EUR/USD

Challenging the key support at 1.3105.

EUR/USD is challenging its key support at 1.3105 (06/09/2013 low). Hourly resistances for a short-term bounce can be found at 1.3221 (28/08/2014 high) and 1.3297 (22/08/2014 high).

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. A long-term decline towards the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) is favoured. However, in the shorter term, monitor the test of the key support at 1.3105 (06/09/2013 low) given the general oversold conditions. A key resistance lies at 1.3444 (28/07/2014 high).

Await fresh signal.

GBP/USD

Fading near its declining trendline.

GBP/USD is fading near the resistance implied by the declining trendline, suggesting persistent short-term selling pressures. Hourly supports stand at 1.6537 and 1.6501 (25/08/2014 low). Hourly resistances can now be found at 1.6644 and 1.6679.

In the longer term, the break of the key support at 1.6693 (29/05/2014 low, see also the 200 day moving average) invalidates the positive outlook caused by the previous 4-year highs. However, the lack of medium-term bearish reversal pattern and the short-term oversold conditions do not call for an outright bearish view. A key support stands at 1.6460 (24/03/2014 low).

Long 2 units at 1.6611, Obj: Close 1 unit at 1.6883, remaining at 1.7165, Stop: 1.6527 (Entered: 2014-08-28).

USD/JPY

Pushing higher towards the strong resistance at 105.44.

USD/JPY is making new highs, opening the way for a test of the strong resistance at 105.44 (see also the 61.8% retracement and the longterm declining trendline). Hourly supports can be found at 104.22 (intraday low) and 103.50 (22/08/2014 low).

A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The break to the upside out of the consolidation phase between 100.76 (04/02/2014 low) and 103.02 favours a resumption of the underlying bullish trend. Strong resistances can be found at 105.44 (02/01/2014 high) and 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Grinding higher.

USD/CHF remains well supported as can be seen by today's new highs. Hourly supports now stand at 0.9177 (01/09/2014 low) and 0.9126 (28/08/2014 low).

From a longer term perspective, the recent technical improvements call for the end of the large corrective phase that started in July 2012. The first upside potential at 0.9207, implied by the March-May double-bottom formation, has been met. Key resistances stand at 0.9250 (07/11/2013 high) and 0.9456 (06/09/2013 high).

Await fresh signal.

USD/CAD

Bouncing.

USD/CAD is bouncing after its successful test of the support area given by 1.0809 (50% retracement) and 1.0797. Hourly resistances can be found at 1.0908 (intraday high) and 1.0928 (22/08/2014 low).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Lack of buying interest.

