EUR/USD

Pushing lower.

EUR/USD has broken the support at 1.3576, confirming a bearish bias. A further short-term decline towards the key support at 1.3503 is likely. An hourly resistance lies at 1.3587 (intraday low), while a key resistance now stands at 1.3651. An hourly support can be found at 1.3536 (17/06/2014 low).

In the longer term, the break of the long-term rising wedge (see also the support at 1.3673) indicates a clear deterioration of the technical structure. A long-term downside risk at 1.3379 (implied by the double-top formation) is favoured as long as prices remain below the resistance at 1.3775. Key supports can be found at 1.3477 (03/02/2014 low) and 1.3296 (07/11/2013 low).

Await fresh signal.

GBP/USD

Failure to hold above the resistance at 1.7180.

GBP/USD moved sharply higher yesterday, only to fade near the resistance at 1.7180. Hourly supports can be found at 1.7110 (61.8% retracement of yesterday's rise) and 1.7060. An hourly resistance now stands at 1.7192.

In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A support lies at 1.6923 (18/06/2014 low).

The failure to hold above the resistance at 1.7180 has stopped our long position.

Our long position has been stopped.

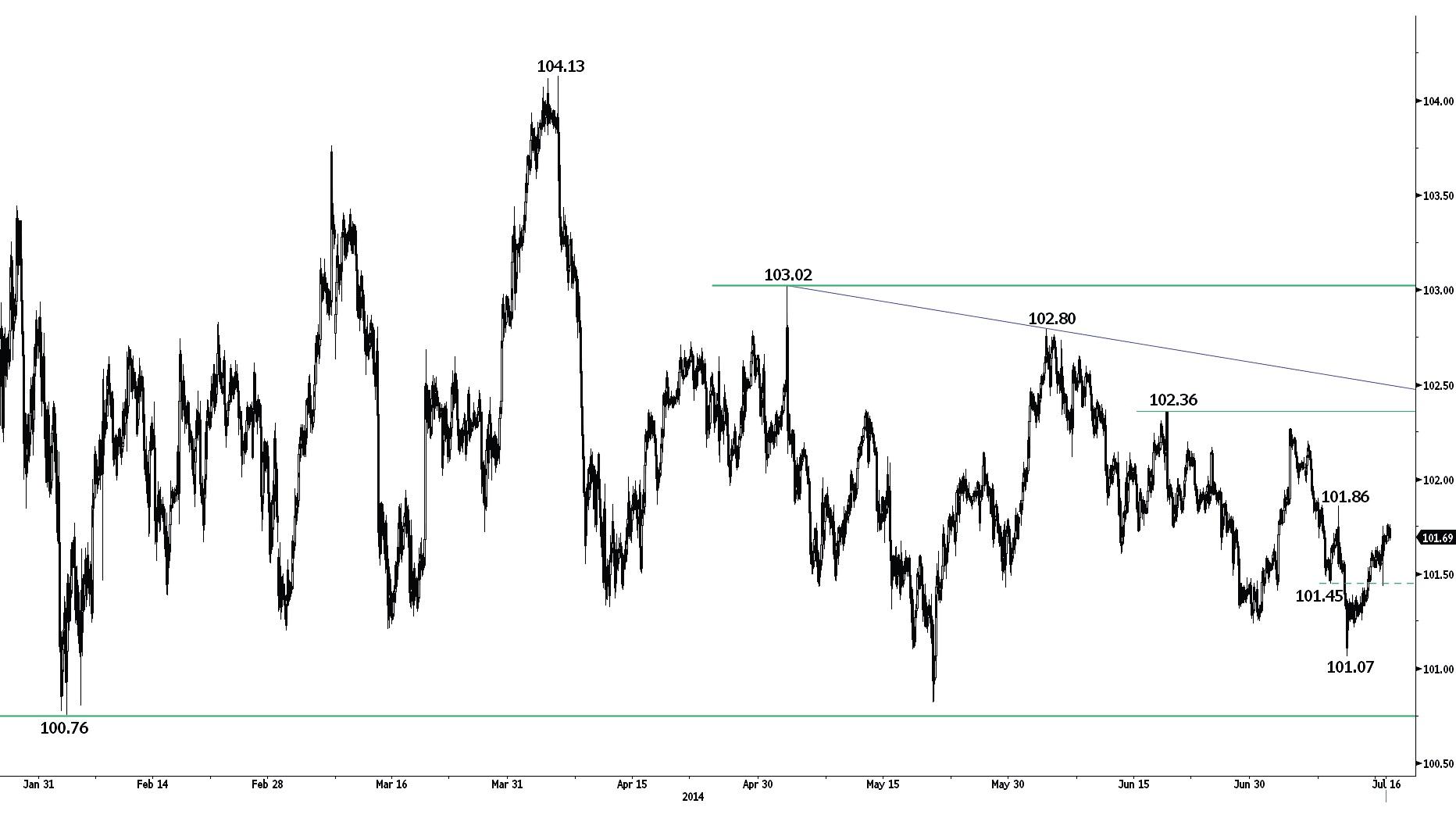

USD/JPY

Approaching the resistance at 101.86.

USD/JPY continues to bounce. Monitor the resistance at 101.86 (09/07/2014 high). Hourly supports can be found at 101.44 (15/07/2014 low) and 101.07. A key resistance stands at 102.36 (see also the declining trendline).

A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. However, a break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Challenging a key resistance area.

USD/CHF has broken out of its declining channel and is now challenging the key resistance area between 0.8959 and 0.8975 (see also the 61.8% retracement). Another resistance stands at 0.9013. Hourly supports can be found at 0.8938 (09/07/2014 high) and 0.8898.

From a longer term perspective, the bullish breakout of the key resistance at 0.8953 suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A key resistance stands at 0.9156 (21/01/2014 high).

Await fresh signal.

USD/CAD

Monitor the key resistance at 1.0814.

USD/CAD continues to bounce, breaking the resistance at 1.0752 (25/06/2014 high). However, the upside potential implied by the recent base formation has been reached and a key resistance stands at 1.0814 (previous support, see also the declining trendline and the 200 day moving average). Hourly supports can be found at 1.0710 (14/07/2014 low) and 1.0694 (08/07/2014 high).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline (around 1.0656) and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Monitor the key support at 0.9319.

