EUR/USD

Making new lows.

EUR/USD has breached the support at 1.3749, confirming persistent short-term selling pressures. An hourly support lies at 1.3708, while a key support stands at 1.3643. An initial resistance is at 1.3779 (intraday high). A key resistance can be found at 1.3876 (see also the declining trendline).

In the medium-term, the break of the support at 1.3834 (11/03/2014 low, see also the rising channel) coupled with general overbought conditions favour a move lower towards the support at 1.3643. The recent high at 1.3967 is likely to act as a strong resistance.

Await fresh signal.

GBP/USD

Continues to bounce.

GBP/USD continues to rise after the successful test of the support implied by its rising channel. Hourly resistances can be found at 1.6666 and 1.6718. Hourly supports stand at 1.6555 (27/03/2014 low) and 1.6460.

In the longer term, a break to the downside out of the rising channel would negate the current bullish bias implied by the break of the resistance at 1.6668 (24/01/2014 high). A strong horizontal support stands at 1.6220 (17/12/2013 low).

Short 2 units at 1.6562, Obj: Close unit 1 at 1.6340, remaining at 1.6050, Stop: 1.6671 (Entered: 2014-03-18).

USD/JPY

Remains weak.

USD/JPY continues to display a succession of short-term lower highs despite its recent bounce. Supports stand at 101.72 and 101.20. Hourly resistances can be found at 102.49 (25/03/2014 high) and 102.68.

A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.63) and 99.57 (see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Pushing higher.

USD/CHF is challenging the resistance at 0.8879 (see also the 38.2% retracement). Another key resistance stands at 0.8930. The short-term technical structure favours a bullish bias as long as the support at 0.8787 holds. An initial support lies at 0.8834 (intraday low).

From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. The recent technical improvements suggest weakening selling pressures.

Await fresh signal.