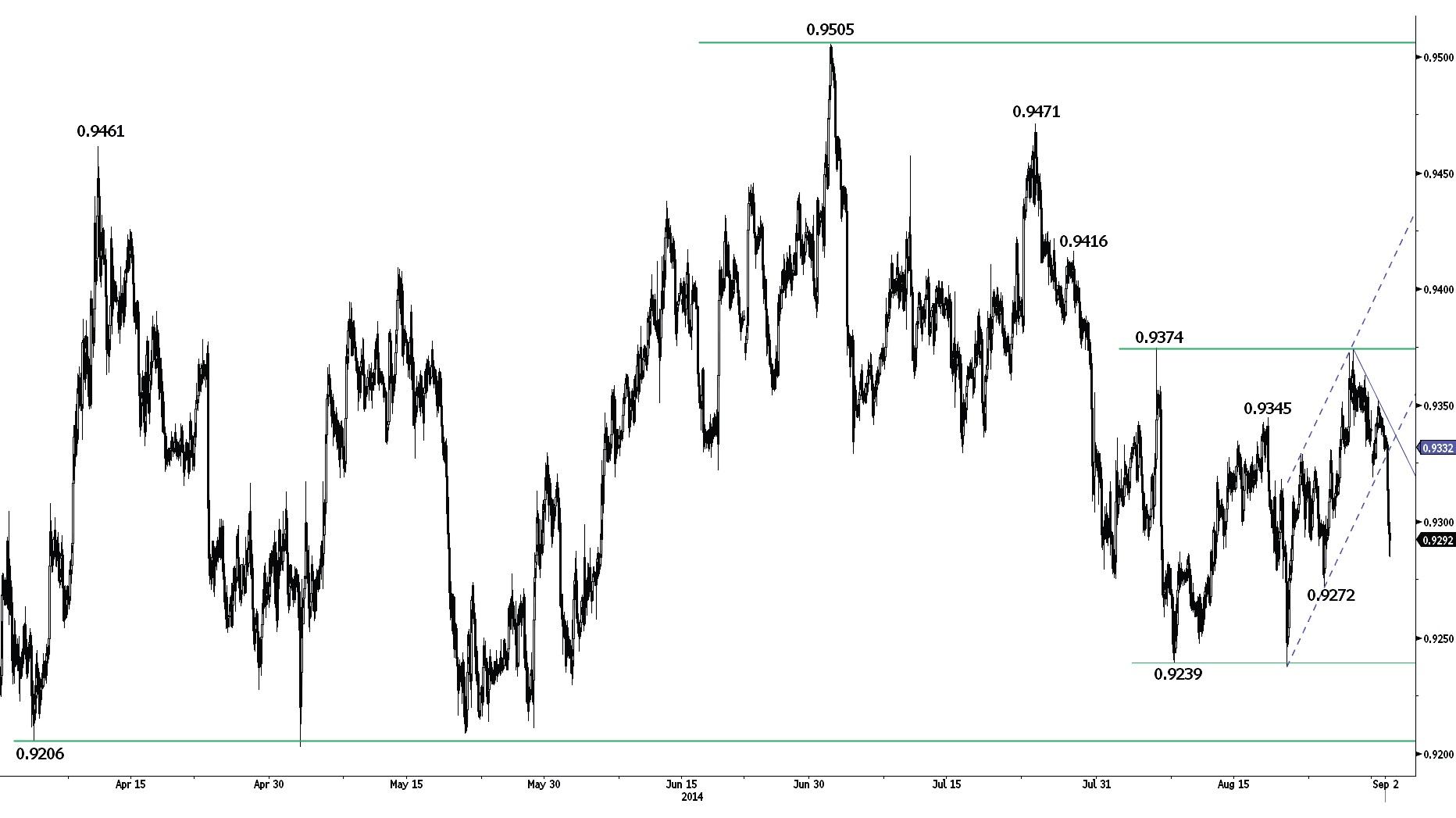

AUD/USD has failed to break the resistance at 0.9374. The subsequent break to the downside out of the rising channel negates a potential short-term double-bottom formation. An hourly support can be found at 0.9272, while a key support stands at 0.9239. An hourly resistance now lies at 0.9319 (01/09/2014 low).

In the longer term, prices are consolidating within the range defined by the key support at 0.9206 (see also the 200 day moving average) and the key resistance at 0.9461 (10/04/2014 high)/0.9505.

Await fresh signal.

GBP/JPY

Pushing higher.

GBP/JPY continues to improve as can be seen by the break of the resistance area given by the declining trendline and 173.51. Other resistances can be found at 174.22 and 174.56. Hourly supports stand at 173.14 (intraday low) and 172.63 (01/09/2014 low).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support at 169.51 (11/04/2014 low) holds.

Await fresh signal.

EUR/JPY

Monitor the strong resistance at 138.03.

EUR/JPY has bounced near its support at 136.37 (12/08/2014 low). The break of the hourly resistance at 137.42 opens the way for a test of the key resistance at 138.03. However, a break of this level is needed to suggest a further sustainable rise (see potential bullish head and shoulders formation). An hourly support now lies at 137.19 (29/08/2014 high).

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. The recent successful test of the key support at 136.23 (04/02/2014 low) favours further sideways moves. A strong resistance lies at 140.09 (09/06/2014 high).

Await fresh signal.

EUR/GBP

Trying to bounce.

EUR/GBP is trying to bounce after the break of the support at 0.7916. The hourly resistance at 0.7931 (intraday high) is challenged. The resistance at 0.7970 (20/08/2014 low) is unlikely to be broken. An hourly support now lies at 0.7892 (01/09/2014 low), while a key support stands at 0.7874.

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

Bouncing.

EUR/CHF is bouncing after having breached the support at 1.2063 (10/12/2012 low). Hourly resistances can be found at 1.2093 (26/08/2014 high) and 1.2121 (15/08/2014 high). An hourly support lies at 1.2049 (28/08/2014 low).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Challenging again its rising trendline.

Gold is weakening and is now challenging the support implied by its recent low at 1273 (21/08/2014 low, see also the symmetrical triangle). Hourly resistances can be found at 1297 (28/08/2014 high) and 1304 (intraday high, see also the declining channel). Another support lies at 1258 (17/06/2014 low).

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

Monitor the support at 19.32.

Silver made a significant bearish intraday reversal on 28 August, favouring a cautious view. Monitor the key support at 19.32, as a break would indicate a resumption of the underlying downtrend. Hourly resistances can be found at 19.64 (29/08/2014 high) and 19.91.

In the long-term, the trend is negative, as can be seen by the long-term succession of lower highs since the April 2011 peak. However, a strong support area stands between 18.84 (31/12/2013 low) and 18.23 (28/06/2013 low). A key resistance lies at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.