AUD/USD is approaching the key support at 0.9319. Monitor this level as the technical configuration since June looks like a bearish head and shoulders. Hourly resistances can be found at 0.9409 (11/07/2014 high) and 0.9457.

In the longer term, the false breakout at 0.9461 confirms a limited upside potential, favouring a bearish bias. However, a break of the key support at 0.9206 (03/04/2014 low) is needed to open the way for a new significant phase of decline.

Sell stop 2 units at 0.9309, Obj: Close 1 unit at 0.9212, remaining at 0.9007, Stop: 0.9348.

GBP/JPY

Pickup in buying interest.

GBP/JPY has improved, breaking the resistance at 173.89 (38.2% retracement of the recent decline) and breaching the resistance at 174.43. Hourly supports are given by the shortterm rising trendline (around 173.40) and 172.97 (10/07/2014 low). Hourly resistances now stand at 174.57 (08/07/2014 high) and 175.37.

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support area defined by 163.89 (04/02/2014 low) holds.

Buy stop 2 units at 175.47, Obj: Close 1 unit at 179.80, remaining at 183.85, Stop: 174.47.

EUR/JPY

Remains weak.

EUR/JPY's short-term technical structure remains weak as long as prices remain below the resistance at 138.83 (07/07/2014 high, see also the declining trendline). Furthermore, a key resistance stands at 139.28. The hourly support at 138.05 (11/07/2014 high) has been broken. Another support lies at 137.50.

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. A strong support can already be found at 136.23 (04/02/2014 low), while a strong resistance stands at 145.69 (27/12/2013 high).

Await fresh signal.

EUR/GBP

Making new lows.

EUR/GBP declined sharply yesterday. The support at 0.7915 has been breached, confirming an underlying downtrend. A resistance stands at 0.7981, while a break of the hourly resistance at 0.8034 is needed to invalidate the bearish technical structure.

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8153 (29/05/2014 high) is needed to suggest some exhaustion in the long-term selling pressures.

Await fresh signal.

EUR/CHF

Moving sideways.

EUR/CHF is moving sideways within the horizontal range between the support at 1.2134 and the resistance at 1.2166. A break to the upside is needed to improve the technical structure and negate the implied downside risk at 1.2104. Another support lies at 1.2122.