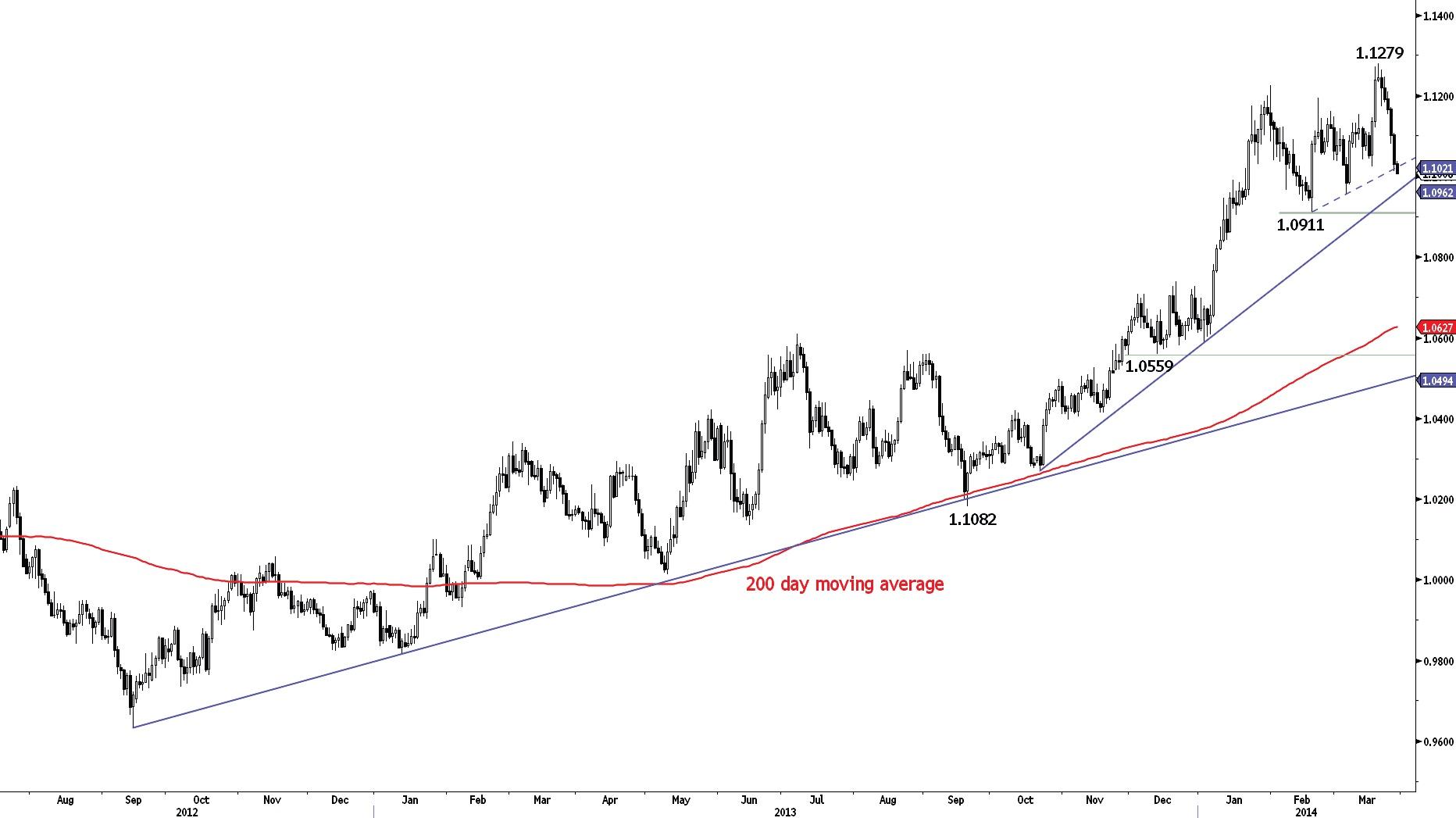

USD/CAD

Approaching a key rising trendline.

USD/CAD continues to weaken, breaking the support at 1.1026 (18/03/2014 low). Monitor the support at 1.0956 (06/03/2014 low, see also the rising trendline). Hourly resistances now lie at 1.1107 (27/03/2014 high) and 1.1171 (26/03/2014 high).

In the longer term, the decisive break of the major resistance at 1.0870 validates a multi-year basing formation whose minimum upside potential is around 1.1910. The key resistance given by the 50% retracement (around 1.1236) of the decline from the September 2009 peak at 1.3065 remains thus far intact. A key support stands at 1.0911 (19/02/2014 low).

Await fresh signal.

AUD/USD

The key resistance at 0.9168 has been broken.

AUD/USD has broken the key resistance at 0.9168, validating a 3 month bullish reversal pattern. Hourly supports can be found at 0.9214 (27/03/2014 low) and 0.9120 (25/03/2014 low).

In the medium-term, the decisive break of the strong resistance at 0.9168 (02/12/2013 high, see also the 200 day moving average) favours a further rise towards the key resistance at 0.9448.

Long 2 units at 0.9175, Obj: Close unit 1 at 0.9429, remaining at 0.9691, Stop: 0.9125 (Entered: 2014-03-26).

GBP/JPY

Breaking to the upside out of its horizontal range.

GBP/JPY has broken to the upside out of its horizontal range between 167.94 and 169.61. Further short-term strength towards the resistance at 171.64 is favoured. An hourly resistance lies at 170.33 (27/03/2014 high). An initial support stands at 169.54 (intraday low), while an hourly support is at 168.64 (27/03/2014 low, see also the rising channel).

The break of the major resistance at 163.09 (07/08/2009 high) calls for further long-term strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key low at 160.41 (19/11/2013 low) holds.

Long 2 units at 169.75, Obj: Close unit 1 at 171.25, remaining at 173.45, Stop: 168.98 (Entered: 2014-03-27).

EUR/JPY

Grinding lower.

EUR/JPY has breached the support at 140.45. The subsequent weak bounce suggests persistent selling pressure. A key support stands at 138.68. The short-term technical structure is negative as long as prices remain below the resistance at 141.04 (27/03/2014 high). Another resistance stands at 141.98.

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low, see also the 200 day moving average) holds. Resistances can be found at 147.04 (16/09/2008 low) and 157.00 (08/09/2008 high).

Await fresh signal.

EUR/GBP

Sliding.

EUR/GBP continues to decline sharply. Monitor the test of the support at 0.8263 (see also the rising trendline). Other supports stand at 0.8191 and 0.8158. An initial resistance can be found at 0.8286 (intraday high). Another resistance lies at 0.8322 (27/03/2014 high).

In the longer term, the failure to make any follow-through after the break of the resistance at 0.8350 (06/02/2014 high) calls for caution as prices remain below a declining 200 day moving average. A key support area stands at between 0.8168 and 0.8158.

Await fresh signal.

EUR/CHF

Weakening.

EUR/CHF has declined after having posted a daily shooting star (26/03/2014). Hourly supports are now given by 1.2163 and the rising channel (around 1.2141). Hourly resistances can be found at 1.2207 (27/03/2014 high) and 1.2235 (26/03/2014 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the medium-term.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Continues its steady decline.

Gold continues to decline as can be seen by the break of the support at 1307 (see also the 200 day moving average). Other supports stand at 1276 and 1232. Hourly resistances can be found at 1317 and 1343.

Longer term, the successful test of the key support at 1181 coupled with the break of the resistance implied by the 200 day moving average are positive. However, we are skeptical of a long-term bullish reversal pattern.

Await fresh signal.

SILVER (in USD)

Continues to decline.

Silver continues to move lower as can be seen by the break of the support at 19.78. The technical structure is negative as long as prices remain below the resistance at 20.58 (21/03/2014 high). An initial resistance lies at 20.22 (25/03/2014 high). A support now stands at 19.01 (30/01/2014 low).

In the long-term, the trend is negative. However, the potential higher low at 18.84 (31/12/2013 low) and the break of the resistance at 20.52 suggest a phase of stabilisation. A key resistance now stands at 23.09.

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.