearish intraday reversal at 180.72 (19/09/2014 high), which is likely to cap prices in the short-term. Monitor the horizontal range defined by the hourly support at 176.65 (23/09/2014 low) and the resistance at 178.74 (23/09/2014 high).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further long-term strength. However, the failure to hold above the resistance at 179.17 (see also psychological threshold at 180.00) favours a phase of consolidation. Other resistances can be found at 183.98 (50% retracement of the 2007-2009 decline) and 197.45. Strong supports lie at 172.99 (16/09/2014 low) and 169.51 (11/04/2014 low).

Await fresh signal.

EUR/JPY

Drifting lower.

EUR/JPY has broken the support at 138.47 (15/09/2014 low, see also the 50% retracement). Hourly resistances stand at 139.13 (29/09/2014 high) and 139.70 (25/09/2014 high). Another support lies at 137.67.

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. The break of the strong resistance at 140.09 (09/06/2014 high) has invalidated the medium-term bearish trend. A resistance can be found at 142.47 (29/04/2014 high).

Await fresh signal.

EUR/GBP

Approaching the strong support at 0.7755.

EUR/GBP is close to the strong support at 0.7755. The short-term technical structure is negative as long as prices remain below the hourly resistance at 0.7889 (23/09/2014 high). An initial resistance lies at 0.7830 (25/09/2014 high).

In the longer term, the underlying downtrend favours a test of the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) at minimum. A decisive break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

Approaching its recent low.

EUR/CHF is moving sideways between the support at 1.2045 and the resistance at 1.2121 (15/08/2014 high). The break of the hourly support at 1.2064 (22/09/2014 low) suggests persistent selling pressures. Hourly resistances can be found at 1.2076 (26/09/2014 high) and 1.2091 (intraday high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future. As a result, further sideways moves are expected in the mediumterm.

Await fresh signal.

GOLD (in USD)

Drifting lower.

Gold has breached its support at 1208 (22/09/2014 low), suggesting a weak buying interest. A break of the hourly resistance at 1236 is needed to invalidate the short-term bearish trend. Other resistances can be found at 1243 (16/09/2014 high) and 1258.

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured. The recent break to the downside out of the symmetrical triangle confirms this scenario.

Await fresh signal.

SILVER (in USD)

No end to the decline in sight yet.

Silver has broken the hourly support at 17.34 (22/09/2014 low), confirming a strong bearish trend. The support at 17.06 does not seem to attract buyers. Another support lies at 16.55 (25/03/2010 low). Hourly resistances can be found at 17.41 (intraday high) and 17.74 (26/09/2014 high).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.23 (28/06/2013 low) confirms an underlying downtrend and favours further decline towards the strong support at 14.64 (05/02/2010 low). A resistance lies at 18.88 (09/09/2014 low).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.