In the longer term, prices are moving in a broad horizontal range between the key support at 1.2104 and the resistance at 1.2261.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

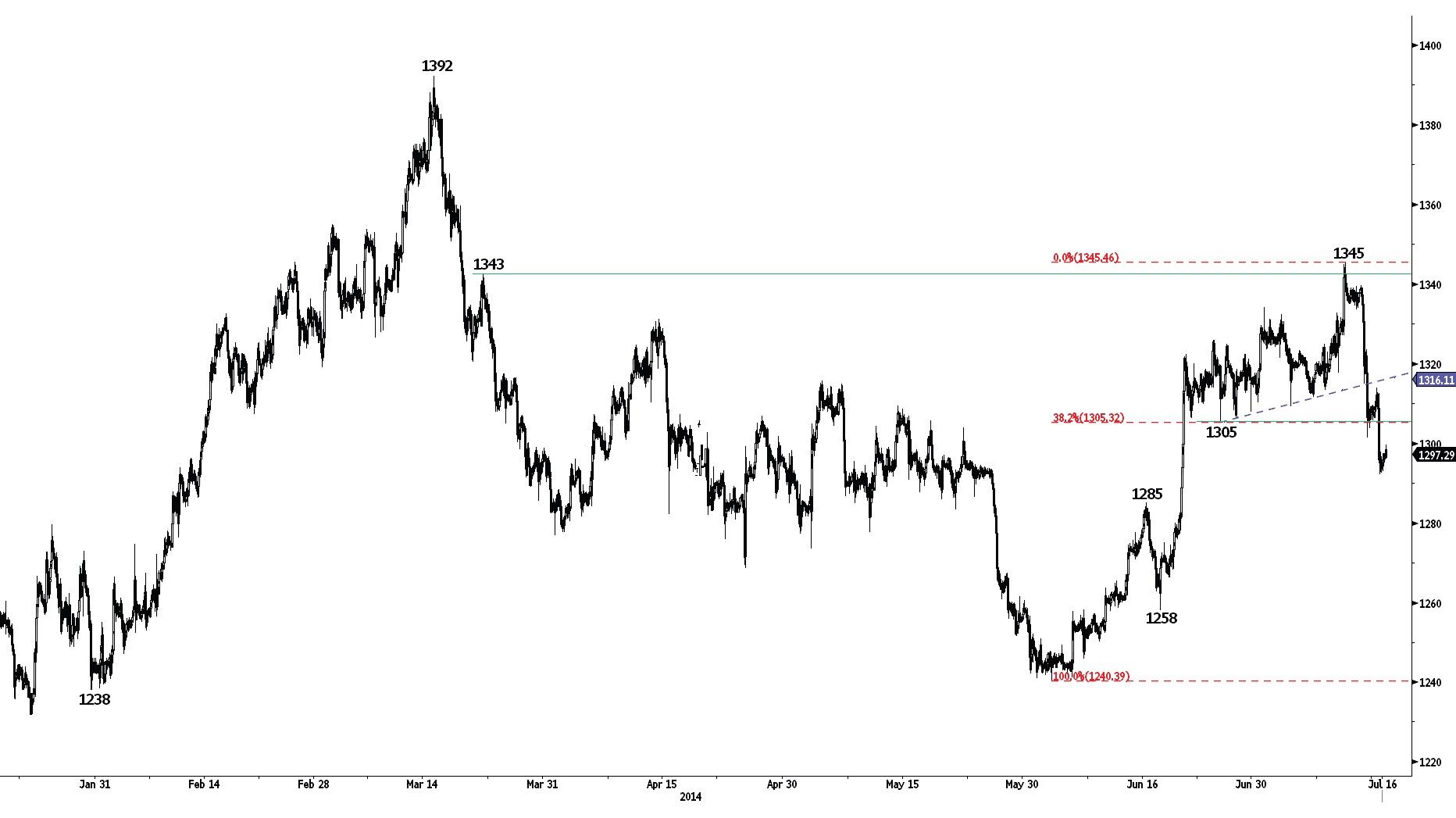

GOLD (in USD)

Bearish breakout of the support at 1305.

Gold has broken the support at 1305, confirming persistent selling pressures. Other supports can be found at 1285 and 1258. A short-term bearish stance is favoured as long as prices remain below the hourly resistance at 1314 (15/07/2014 high). A key resistance now stands at 1345.

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

Monitor the support at 20.58.

Silver weakened further yesterday. The support at 20.83 has been broken. Monitor the support at 20.58. Another support lies at 20.00. An hourly resistance can now be found at 21.08.

In the long-term, the trend is negative. However, the successful test of the strong support area between 18.84 and 18.23 (28/06/2013 low) and the break of the resistance at 20.41 (24/02/2014 high) indicate clear exhaustion in the selling pressures. A key resistance stands at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.